snowrider

Well-known member

- Messages

- 423

- Likes

- 3

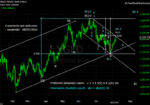

I'll maintain my weekly posts in one thread for each month so that a thread won't be too long or too short. I am starting from this (2010-08) thread. For past long term view, please see:

http://www.trade2win.com/boards/metals/99146-gold-wave-count.html

http://www.trade2win.com/boards/metals/99146-gold-wave-count.html