To be honest, I am half hoping that you are pulling our legs with your proposal.

Hi George,

I've been trading on and off for twenty years. In that time, I've mainly traded equities and indexes (starting with full blown shares, then CFDs and then Spread betting) with some FX thrown in. I've had some terrific months, +40k on my best one.

I believe that all trading is gambling (only my opinion of course) and trying to predict the unpredictable is futile. For that reason I don’t use charts. I also don’t sit in front of a screen all day looking at prices as I find its boring and stressful and in my experience, I make less money that way.

I may have been lucky, you may be right there, but only time will tell. I am in a fortunate position financially and only trade with money I can afford to lose, I also have very low outgoings these days.

I make good percentages when trading small as there is no stress and find that scaling trades up adds to stress levels and therefor affects my decisions. Since I trade small, I trade high risk. It’s easy to double or even triple your money that way and that is why I may be naive in thinking I can do so with larger trades, as I said, time will tell.

As far as strategy is concerned. I’ve tried and tested everything over the years. One thing I am 100% sure of is that there are a hundred trading strategies out there, and they all work! As long as you stick to it that is. That’s where people seem to go wrong, they try something and it works for a while, then it goes wrong and they leave it and move on to the next one. They don’t realise that there two markets – trending and consolidating and there is no one system that works in both markets. Strategies are like people, they have personalities and traders need to find a strategy that suits their personality. For example, some people like high volume trading where they trade multiple times a day, some traders are low frequency and trade once a month. Both of these strategies work but if you tried to make the low volume trader swap with the high volume trader, he would probably get burned out and stressed and lose his money. In the same way, the high volume trader would get bored with only being able to trade once a month and he would end up changing the system to match his personality. This is what I have done - taken the bits of systems that I like and discarded the bits I don’t like. For example, every time I use stop loss, I get stopped out! So I don’t use it.

Anyway, I’ve rambled. December is nearly up and I'm at 11% at the minute, not great but as I stated earlier, my aim was simply to beat the banks and in that manner, I'm winning!

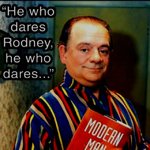

I very much believe Dell Boy – He who dares…wins!