sujithsstorock

Veteren member

- Messages

- 4,236

- Likes

- 42

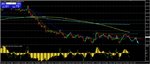

Gold sell

Crude sell open

Silver sell open

We collect data of retail traders. Since 90 percentage of retail traders fail. We trade against them. That's how we work . it's complicated than easily said. But our team is now awesome.

Crude sell open

Silver sell open

We collect data of retail traders. Since 90 percentage of retail traders fail. We trade against them. That's how we work . it's complicated than easily said. But our team is now awesome.