Implementing sound money management encompasses many techniques and skills intertwined by the trader's judgment. All three of these ingredients must be in place before the trader is said to be using a money management program along with their trading. Failure to implement a good money management program will leave the trader subject to the deadly "risk-of-ruin" exposure leading eventually to a probable equity bust.

Whenever I hear of a trade making a huge killing in the market on a relatively small or average trading account, I know the trader was most likely not implementing sound money management. In cases such as this, the trader more than likely exposed themselves to obscene risk because of an abnormally high "Trade Size." In this case the trader or gambler may have gotten lucky leading to a profit windfall. If this trader continues trading in this manner, probabilities indicate that it is just a matter of time before huge losses dwarf the wins, and/or eventually lead to a probable equity bust or total loss.

Whenever I hear of a trader trading the same number of shares or contracts on every trade, I know that this trader is not calculating their maximum "Trade Size." If they where, then the "Trade Size" would change from time to time when trading.

In order to implement a money management program to help reduce your risk exposure, you must first believe that you need to implement this sort of program. Usually this belief comes after having a few large losses that cause enough psychological pain that you want and need to change. You need to understand how improper "Trade Size" actually will hurt your trading.

Novice traders tend to focus on the trade outcome as only winning and therefore do not think about risk. Professional traders focus on the risk and take the trade based on a favorable outcome. Thus, "The Psychology Behind 'Trade Size'" begins when you believe and acknowledge that each trade's outcome is unknown when entering the trade. Believing this makes you ask yourself, how much can I afford to lose on this trade and not fall prey to the "risk-of-ruin" outcome?

When traders ask themselves that, they will then either adjust their "Trade Size" or tighten their stop-loss before entering the trade. In most situations, the best method it to adjust your "Trade Size" and set your stop-loss based on market dynamics.

During "draw-down" periods, risk control becomes very important and since good traders test their trading systems, they have a good idea of the probabilities of how many consecutive losses in a row can occur. Taking this information into account, allows the trader to further determine the appropriate risk percentage to take on each trade.

Let's talk about implementing sound money management in your trading formula so as to improve your trading and help control risk. The idea behind money management is that given enough time, even the best trading systems will only be right about 60% to 65% of the time. That means 40% of the time we will be wrong and have losing trades. For every 10 trades, we will lose an average of 4 times. Even trading systems or certain trading set ups with higher rates of returns nearing 80% usually fall back to a realistic 60% to 65% return when actually traded. The reason for this is that human beings trade trading systems. And when human beings get involved, the rates of returns on most trading systems are lowered. Why? Because humans make trading mistakes, and are subject from time to time to emotional trading errors. That is what the reality is and what research indicates with good quality trading systems traded by experienced traders.

If we are losing 40% of the time then we need to control risk! This is done through implementing stops and controlling position size. We never really know which trades will be profitable. As a result, we have to control risk on every trade regardless of how sure we think the trade will be. If our winning trades are higher than our losing trades, we can do very well with a 60% trading system win to loss ratio. In fact with risk control, we can sustain multiple losses in a row without it devastating our trading account and our emotions.

Some traders can start and end their trading careers in just one month! By not controlling risk and by using improper "Trade Size" a trader can go broke in no time. It usually happens like this; they begin trading, get five losses in a row, don't use proper position size and don't cut their losses soon enough. After five devastating losses in a row, they're trading capital is now too low to continue trading. It can happen that quickly!

It is equally important that the trader is comfortable with their trading system and have the knowledge to know that it is possible and inevitable to have a losing streak of five losses in a row. This is called drawdown. Knowing this eventuality prepares the trader to control their risk and not abandon their chosen trading system when it occurs. It is another ingredient in "The Trader's Mindset."

What we are striving for is a balanced growth in the trader's equity curve over time.

Below is a list of the ingredients in devising a sound money management plan for your trading:

"Trade Size" And The 2% Risk Rule

The two percent risk rule along with the six percent portfolio risk rule are shown to keep a trader out of trouble provided their trading system can produce 55% or above win to loss ratio with an average win of at least 1.6 to 1.0 meaning wins are 60% larger than loses. So, for every dollar you lose when you have a losing trade, your winning trades produce a dollar and sixty cents.

Assuming the above, we can then proceed to calculate risk. The two percent risk is calculated by knowing your trade entry price and your initial stop loss exit price. The difference of the two gives you a number that when multiplied by your position size (shares or contracts) will give you your dollar loss if you are stopped out. That dollar loss must be no larger than two percent of the equity in your trading account. It has nothing to do with leverage, and in fact you can use leverage and still stay within a two percent risk of equity in your trading account.

Money Management Example

Calculating The Dollar Amount Of Two Percent Risk:

Trading Account Equity: $ 25,000

2% of $ 25,000 (Trading Account Equity) = $ 500

Assuming no slippage in this example

Thus on any given trade you should risk no more than $500 net which includes commission and slippage.

Actual Example In The Market Place:

MSFT is currently trading at $60.00 per share

Round trip commission is $ 80.00

Our trading system says to go long now at $ 60.00 per share. Our initial stop loss is at $ 58.50 and the difference between our entry at $ 60.00 and our initial stop loss at $58.50 is $ 1.50 per share.

Now the question is how many shares ("Trade Size") can we buy when our risk is $ 1.50 per share and our two percent account risk is $ 500.00?

The answer is:

That means you should buy no more than 280 shares of the stock MSFT to maintain proper risk control and obey the 2% risk rule. If you trade future contracts or option contracts, you calculate your position size the same way. Note that your "Trade Size" may be capped by the margin allowances for futures traders and for stock traders.

Note that MSFT which is Microsoft is a technology company in the technology sector. It is important that if you want to take another trade while you are still in the Microsoft trade, that you trade a different sector of the market. This same rule applies to options and futures as well. In futures trade a different commodity. So, basically using these rules you will be automatically diversified.

Also note that if your risk in one sector is only one percent, you may take additional trades in that sector until you reach a total of two percent. You should not exceed six percent overall between all sectors. In other words, the most or total account portfolio risk you should have at any given time should not exceed six percent. Remember the two percent risk must include commissions and if possible slippage, if you can determine that. Using this technique will also keep your trade and risk in proportion to your trading account size at all times.

If you do not add-on to a current position, but your stop moves up along with your trade, then you are locking in profits. When you lock in profits with a new trailing stop, your risk on this profitable trade is no longer 2%. Thus, you may now trade another market. So, multiple positions can be possible.

Trading Capital - Funding Your Trading Account

It is alarming that many traders use either borrowed money or money they really cannot afford to lose or risk. This usually will set the trader up for failure because they will be subject to the market's emotional manipulation since the trader cares too much about the outcome of each trade.

In simpler terms, the trader is nervous about losing the money and therefore each stop out creates more anxiety up to a point where the trader may not want to get out when suppose to and take the loss, but instead hope the trade comes back. It takes both responsibility and discipline for accepting the trading loss and getting out. This is the same type responsibility and discipline the trader did not have when he or she decided to trade with money that shouldn't be traded. So, it is not likely the trader will have the discipline nor have the responsibility to trade successfully. If you do not have sufficient risk capital to trade, begin "Paper Trading" to improve your trading skills while you are saving enough risk capital to begin trading with real money. This way when you are ready to trade with real money you will have practiced your trading skills so that you will do better.

The Psychology Behind "Scaling" Out Of Trades

"Scaling" out of trades can be incorporated into your money management game plan since it is a component of risk control.

"Scaling" out of trades is a great technique that actually can convert some losing trades into profitable ones, reduce stress, and increase your bottom line! As you all know by now, I am a big advocate of reducing stress while you're in a trade. This way you can focus on the trade and not be subject to emotions such as fear and greed which usually hamper your trading. Properly "Scaling" out of positions can not only at times make you more profitable, but it can also reduce the stress that some traders incur during trading.

In order to "Scale" out of trades the initial "trade size" must be large enough so you can reap the benefits of "scaling." The technique is applicable for both long and short positions, and for all types of markets like futures, stocks, indexes, options, etc. The key here is that the initial position must be large enough to enable you to cover your profitable trade in increments without incurring additional risk form such a large opening position. Remember, we want less stress, not more!

Your initial position or "trade size" should always be within a 2% risk parameter. Therefore, the key now is be able to initiate a large enough "trade size" while not risking more than 2% on entering the trade. There is only two ways to do this. One way is to find a market that you can initiate a large enough "trade size" with your current trading account size based on a 2% or less loss if this initial position is stopped out. The other way, is to add additional trading capitol to your trading account that will allow for a larger position because 2% of a larger account allows for a larger "trade size." There is even another way, and that is to use the leverage of options, but you must be familiar with options, their "time value" decay, delta, etc. Using options would be considered a specialty or advanced technique, and if you are not familiar with them, this method could lead to increasing your stress!

Here is an overview of "scaling" out of a position and how it can help your trading. This technique works on all time frames from intra-day to long-term term monthly charts!

"Scaling" Out Example

Let's choose the e-mini as an example. In our example, your account size is $25,000 and you choose to risk 2% on this trade. 2% of $25,000 is $500. Your trade entry is 1037.75 and your exit is 1036.25 so you can buy approximately 6 contracts and stay within your risk parameters. Now this means if you get stopped out before having a chance to "scale" out, your loss would only be 2% which is acceptable from a "risk-of-ruin" stand point and therefore, this potential risk should not create any stress. Note, that if you add risk capitol to this trading account, you would be able to increase your initial "trade size" and still maintain a 2% risk. Let's say we enter this trade and it starts to become profitable. Here is where "scaling" out comes in and there are many variations to "scaling" out, so you will need to "paper trade" this technique to find which way works best for you. The idea is, as soon as the trade is profitable enough, cover part of your position and liquidate enough contracts so that if you are still stopped out, you make a small profit! If the trade becomes even more profitable, then you may want to liquate some more contracts to lock in more profit as well. The idea here is that as soon as your trade is profitable enough; liquidate enough contracts so that even if your original stop-loss is triggered, you make a profit. If your initial stop-loss is never triggered, then you should be able enjoy the rest of the trade and let it go as long as the trend takes it knowing that no matter what happens, you should at least make a profit on this trade. Knowing this is a great feeling and you will even have more fun trading!

There are many variations and themes on how to "scale" out, but this is the basic idea. If you trade only one or two contracts you really can't "scale" out of positions that well. This is another reason why larger trading accounts have an advantage over smaller ones! Also, some markets are more expensive then others, so the cost of the trade will also determine your "trade size." Remember in choosing your market, liquidity is important, and you must have sufficient market liquidity as well to execute "scaling" out of positions in a meaningful way. Poor fills due to poor liquidity can adversely effect our "scaling" out technique.

The psychology behind "scaling" out is to reduce stress by quickly locking in a profit, which should also help you stay in trends longer with the remaining positions.

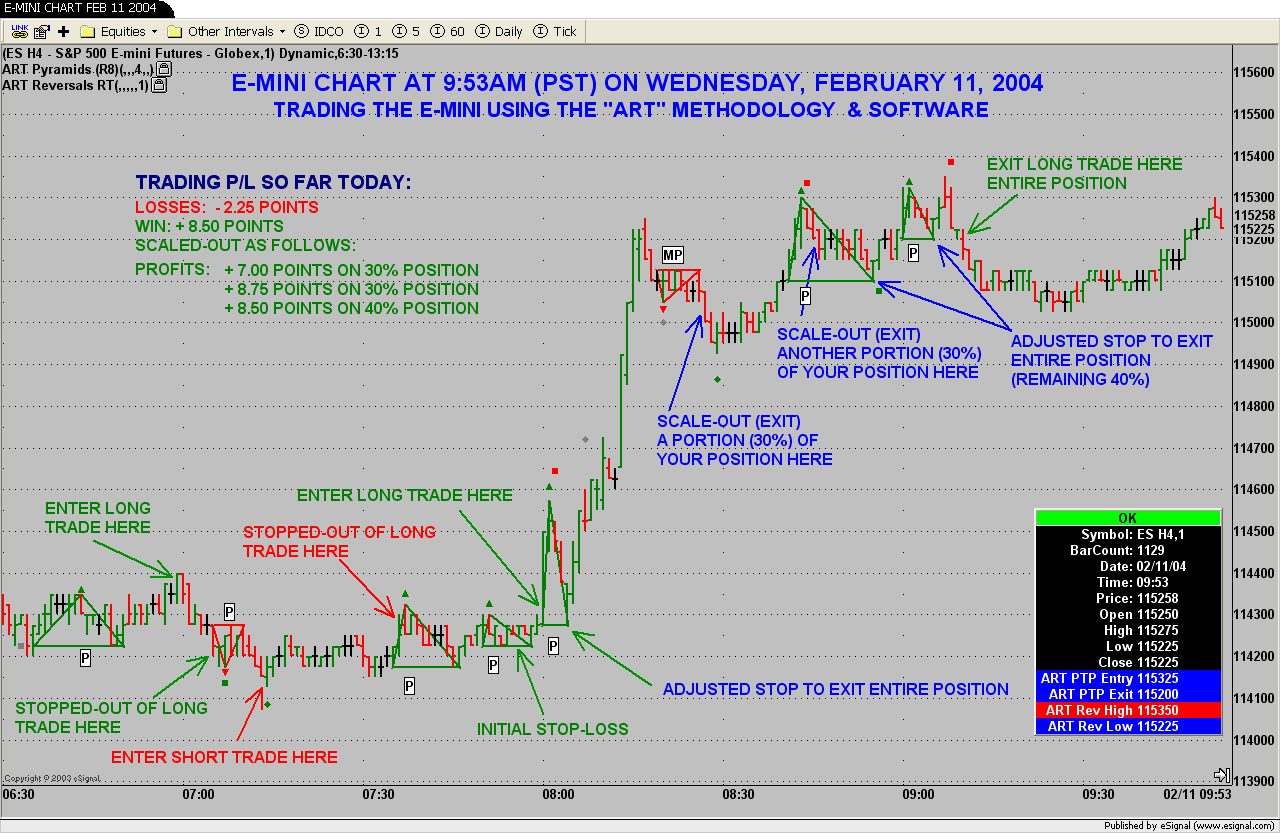

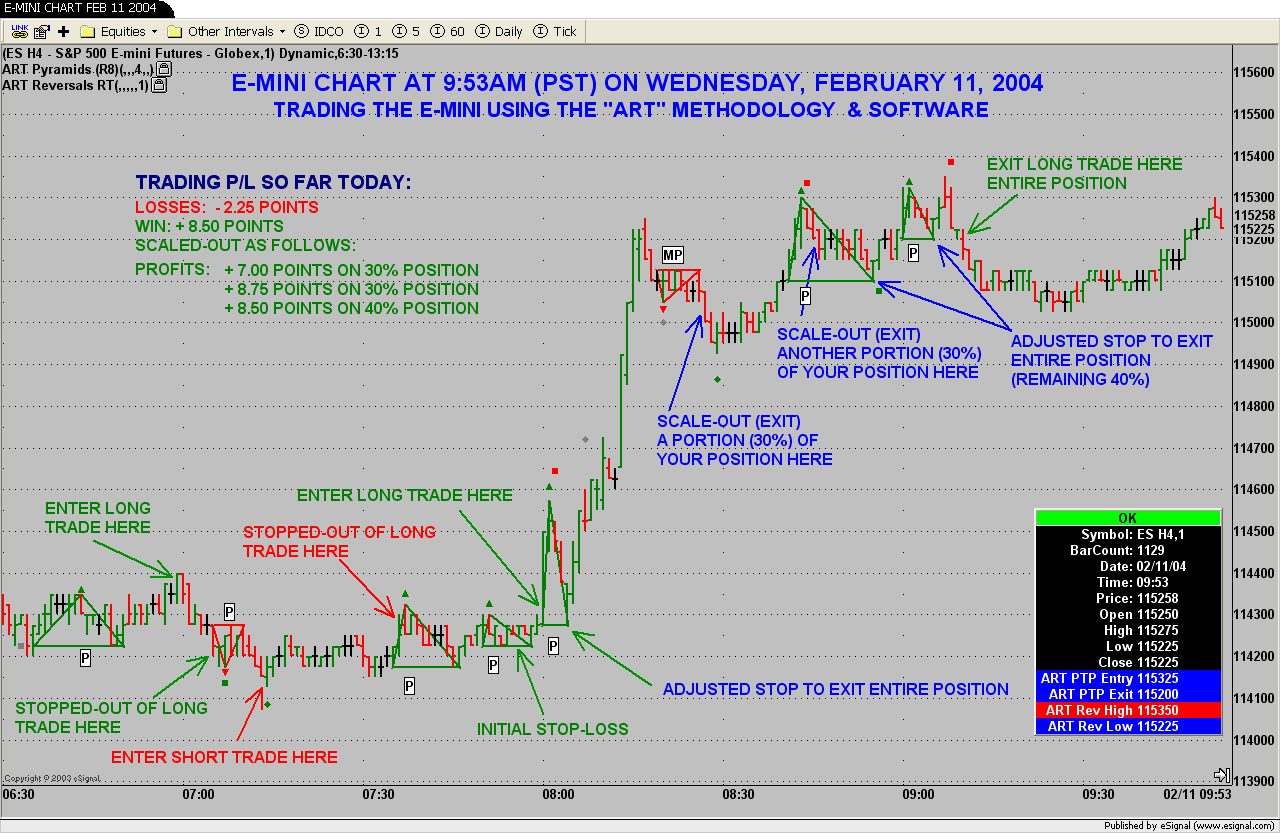

Here is an example of using multiple money management techniques. In the chart below we adjust stops and "scale" out of the trade in increments as part of our money management program. The initial "trade size" was calculated using a 2% risk based on the trade entry and the initial stop-loss point as indicated on the chart.

Whenever I hear of a trade making a huge killing in the market on a relatively small or average trading account, I know the trader was most likely not implementing sound money management. In cases such as this, the trader more than likely exposed themselves to obscene risk because of an abnormally high "Trade Size." In this case the trader or gambler may have gotten lucky leading to a profit windfall. If this trader continues trading in this manner, probabilities indicate that it is just a matter of time before huge losses dwarf the wins, and/or eventually lead to a probable equity bust or total loss.

Whenever I hear of a trader trading the same number of shares or contracts on every trade, I know that this trader is not calculating their maximum "Trade Size." If they where, then the "Trade Size" would change from time to time when trading.

In order to implement a money management program to help reduce your risk exposure, you must first believe that you need to implement this sort of program. Usually this belief comes after having a few large losses that cause enough psychological pain that you want and need to change. You need to understand how improper "Trade Size" actually will hurt your trading.

Novice traders tend to focus on the trade outcome as only winning and therefore do not think about risk. Professional traders focus on the risk and take the trade based on a favorable outcome. Thus, "The Psychology Behind 'Trade Size'" begins when you believe and acknowledge that each trade's outcome is unknown when entering the trade. Believing this makes you ask yourself, how much can I afford to lose on this trade and not fall prey to the "risk-of-ruin" outcome?

When traders ask themselves that, they will then either adjust their "Trade Size" or tighten their stop-loss before entering the trade. In most situations, the best method it to adjust your "Trade Size" and set your stop-loss based on market dynamics.

During "draw-down" periods, risk control becomes very important and since good traders test their trading systems, they have a good idea of the probabilities of how many consecutive losses in a row can occur. Taking this information into account, allows the trader to further determine the appropriate risk percentage to take on each trade.

Let's talk about implementing sound money management in your trading formula so as to improve your trading and help control risk. The idea behind money management is that given enough time, even the best trading systems will only be right about 60% to 65% of the time. That means 40% of the time we will be wrong and have losing trades. For every 10 trades, we will lose an average of 4 times. Even trading systems or certain trading set ups with higher rates of returns nearing 80% usually fall back to a realistic 60% to 65% return when actually traded. The reason for this is that human beings trade trading systems. And when human beings get involved, the rates of returns on most trading systems are lowered. Why? Because humans make trading mistakes, and are subject from time to time to emotional trading errors. That is what the reality is and what research indicates with good quality trading systems traded by experienced traders.

If we are losing 40% of the time then we need to control risk! This is done through implementing stops and controlling position size. We never really know which trades will be profitable. As a result, we have to control risk on every trade regardless of how sure we think the trade will be. If our winning trades are higher than our losing trades, we can do very well with a 60% trading system win to loss ratio. In fact with risk control, we can sustain multiple losses in a row without it devastating our trading account and our emotions.

Some traders can start and end their trading careers in just one month! By not controlling risk and by using improper "Trade Size" a trader can go broke in no time. It usually happens like this; they begin trading, get five losses in a row, don't use proper position size and don't cut their losses soon enough. After five devastating losses in a row, they're trading capital is now too low to continue trading. It can happen that quickly!

It is equally important that the trader is comfortable with their trading system and have the knowledge to know that it is possible and inevitable to have a losing streak of five losses in a row. This is called drawdown. Knowing this eventuality prepares the trader to control their risk and not abandon their chosen trading system when it occurs. It is another ingredient in "The Trader's Mindset."

What we are striving for is a balanced growth in the trader's equity curve over time.

Below is a list of the ingredients in devising a sound money management plan for your trading:

- Always use stops

- Determine your "Trade Size" based on your trading account equity, your stop loss price for every trade

- Never exceed a loss of 2% on any given trade

- Never trade more than 2% on any give sector

- Never exceed a total portfolio risk of 6%

- Always trade with risk capital, money you can afford to lose

- Never trade with borrowed money

- Don't overtrade based on the time frame you have chosen to trade

"Trade Size" And The 2% Risk Rule

The two percent risk rule along with the six percent portfolio risk rule are shown to keep a trader out of trouble provided their trading system can produce 55% or above win to loss ratio with an average win of at least 1.6 to 1.0 meaning wins are 60% larger than loses. So, for every dollar you lose when you have a losing trade, your winning trades produce a dollar and sixty cents.

Assuming the above, we can then proceed to calculate risk. The two percent risk is calculated by knowing your trade entry price and your initial stop loss exit price. The difference of the two gives you a number that when multiplied by your position size (shares or contracts) will give you your dollar loss if you are stopped out. That dollar loss must be no larger than two percent of the equity in your trading account. It has nothing to do with leverage, and in fact you can use leverage and still stay within a two percent risk of equity in your trading account.

Money Management Example

Calculating The Dollar Amount Of Two Percent Risk:

Trading Account Equity: $ 25,000

2% of $ 25,000 (Trading Account Equity) = $ 500

Assuming no slippage in this example

Thus on any given trade you should risk no more than $500 net which includes commission and slippage.

Actual Example In The Market Place:

MSFT is currently trading at $60.00 per share

Round trip commission is $ 80.00

Our trading system says to go long now at $ 60.00 per share. Our initial stop loss is at $ 58.50 and the difference between our entry at $ 60.00 and our initial stop loss at $58.50 is $ 1.50 per share.

Now the question is how many shares ("Trade Size") can we buy when our risk is $ 1.50 per share and our two percent account risk is $ 500.00?

The answer is:

- $ 500.00 minus $ 80.00 (commissions) = $ 420.00

- $ 420.00 divided by $ 1.50 (initial stop loss amount) = 280 shares

That means you should buy no more than 280 shares of the stock MSFT to maintain proper risk control and obey the 2% risk rule. If you trade future contracts or option contracts, you calculate your position size the same way. Note that your "Trade Size" may be capped by the margin allowances for futures traders and for stock traders.

Note that MSFT which is Microsoft is a technology company in the technology sector. It is important that if you want to take another trade while you are still in the Microsoft trade, that you trade a different sector of the market. This same rule applies to options and futures as well. In futures trade a different commodity. So, basically using these rules you will be automatically diversified.

Also note that if your risk in one sector is only one percent, you may take additional trades in that sector until you reach a total of two percent. You should not exceed six percent overall between all sectors. In other words, the most or total account portfolio risk you should have at any given time should not exceed six percent. Remember the two percent risk must include commissions and if possible slippage, if you can determine that. Using this technique will also keep your trade and risk in proportion to your trading account size at all times.

If you do not add-on to a current position, but your stop moves up along with your trade, then you are locking in profits. When you lock in profits with a new trailing stop, your risk on this profitable trade is no longer 2%. Thus, you may now trade another market. So, multiple positions can be possible.

Trading Capital - Funding Your Trading Account

It is alarming that many traders use either borrowed money or money they really cannot afford to lose or risk. This usually will set the trader up for failure because they will be subject to the market's emotional manipulation since the trader cares too much about the outcome of each trade.

In simpler terms, the trader is nervous about losing the money and therefore each stop out creates more anxiety up to a point where the trader may not want to get out when suppose to and take the loss, but instead hope the trade comes back. It takes both responsibility and discipline for accepting the trading loss and getting out. This is the same type responsibility and discipline the trader did not have when he or she decided to trade with money that shouldn't be traded. So, it is not likely the trader will have the discipline nor have the responsibility to trade successfully. If you do not have sufficient risk capital to trade, begin "Paper Trading" to improve your trading skills while you are saving enough risk capital to begin trading with real money. This way when you are ready to trade with real money you will have practiced your trading skills so that you will do better.

The Psychology Behind "Scaling" Out Of Trades

"Scaling" out of trades can be incorporated into your money management game plan since it is a component of risk control.

"Scaling" out of trades is a great technique that actually can convert some losing trades into profitable ones, reduce stress, and increase your bottom line! As you all know by now, I am a big advocate of reducing stress while you're in a trade. This way you can focus on the trade and not be subject to emotions such as fear and greed which usually hamper your trading. Properly "Scaling" out of positions can not only at times make you more profitable, but it can also reduce the stress that some traders incur during trading.

In order to "Scale" out of trades the initial "trade size" must be large enough so you can reap the benefits of "scaling." The technique is applicable for both long and short positions, and for all types of markets like futures, stocks, indexes, options, etc. The key here is that the initial position must be large enough to enable you to cover your profitable trade in increments without incurring additional risk form such a large opening position. Remember, we want less stress, not more!

Your initial position or "trade size" should always be within a 2% risk parameter. Therefore, the key now is be able to initiate a large enough "trade size" while not risking more than 2% on entering the trade. There is only two ways to do this. One way is to find a market that you can initiate a large enough "trade size" with your current trading account size based on a 2% or less loss if this initial position is stopped out. The other way, is to add additional trading capitol to your trading account that will allow for a larger position because 2% of a larger account allows for a larger "trade size." There is even another way, and that is to use the leverage of options, but you must be familiar with options, their "time value" decay, delta, etc. Using options would be considered a specialty or advanced technique, and if you are not familiar with them, this method could lead to increasing your stress!

Here is an overview of "scaling" out of a position and how it can help your trading. This technique works on all time frames from intra-day to long-term term monthly charts!

"Scaling" Out Example

Let's choose the e-mini as an example. In our example, your account size is $25,000 and you choose to risk 2% on this trade. 2% of $25,000 is $500. Your trade entry is 1037.75 and your exit is 1036.25 so you can buy approximately 6 contracts and stay within your risk parameters. Now this means if you get stopped out before having a chance to "scale" out, your loss would only be 2% which is acceptable from a "risk-of-ruin" stand point and therefore, this potential risk should not create any stress. Note, that if you add risk capitol to this trading account, you would be able to increase your initial "trade size" and still maintain a 2% risk. Let's say we enter this trade and it starts to become profitable. Here is where "scaling" out comes in and there are many variations to "scaling" out, so you will need to "paper trade" this technique to find which way works best for you. The idea is, as soon as the trade is profitable enough, cover part of your position and liquidate enough contracts so that if you are still stopped out, you make a small profit! If the trade becomes even more profitable, then you may want to liquate some more contracts to lock in more profit as well. The idea here is that as soon as your trade is profitable enough; liquidate enough contracts so that even if your original stop-loss is triggered, you make a profit. If your initial stop-loss is never triggered, then you should be able enjoy the rest of the trade and let it go as long as the trend takes it knowing that no matter what happens, you should at least make a profit on this trade. Knowing this is a great feeling and you will even have more fun trading!

There are many variations and themes on how to "scale" out, but this is the basic idea. If you trade only one or two contracts you really can't "scale" out of positions that well. This is another reason why larger trading accounts have an advantage over smaller ones! Also, some markets are more expensive then others, so the cost of the trade will also determine your "trade size." Remember in choosing your market, liquidity is important, and you must have sufficient market liquidity as well to execute "scaling" out of positions in a meaningful way. Poor fills due to poor liquidity can adversely effect our "scaling" out technique.

The psychology behind "scaling" out is to reduce stress by quickly locking in a profit, which should also help you stay in trends longer with the remaining positions.

Here is an example of using multiple money management techniques. In the chart below we adjust stops and "scale" out of the trade in increments as part of our money management program. The initial "trade size" was calculated using a 2% risk based on the trade entry and the initial stop-loss point as indicated on the chart.

Last edited by a moderator: