Moved down to $2869. I am eyeing Powell's testimony for fed clues.The price of gold is now around $2872, gold is moving more above $2800. Is it possible that gold can reach $3000 as predicted by Citigroup?

The People's Bank of China (PBOC), has expanded its gold reserves for the third month in a row, which has a positive impact on gold as a safe-haven asset amid concerns about economic uncertainty. Gold reserves held by the People's Bank of China increased by 0.16 million troy ounces last month.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

it is at $2896. It seems possible to me that it can touch $3000 soon maybe by end of this month. Do you agree?Moved down to $2869. I am eyeing Powell's testimony for fed clues.

I cannot understand why this price of gold discussion thread is in the forex forum. So I thought I would make the connection between forex and gold prices.

Anyone following my posts will have seen me describe the volatility response model for fx that relates candlesticks by a single mathematical function. So for any timescale (1 day, 2 day,...8 day and 1 week, 2 week,...8 week) the maths can take one step into the future. One of the outcomes is a long term trend channel (LTTC). I call the maths by the acronym "vrmfx" for short.

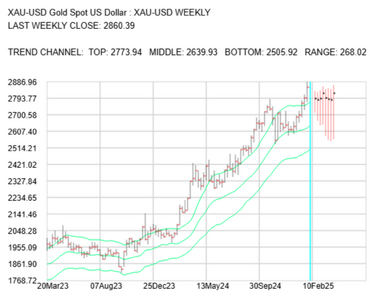

So I have now applied the same maths to spot gold prices and I attach the LTTC for this commodity over 100 weeks. The LTTC is shown top, middle and bottom by a green curve. For this week the top, middle and bottom are listed at the top of the chart. One of the properties of the LTTC is that for a bullish market the price is above the middle of the LTTC. And for a bearish market the price is below the middle of the LTTC. So from 16th October 2023 you could have happily sat on XAU-USD. You would have had to accept the rise and fall of the price. But from 16th October 2023 the price was always above the middle of the LTTC. The price of gold did test the middle of the LTTC from 11th Nov. 2024 through 30th Dec 2024 but in the end the support at the middle of the LTTC held.

At the moment gold is making new highs and the LTTC is chasing the gold price.

So to address the question of whether gold will make $3000 I think the real question is... will the price of gold remain above the middle of the LTTC which is currently 2639.93 USD. That is the price that gold could fall to 2639.93 USD and the market could still be long term bullish. So long as the market finds support on the middle of the LTTC then the market is long term bullish.

gka

Anyone following my posts will have seen me describe the volatility response model for fx that relates candlesticks by a single mathematical function. So for any timescale (1 day, 2 day,...8 day and 1 week, 2 week,...8 week) the maths can take one step into the future. One of the outcomes is a long term trend channel (LTTC). I call the maths by the acronym "vrmfx" for short.

So I have now applied the same maths to spot gold prices and I attach the LTTC for this commodity over 100 weeks. The LTTC is shown top, middle and bottom by a green curve. For this week the top, middle and bottom are listed at the top of the chart. One of the properties of the LTTC is that for a bullish market the price is above the middle of the LTTC. And for a bearish market the price is below the middle of the LTTC. So from 16th October 2023 you could have happily sat on XAU-USD. You would have had to accept the rise and fall of the price. But from 16th October 2023 the price was always above the middle of the LTTC. The price of gold did test the middle of the LTTC from 11th Nov. 2024 through 30th Dec 2024 but in the end the support at the middle of the LTTC held.

At the moment gold is making new highs and the LTTC is chasing the gold price.

So to address the question of whether gold will make $3000 I think the real question is... will the price of gold remain above the middle of the LTTC which is currently 2639.93 USD. That is the price that gold could fall to 2639.93 USD and the market could still be long term bullish. So long as the market finds support on the middle of the LTTC then the market is long term bullish.

gka

Attachments

Zerologic

Well-known member

- Messages

- 374

- Likes

- 27

Thank you for your analysis, what is your opinion, could gold reach $3000? Now gold already reached 2922 on the FXOpen platform.I cannot understand why this price of gold discussion thread is in the forex forum. So I thought I would make the connection between forex and gold prices.

Anyone following my posts will have seen me describe the volatility response model for fx that relates candlesticks by a single mathematical function. So for any timescale (1 day, 2 day,...8 day and 1 week, 2 week,...8 week) the maths can take one step into the future. One of the outcomes is a long term trend channel (LTTC). I call the maths by the acronym "vrmfx" for short.

So I have now applied the same maths to spot gold prices and I attach the LTTC for this commodity over 100 weeks. The LTTC is shown top, middle and bottom by a green curve. For this week the top, middle and bottom are listed at the top of the chart. One of the properties of the LTTC is that for a bullish market the price is above the middle of the LTTC. And for a bearish market the price is below the middle of the LTTC. So from 16th October 2023 you could have happily sat on XAU-USD. You would have had to accept the rise and fall of the price. But from 16th October 2023 the price was always above the middle of the LTTC. The price of gold did test the middle of the LTTC from 11th Nov. 2024 through 30th Dec 2024 but in the end the support at the middle of the LTTC held.

At the moment gold is making new highs and the LTTC is chasing the gold price.

So to address the question of whether gold will make $3000 I think the real question is... will the price of gold remain above the middle of the LTTC which is currently 2639.93 USD. That is the price that gold could fall to 2639.93 USD and the market could still be long term bullish. So long as the market finds support on the middle of the LTTC then the market is long term bullish.

gka

Not this week, may be next week.it is at $2896. It seems possible to me that it can touch $3000 soon maybe by end of this month. Do you agree?

How'd you know?Not this week, may be next week.

It might be the case. Once he start imposing those tariffs Gold might surge again. Keeping an close eye on the market.We're just following the flow, yesterday gold corrected after reaching an all time high of 2924, dropping to 2881 after Trump's new tariff policy was announced, but maybe that's only temporary.

I said 'maybe' next week. because it touched 2924, it may go higher.How are you so sure about this?

Zerologic

Well-known member

- Messages

- 374

- Likes

- 27

Let's see, now gold is at 2907, and the potential to rise still appears to give hope.I said 'maybe' next week. because it touched 2924, it may go higher.

Yeah, it's still rising despite the peace talksLet's see, now gold is at 2907, and the potential to rise still appears to give hope.

Zerologic

Well-known member

- Messages

- 374

- Likes

- 27

Perhaps gold's rise was triggered more by concerns that Trump's tariffs could encourage inflation.Yeah, it's still rising despite the peace talks

MonicaGong

Junior member

- Messages

- 20

- Likes

- 5

back to 2900

Zerologic

Well-known member

- Messages

- 374

- Likes

- 27

In three days the price of gold drop more and drew a bearish candle, yesterday gold dropped to a low of 2867 and crossed the middle band line from the upside, Trump has confirmed the proposed tariffs on Mexico and Canada on March 4, this seems to be the momentum for strengthening the US dollar at this moment.

MonicaGong

Junior member

- Messages

- 20

- Likes

- 5

I noticed this too. From an all time high to this drop!In three days the price of gold drop more and drew a bearish candle, yesterday gold dropped to a low of 2867 and crossed the middle band line from the upside, Trump has confirmed the proposed tariffs on Mexico and Canada on March 4, this seems to be the momentum for strengthening the US dollar at this moment.

Zerologic

Well-known member

- Messages

- 374

- Likes

- 27

Even though it has dropped, the question remains whether the decline will continue. Now gold is correcting up in the price range of 2865, while the dollar index has been strengthening in recent days.I noticed this too. From an all time high to this drop!

Similar threads

- Replies

- 0

- Views

- 3K

- Replies

- 13

- Views

- 4K

- Replies

- 0

- Views

- 2K