EUR/USD is trading higher in today's session after a few days of high volatility and uncertainty. Current market price is 1.0643, close to first resistance at 1.0650. If bulls manage to pull through that level then we might an attempt to go higher possibly above 1.0750 before the weekend. On the other hand, bears need to go below 1.06 in order for the bull run to be discontinued.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD bounced off 1.0660 and is retracing back towards 1.0600, so for now the sideways consolidation continues and it's unlikely to end before the FOMC meeting minutes are announced tomorrow.

Yesterday the EURUSD went back and forward without any clear direction but closed in the red, in the middle of the daily range, in addition managed the pair managed to close within previous day range, which suggests being clearly neutral, neither side is showing control.

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), the 10-day moving average at 1.0691(resistance), a Fibonacci extension at 1.0666 (resistance) and a daily support at 1.0622 and the all-time low at 1.0462 (support).

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), the 10-day moving average at 1.0691(resistance), a Fibonacci extension at 1.0666 (resistance) and a daily support at 1.0622 and the all-time low at 1.0462 (support).

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD broke below 1.0600 and continued moving to the downside. It's currently testing 1.0550, and if it breaks out below that support it will likely reach 1.0520, which is the previous low.

Currently the EUR/USD pair is exposed to further downward slope, having in mind that is placed below 1.0600 area and also below the moving averages. Immediate resistance is seen at 1.0605, where know is lying the 20-day SMA. Support is located now at 1.0525 and lower at 1.0500.

Yesterday the EURUSD fell with a wide range and closed near the low of the day, in addition the pair managed to close below previous day low, which suggests a strong bearish momentum.

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), the 10-day moving average at 1.0661(resistance), a daily resistance at 1.0622 and the all-time low at 1.0462 (support).

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), the 10-day moving average at 1.0661(resistance), a daily resistance at 1.0622 and the all-time low at 1.0462 (support).

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD bounced off 1.0540 and it might climb back up to 1.0600, but the overall trend remains very bearish. The move to the downside will likely contonue until the pair eventually reaches the previous low at 1.0462.

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

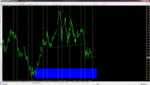

Considering the week ahead in terms of political upheaval in the Eurozone.

4th Dec we have the re-run of the Austrian election for President.

4th Dec we have the Italian referendum on political reform. These events could see the Euro drop into the target area, highlighted in blue. 0.94000 to 0.82000

We have had Brexit and also Trumps election win in the US. If Europe now starts to follow that trend, then the Euro should go into free fall . It is already very weak against the majority of it's crosses and simply needs an event to tip it over the edge.

Be mindful of volatility when position sizing.

Monthly chart for context.

4th Dec we have the re-run of the Austrian election for President.

4th Dec we have the Italian referendum on political reform. These events could see the Euro drop into the target area, highlighted in blue. 0.94000 to 0.82000

We have had Brexit and also Trumps election win in the US. If Europe now starts to follow that trend, then the Euro should go into free fall . It is already very weak against the majority of it's crosses and simply needs an event to tip it over the edge.

Be mindful of volatility when position sizing.

Monthly chart for context.

Attachments

Last edited:

The euro rose against the dollar on Friday. By the end of the Asian session EUR/USD was trading at 1.0571, gaining 0.16%. I believe that the support is now located at the level of 1.0515, the low of Thursday, and resistance is likely at the level of 1.0660 - the maximum of Tuesday.

The single currency performed neutral during Thursday session. The opening price of opening completely coincided with that of closing - 1.0551. The EUR/USD moved within extremely narrow range, but the pair managed to break the first support at 1.0519 and reached its lowest level for the day at 1.0517. If bearish sentiment continue to dominate , the second key level at 1.0452 could be tested soon.

Yesterday the EURUSD went back and forward without any clear direction although closed slightly in the green, in the middle of the daily range, creating a doji pattern. In addition the pair closed within the previous day range, which suggests being clearly neutral, neither side is showing control.

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), the 10-day moving average at 1.0633(resistance), a daily resistance at 1.0622 and the all-time low at 1.0462 (support).

The pair continues to trade well below the 10, 50 and the 200-day moving average that should act as dynamic resistances.

The key levels to watch are: a daily resistance at 1.0819 (resistance), a Fibonacci extension at 1.0666 (resistance), the 10-day moving average at 1.0633(resistance), a daily resistance at 1.0622 and the all-time low at 1.0462 (support).

Sberbank CIB believes that EUR / USD is headed to parity. The exchange rate fell below the key support level of 1.0525, which is its lowest level since December last year when the ECB did not meet market expectations for further easing of monetary policy, remind analysts. In their view, this increases the likelihood that the pair will reach parity in the coming months. Another argument to wait parity is a supportive fiscal policy in the US and politically busy calendar in the EU.

victoriajensen

Established member

- Messages

- 648

- Likes

- 10

EUR/USD broke above 1.0600 again today after forming an impressive doji candlestick on the daily time-frame above the support at 1.0500. Next target is likely 1.0645.

Last edited:

arigoldman

Established member

- Messages

- 626

- Likes

- 10

Expecting more to the downturn.