You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Indicators are liars! Support and Resistance Trading for the S&P emini

What time frame do you draw your fibs. Do you base it off of the weekly chart or do you use the four hour chart? Also, do you draw it from a Monday low/high?

Are the pivots, daily pivots? And what is the meaning of VAH, POC, VAL. And how do those play in the confluence of a level.

As for set ups. Do you set up in areas of high confluence or will you trade an any one of the listed s/r line.

How do you use the BB's in your trading decision on the 1 minute chart.

Thanks.

- Fibs are based upon the high and low of the previous day

- pivots are daily pivots

-VAH, POC and VAL are Market Profile numbers meaning VALUE AREA HIGH, POINT OF CONTROL, VALUE AREA LOW.

Dont get too concerned about these numbers we only use them for confluence for the S/R numbers, to help us gauge when other market participants are entering, they improve the odds of our numbers working.

- With the BBs as I explained I look for price to be at an extreme, i.e. outside the bands when I enter.

By the way, do you do any premarket trading?

I answered this question in my first reply to you. Yes, I do trade the premarket very often

Hi everyone

Please find attached todays levels.

Always remember to use the numbers as a guideline for potential areas of high probability plays

Always use a set up based upon your system to enter a trade.

The Levels have been working AMAZINGLY well even in this volatile market

Good trading all

ESResistance

Please find attached todays levels.

Always remember to use the numbers as a guideline for potential areas of high probability plays

Always use a set up based upon your system to enter a trade.

The Levels have been working AMAZINGLY well even in this volatile market

Good trading all

ESResistance

Attachments

AAmarx. I continue to learn much by paying attention to SR levels.

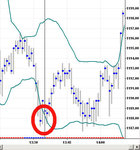

Thanks a lot for your post on this. I attach a picture of the ES mini SR levels that I drew on Thursday extended through today's price action (Mon 22). (I don't trade the ES and did not change the lines from Thursday and Friday did not get down this low).

Nearly all of them came into play today, some within a tick or two, many serving as both Support and Resistance during the day. Pretty amazing.

This further bolsters your main thesis that SR is actually what is going on in terms of what pro traders are looking at. I hope this link works for the image. If not let me know and I'll post it somewhere else.

Thanks a lot for your post on this. I attach a picture of the ES mini SR levels that I drew on Thursday extended through today's price action (Mon 22). (I don't trade the ES and did not change the lines from Thursday and Friday did not get down this low).

Nearly all of them came into play today, some within a tick or two, many serving as both Support and Resistance during the day. Pretty amazing.

This further bolsters your main thesis that SR is actually what is going on in terms of what pro traders are looking at. I hope this link works for the image. If not let me know and I'll post it somewhere else.

Last edited:

Trader333

Moderator

- Messages

- 8,766

- Likes

- 1,030

AAmarx. I continue to learn much by paying attention to SR levels. Thanks a lot for your post on this. I attach a picture of the ES mini SR levels that I drew on Thursday. I don't trade the ES and did not change the lines from Thursday. Nearly all of them came into play today, some within a tick or two. I think this further bolsters your main thesis that SR is actually what is going on in terms of what pro traders are looking at. I hope this link works for the image. If not let me know and I'll post it somewhere else.

Click on "Manage Attachments" and you will get the option to upload the picture.

Paul

What is the best time to start pre-market trading? And is there more risk involved by trading pre-market since it is much lighter volume?

Higher Margin

Lower volume, sometimes difficult to get filled.

Also the $tick is not running.

Pre market is not the best time to trade, lately pre market volume has been higher and the moves more substantial, but still market hours are best.

Action in the premarket in my experience usually starts around 5am EST when the Euro session is well under way.

Last edited:

aamarx, if you don't mind would you post a couple of trades you make during the day so that I can go back to my charts and study your set ups. And thanks for the two pics you posted.

http://www.trade2win.com/boards/us-...esistance-trading-s-p-emini-2.html#post497014

I have gone through some potential trades there. I think you will find some good examples in that. If you would like some further examples let me know.

Similar threads

- Replies

- 16

- Views

- 11K

- Replies

- 21

- Views

- 5K

- Replies

- 24

- Views

- 6K