Dentalfloss

Legendary member

- Messages

- 63,404

- Likes

- 3,726

malaguti

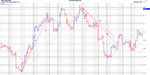

subjective trendlines...not really subjective

place them on the right hand side of semi catapults/one box reversal

so really they are not too subjective

if you are trading and using one box reversal,then you might be living too dangerously without them

only needs a tiny bit of practice ..imho

others.ie..connecting 2 highs or lows..well if you confirm with a bullish supp line /bearish res line and internal trendlines,then it all falls into place

p/f is all about the trend..the trend is defined by price change per reversal.the signals are just who has control,the bears or the bulls

so,any trend mark the bullish supp line/bearish res line first...then put in internals...then subjective..by doing this it will split the range into bullish and bearish sections

subjective trendlines...not really subjective

place them on the right hand side of semi catapults/one box reversal

so really they are not too subjective

if you are trading and using one box reversal,then you might be living too dangerously without them

only needs a tiny bit of practice ..imho

others.ie..connecting 2 highs or lows..well if you confirm with a bullish supp line /bearish res line and internal trendlines,then it all falls into place

p/f is all about the trend..the trend is defined by price change per reversal.the signals are just who has control,the bears or the bulls

so,any trend mark the bullish supp line/bearish res line first...then put in internals...then subjective..by doing this it will split the range into bullish and bearish sections

Last edited: