You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Live Trading and General Chat Lounge

- Thread starter Lord Flasheart

- Start date

- Watchers 192

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

stop +40

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

Short gbp/chf at 1.4482 sl 1.4519

out for +40 and +25

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

long eur/gbp at .8631 sl .8622, small stakes,just a hunch

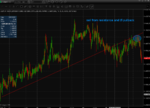

Am long Gold at 1680.14 and short S&P at 1247.47 at a ratio of 0.231:0.311.

The time frame on this trade is a number of weeks, possibly months.

The expectation is that the basis between Gold and Equities (recently widened up significantly) will close for both fundamental reasons (based around monetary easing and a possible re-emergence of "safe haven" status) and for technical reasons (see chart for trendline support and strong support at 1600).

The trade is currently showing a small loss, my position is relatively small, expecting a big move.

Happy to answer qus about this trade,

The time frame on this trade is a number of weeks, possibly months.

The expectation is that the basis between Gold and Equities (recently widened up significantly) will close for both fundamental reasons (based around monetary easing and a possible re-emergence of "safe haven" status) and for technical reasons (see chart for trendline support and strong support at 1600).

The trade is currently showing a small loss, my position is relatively small, expecting a big move.

Happy to answer qus about this trade,

Attachments

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

long eur/gbp at .8631 sl .8622, small stakes,just a hunch

-9,

looking at gbp/chf again

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

short gbp/chf at 1.4507 sl 1.4527

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

short GBPUSD 1.5611 , multi market resistance and upward trending DXY on pull back.

market feels much weaker today

wheres stop,thanks

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

short gbp/chf at 1.4507 sl 1.4527

-20 x 2,no more shorts on that pair

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

try a short from the top

short gbp at 1.5625 sl 1.5640

short gbp at 1.5625 sl 1.5640

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

eurusd already has a 130 pip range today and I think it could still go much lower. Should be good to short as long as it stays below 1.3300

Peter

Peter

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

short ES 1243, stop 1245

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

try a short from the top

short gbp at 1.5625 sl 1.5640

1/2 off +11,rest to be/e

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Target is 1240, just above this morning's low.

Peter

Peter

Similar threads

- Replies

- 27

- Views

- 46K

- Replies

- 4

- Views

- 3K

- Replies

- 34

- Views

- 7K