Understanding and using point and figure charts - £99*

Friday, 11 November | 1.15 pm – 5.15 pm

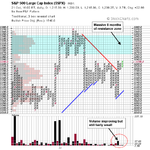

Jeremy du Plessis Jeremy du Plessis, author of The Definitive Guide to Point and Figure, will be hosting a rare "Point and Figure" workshop for retail traders and investors at this year's World MoneyShow in London. The four-hour intensive workshop is designed to give you a full understanding of point and figure charts, starting from the history of this charting technique, covering the theoretical and practical aspects of point and figure charts, leading to more advanced professional and modern approaches of using point and figure charts.

This interactive workshop will cover:

How and why point and figure charts were developed.

Point and figure construction methods and when each method should be used.

Trend lines as a vital part of point and figure analysis.

Establishing accurate price targets with point and figure charts.

Calculating risk/reward ratios and how they can help assess your position.

Using point and figure to measure market breadth and to determine market turning points.

Ground breaking new point and figure charting techniques.

Live point and figure charting session, including live interactive analysis with the audience.

This workshop is a must for any serious home-based trader or investor.

world moneyshow in london