bottomleyp said:

Started looking at Gold and Oil.

You say buy at 643.5,stop at 635

Are these spot positions or April contract ?

They are rollover Cash Bets. You can get monthly bets to but I prefer these.

Thought behind it as in this thread price of gold IMO driven by

1. uncertainty in markets due to upcoming confrontation with Iran

2. increased economic activity

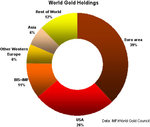

3. weakness in $ and switch by central banks to gold and the Euro

To add more fuel to the fire

=====================

Russian foreign minister Sergey Lavrov has questioned the occupation of Iraq by US and the increase in troop numbers. They are alarmed.

China's test on taking out their sattelite is no accident and you can be sure Iran is currently developing a ballistic missile with the same intention.

The recent announcement of $10bn for Afghanistan development to build schools and roads and hospitals is BS. It's to open up a rear front against Iran . The taliban have announced 2000 suicidal maniacs ready for a spring offensive against all foreign troops.

The Arabian committees have announced an attack on Iran will turn ME into a hell hole. Recent conflict in Leabonan is not just coincidental. You can be sure in event of conflict Leabonen and Syria will be drawn in as if Iran is attacked Syria will be next. If Israel has a part to play as inevitably it will then think how other Arab countries and popullations will respond?

The ex head of Mossad Efraim Halevy has commented that a third world war between millitant fundamentalists and the west has already started. Whilst I don't share his view just like US attack on Iraq has increased the terrorism threat without doubt, and attack on Iran will almost certainly lead to a major war in the Middle East that I don't believe can be won by any country as we will be up against China and Russia in a proxy war. Inevitably peoples paranoia lead to the very prospect they fear. Obsessive infatuation is very bad...

Bushes recent provocation to Iran re: arresting diplomatic staff and now shoot to kill policy is as I mentioned an effort to provoke a confrontation.

Just as the US administration got it wrong in Iraq they are wrong again. Iraq is another Vietnam already and the $ will pay the price. Oil and gold will rise.

Russia will gain as they are gold and oil producing countries. China may lose some speed but will not lose much. The ME will be redefined but US influence will decline.

I think if the calculation is that Iran's infrastructure will be damaged and their nuclear development will be stalled and that will teach them not to continue like Iraq then those calculations are wrong. Iran is not Iraq. Millions will die. If we don't pull our troops out we will be aligned with US and become likewise targets.

So what does all this FA and strategic analysis mean to our trades.

1. Gold will rise - always does in times of war and uncertainty.

2. Oil will rise as Iraq & Iran's oil fields will be out of production.

3. $ will fall and be worth much less. Gold and Euro and other currencies will rise.

4. Russia, Latin American countries and other Oil producing ME countries will benefit.

5. We may see other struggles for mineral resources and border conflicts may arise in Africa & Latin America and in Asia as smaller countries settle border and resource disputes

6. US will concede being an economic power and military power.

So perhaps Efraim Halevy may be right after all.

This may sound like conspiracy or fruit cake news but IMO the BBC and Western media provide sanitized news for mass consumption to support their political objectives. Listening to satellite news and topical debates on foreign stations like the Chineese CCTV or ME station like AlJazeera you get a much better grasp of developments and how developments are perceived by others.

PS. I think Climate Change is more of a threat to us all than above fruit cakes that we may be fed but nough said.

🙄