You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

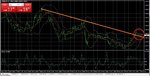

On Monday session EUR/USD continued the negative performance for the fourth consecutive day. Ahead of the ECB meeting and expected further monetary stimulus, the euro fell by 25 pips and closed at 1.0563. During the whole session the single currency couldn’t break the key level at 1.0600. The sentiment is still negative and potential break of 1.0460 will intensify the bears presence.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD bounced off the support at 1.0560 and moved to the upside. I think it will climb towards the resistance at 1.0690 - 1.0700 at most before it falls again.

Sherif Fares

Active member

- Messages

- 181

- Likes

- 3

Again EUR/USD over 1.600 and now we will wait for the NFP on friday I doubt there will be much of sudden movemennt before that.

On Tuesday session the euro interrupted a four-day negative series and added nearly 70 pips against the dollar to a closing price of 1.0631. The trading passed within the extreme values 1.0636 and 1.0562. Relative strength index moved to positive territory, but the recent downward trend is still in force. Consecutive break of 1.0650 and the psychological level at 1.0690 will contribute to positive attitudes. The upcoming inflation data in the euro area and Yellen's comments will prove to be a key indicator for the pair.

Yesterday the EURUSD rallied with a wide range and closed in the green near the high of the day, suggesting a stronger pullback to a Fibonacci extension at 1.07032.

Yesterday the pair closed above the 10-day moving average that was pushing the currency down acting as a strong resistance. The question is if the pair can follow thru with the bullish momentum or go back down below the 10-day moving average.

The key levels to watch are the 1.0819 (resistance), a Fibonacci extension at 1.0703 (resistance), the 10-day moving average at 1.0615 (support), 1.0622 (Support), and 1.0462 (support).

Yesterday the pair closed above the 10-day moving average that was pushing the currency down acting as a strong resistance. The question is if the pair can follow thru with the bullish momentum or go back down below the 10-day moving average.

The key levels to watch are the 1.0819 (resistance), a Fibonacci extension at 1.0703 (resistance), the 10-day moving average at 1.0615 (support), 1.0622 (Support), and 1.0462 (support).

Sherif Fares

Active member

- Messages

- 181

- Likes

- 3

EUR/USD is back to yesterday's opening price. I will go short but after the break of yesterday's low price 1.05550.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

I don't think it will break below the support at 1.0550 before the ECB press-conference tomorrow.

I don't think it will break below the support at 1.0550 before the ECB press-conference tomorrow.

I agree with you in this point, thank you.

On Monday session the single currency recorded unsicnificant decline after a relatively volatile session. The pair was trading between 1.0635 and 1.0551, and and the end euro lost 20 pips to a closing price of 1.0612. Currently the sentiment is neutral, the pair formed range of 1.0640 - 1.0560.

Yesterday the EURUSD initially fell but found enough support to turn around and close near the open of the day although closed within previous day range, suggesting a mildly bullish to a ranging tone.

Yesterday the pair failed to close above the 10-day moving average showing that the currency did not have the strength to continue its bullish momentum.

Today is the Big day with the ECB interest rate decision and monetary policy statement plus on the table is a potential increase or further extend of its dovish monetary policy.

Also today we will have Fed's Yellen testimonials before the Congress or some of its Committees to explain the current economic situation and the policies applied to improve it.

The key levels to watch are the 1.0819 (resistance), a Fibonacci extension at 1.0703 (resistance), the 10-day moving average at 1.0605 (resistance), 1.0622 (Support), and 1.0462 (support).

Yesterday the pair failed to close above the 10-day moving average showing that the currency did not have the strength to continue its bullish momentum.

Today is the Big day with the ECB interest rate decision and monetary policy statement plus on the table is a potential increase or further extend of its dovish monetary policy.

Also today we will have Fed's Yellen testimonials before the Congress or some of its Committees to explain the current economic situation and the policies applied to improve it.

The key levels to watch are the 1.0819 (resistance), a Fibonacci extension at 1.0703 (resistance), the 10-day moving average at 1.0605 (resistance), 1.0622 (Support), and 1.0462 (support).

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

The fundamentals today pushed EUR/USD up and it reached the resistance at 1.0890. It's possible the pair might reach 1.1000 again depending on the results of the NFP tomorrow.

Sherif Fares

Active member

- Messages

- 181

- Likes

- 3

EUR/USD spiked suddenly and rose over 400 pips and now we are back to test 1.100.