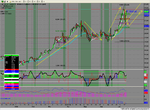

Bgold - not sure whether it is fundamentally driven or not.

There have been rains delaying Brazilian harvest over the last week - but latest forecasts say dry conditions ahead.

USDA update their supply/demand etc tomorrow. COT report last week showed fund/spec longs greatly trimmed. But that was last week....

Note however, that London LIFFE AUG 04 has stalled and sold off towards the close. There has been persisant selling of the White-over-Raw premium of late.

I am long-term bullsih, but agree with your earlier comments that it is a difficult market to trade.

There have been rains delaying Brazilian harvest over the last week - but latest forecasts say dry conditions ahead.

USDA update their supply/demand etc tomorrow. COT report last week showed fund/spec longs greatly trimmed. But that was last week....

Note however, that London LIFFE AUG 04 has stalled and sold off towards the close. There has been persisant selling of the White-over-Raw premium of late.

I am long-term bullsih, but agree with your earlier comments that it is a difficult market to trade.