Start Quote:

Nas

The challenge in TA is to find the reversal points using cycles and to do that you need a concept such as Exhaustion engine but in many many time frames instead of basic 1.3.5 min .

when the TOP NODES of cycles in different time frames match and meet then the reversal occurs . The more number of cycles NODE'S meet,, the heavier the reversal and hence a new trend is born ...

Grey1

End Quote:

Hi Grey1,

After reading your reply to post # 743 from Friday, I did some OB, OS comparisons in Multi-TF’s, that is, in 1, 3, 5, 10, 15, & 30-Min TF’s. Your comments made a lot of sense, and it caused me to make some analysis. Since, I had this complete and was trying to analyze the market, I’ve attached the data in MS Excel, and see the "notes" in 2nd Tab of the Excel sheet. The excel lists all of the peaks & valleys MACCI values & exact time they occurred in each TF. This analysis of the peak (O/B) & valleys (O/S) when compared to the Dow charts listed below, indicated that it's the fall of the MACCI's form their peaks when in combination with other TF's and is the key to ID for a proper short. I was disappointed that the excel analysis wasn't the holy grail - LOL.

Also, the 1st Dow Charts in same TF’s are attached in MS Word (Dow Charts, in Multi-f TF's,m 12-15-06). On Sunday, I reviewed the Dow Charts again, and realized that theses 1st Charts were not the correct way ID proper oscillations for a short, so I quickly did another analysis on the Dow and attached them as the 2nd Dow Charts in MS Word (Dow Charts, Multi TF's, 12-17-06). The MACCI’s which I normally use are the 1, 5, 10, & 15-Min. I'm still trying to get a handle on this strategy, and improve my understand on their optimum use.

------------------------------------------------------------------------------------------------

The 1st & wrong method I used (Dow Charts, in Multi TF's, 12-15-06):

I went through each chart and annotated the MACCI’s 1st fall below it’s previous low – like a Break Down (B/D). The 1-Min Chart was the least helpful, and its B/D occurred at 10: 15, B/D thru the “0” MACCI line with no confirmation in the Other TF’s. With the many cycles in the 1-Min chart, how can one tell which MACCI falling from its O/B condition is correct? The 3-Min’s MACCI did it’s 1st fall below its previous low at 11:18, with a MACCI of + 60.

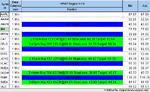

The 1st set of Dow Charts, the 5, 10 & 15-Min MACCI’s were hit and were the best indication of the oscillations falling between 11:15 and 11:25 ET. The following are a summary of each TF (O/B) indication of falling below its previous low (also shown on the Charts):

1-Min, MACCI’s fell thru “0” at 10:15

3-Min, MACCI’s fell thru + 60 at 11:18

5-Min, MACCI’s fell thru + 90 at 11:25

10-Min MACCI’s fell thru + 100 at 11:20

15-Min MACCI’s fell thru + 138 at 11:15

30-Min MACCI’s fell thru + 110 at 13:00

---------------------------------------------------------------------------------

The 2nd method I used on Sunday (Dow Charts, Multi TF's, 12-17-06) - with better results:

I used the same TF's, and drew a "trend line" on the bottom of the Dow on a 3-Min chart first. Next, I made a vertical line straight down to align & cross with the MACCI Value & Time in all TF's. Obviously this may not the proper method, but is about as close as the best which can be used to match the proper MACCI value & time to start looking for the weakest stocks to short. An interesting thing which I found doing this analysis method, was by using the same trend lines (after I used the 3-Min chart & trend lines) when I changed my charts to 5-Min thru the 15-Min, the trend line (obviously) stayed the same, but the vertical line stayed in the same location crossing the MACCI as it was falling - calling for a short. Coincidently, the MACCI values between the 3-Min & 15-Min were all > + 100 (O/B), although the 5-Min was + 95 at the MACCI & Time intersecting lines. Therefore, this was a very strong signal, between 11:10 and 11:15 or 12:00 to short a stock. The following data are a summary of each TF from this 2nd Dow Charts:

1-Min, MACCI = + 5, 11:14

3-Min, MACCI = + 120, 11:12

5-Min, MACCI = + 95, 11:10

10-Min, MACCI = + 120, 11:10

15--Min, MACCI = + 138, 11:15

30-Min, MACCI = + 140, 12:00

Now I am far from being an expert in this strategy, I am trying to better understand this concept.

Therefore, Grey1 would you be so kind as to review the 2nd Dow Chart analysis (Dow Charts, Multi TF's, 12-17-06), which I’ve constructed with Charts & MACCI values for Friday, 12/15/06, and let me know if my review using the 2nd Dow Charts is correct? I would like to fine tune this strategy on MACCI oscillations - thanks!

NasTrader