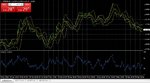

Yesterday EURUSD initially fell but found enough support at 1.1097 to reverse and closed near the high of the day however did not had the strength to close above Fridays high, which suggests being slightly on the bullish side of neutral.

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: A daily resistance at 1.1237, the 10-day moving average at 1.1170 (resistance), a swing low at 1.1141 (resistance), a daily support at 1.1097 and the 200-day moving average at 1.1070 (Support).

The pair is trading below the 10 and the 50-day moving averages that are acting as dynamic resistances although still trading above the 200-day moving average that is acting as a dynamic support.

The key levels to watch are: A daily resistance at 1.1237, the 10-day moving average at 1.1170 (resistance), a swing low at 1.1141 (resistance), a daily support at 1.1097 and the 200-day moving average at 1.1070 (Support).