You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Getting back to basics- trading false breakouts and candlestick reversals

okay, just to show you what i mean by lowering risk by waiting for a confirmation bar, il show you a H4 chart, there would be many,many failed candlestick failed reversals had you not waited for the confirmationl, i'll underline to indicate failed reversal candles...

.

.

Attachments

Last edited:

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

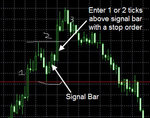

Based on your first post, I'd have gotten in here :

You had 2 strong bars down followed by what appears to be a reversal bar but is still a lower low. After the reversal bar you got a bullish bar but I'd wait for more sign of bullish action which came at the next bar, then have a stop order above that.

I try to trade retracements by getting in below the last cycle high based on the action within the retracement. I don't use the breakout of the last cycle high as the entry.

You had 2 strong bars down followed by what appears to be a reversal bar but is still a lower low. After the reversal bar you got a bullish bar but I'd wait for more sign of bullish action which came at the next bar, then have a stop order above that.

I try to trade retracements by getting in below the last cycle high based on the action within the retracement. I don't use the breakout of the last cycle high as the entry.

Attachments

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

interesting , but would you say i could still trade retracements effectively by doing what i illustrated?

Sure - but look at the price action within the retracement for an entry, don't wait for it to take out the last high, get in on a stop order when you see signs of strength.

N Rothschild

Legendary member

- Messages

- 5,296

- Likes

- 603

"i know myself what works for me" no, you dont..come back after a 5 years and you can say that then

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

tight stops, i.e. close to the price of entry, an aggressive way to control risk

others might argue that it's actually a cowardly way to control risk ........

pedro01

Guest

- Messages

- 1,058

- Likes

- 150

o sorry i get what you mean now- that if the retracement bounces of prior support you would go long just before the last cycle's high?

Not really - you are going long when you see signs of strength.

3 descending bars in a row is not a sign of strength. The 3rd descending bar did show signs that the market was rejecting the low but the bar still closed lower than it's open.

Then there was an up bar but with a bit too high a shadow at the top for my liking, plus it had followed 3 down bars. The 2nd up bar was the signal bar for me, now we have 2 up bars in the retracement. I'd have put in a stop order 1 or 2 ticks above that & the exit a few ticks below.

Attachments

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

But divergence seems too counter-trend for me,

err, what happens if you ignore the counter-trend signals that Divergence throws up and just focus on the pro-trend signal that Divergence throws up ?

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

first tweak- i will now be trading of H4 timescale only, i realise that is where the bigger plays seems to be in candlesticks, yet to determine a timescale for the false breakout strategy, any ideas?

you don't need any timescale at all for breakouts.

think about it: you draw a line in the sand.

either it gets breached or it doesn't.

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

okay, just to show you what i mean by lowering risk by waiting for a confirmation bar, il show you a H4 chart, there would be many,many failed candlestick failed reversals had you not waited for the reversal, i'll underline to indicate failed reversal candles...

.

the safest trade on that chart was playing the breakout above 1.4350 with a resting Buy Stop Entry

rathcoole_exile

Guest Author

- Messages

- 3,925

- Likes

- 767

TAJ,

only a couple of days ago you posted about a set-up that was working for you, something to do with MACD if I recall ?

I predicted then that you would soon drop this method out of boredom, tweaking it beyond recognition or because the method threw up a first big loss. Or the eternal search for the HG.....

Now here you are with another "system" which in less than 50 posts has already gone from 5 minute charts to 4 hours.

No harm to you, what you're going through is a natural process of discovery and more importantly, self-discovery regarding trading. Most if not all of us have been through it to one degree or another.

what you need to do though, advice from one ulsterman to another, is wind your neck in.

Less of the unqualified opinions, statements, assertions, more of the humble, polite questions, and pay attenntion to what people are telling you.

There are some very helpful people here, guys who trade professionaly with sums you can only ever dream of. If you show a certain amount of humility, respect and gratitude, these guys are willing to help you.

make the most of it. I don't know of another profession that is allegedly so "cut-throat" "dog eat dog" etc, where the participants are so willing to provide a boost to newbies.

But the other side of the coin, and it can happen in an instant, if you pyss people off, they'll drop you like a hot brick.

Listen, look, observe, learn.

best of luck from Co. Antrim

only a couple of days ago you posted about a set-up that was working for you, something to do with MACD if I recall ?

I predicted then that you would soon drop this method out of boredom, tweaking it beyond recognition or because the method threw up a first big loss. Or the eternal search for the HG.....

Now here you are with another "system" which in less than 50 posts has already gone from 5 minute charts to 4 hours.

No harm to you, what you're going through is a natural process of discovery and more importantly, self-discovery regarding trading. Most if not all of us have been through it to one degree or another.

what you need to do though, advice from one ulsterman to another, is wind your neck in.

Less of the unqualified opinions, statements, assertions, more of the humble, polite questions, and pay attenntion to what people are telling you.

There are some very helpful people here, guys who trade professionaly with sums you can only ever dream of. If you show a certain amount of humility, respect and gratitude, these guys are willing to help you.

make the most of it. I don't know of another profession that is allegedly so "cut-throat" "dog eat dog" etc, where the participants are so willing to provide a boost to newbies.

But the other side of the coin, and it can happen in an instant, if you pyss people off, they'll drop you like a hot brick.

Listen, look, observe, learn.

best of luck from Co. Antrim

I'll still keep an eye on divergence, and maybe still even play it, it's just that IMO divergence seems to come up more on daily charts, il keep it in mind to warn of a turnaround.err, what happens if you ignore the counter-trend signals that Divergence throws up and just focus on the pro-trend signal that Divergence throws up ?

This has been an intense year for me, learning about the markets, and that divergence system i eactually edited out of my first post- i said it works, but i didn't want to bring it into the thread- i may still use it on daily charts to keep me with the trend. I know there are people who want to help, it's just that when people say 'this is s***e' it's hard to believe that their motive is to help,heck, why don't i bring the divergence system into this strategy? that's an idea....i could trade false breakouts when they came up, look out for candlestick reversals on H4, and check for divergence on the daily- i have not ditched the system of divergence!TAJ,

only a couple of days ago you posted about a set-up that was working for you, something to do with MACD if I recall ?

I predicted then that you would soon drop this method out of boredom, tweaking it beyond recognition or because the method threw up a first big loss. Or the eternal search for the HG.....

Now here you are with another "system" which in less than 50 posts has already gone from 5 minute charts to 4 hours.

No harm to you, what you're going through is a natural process of discovery and more importantly, self-discovery regarding trading. Most if not all of us have been through it to one degree or another.

what you need to do though, advice from one ulsterman to another, is wind your neck in.

Less of the unqualified opinions, statements, assertions, more of the humble, polite questions, and pay attenntion to what people are telling you.

There are some very helpful people here, guys who trade professionaly with sums you can only ever dream of. If you show a certain amount of humility, respect and gratitude, these guys are willing to help you.

make the most of it. I don't know of another profession that is allegedly so "cut-throat" "dog eat dog" etc, where the participants are so willing to provide a boost to newbies.

But the other side of the coin, and it can happen in an instant, if you pyss people off, they'll drop you like a hot brick.

Listen, look, observe, learn.

best of luck from Co. Antrim

ok going to point out a trade which i certainly would have taken and would have led to a loss- the circled canlde is where i would have entered, as the inverted hammer two candles before had a confirmation bar, with a stop at the previous candle's high ( i need some advice with stop-losses with this system, any ideas?) and not to mention the divergence on the MACD which signals a reversal. I would have exited on the second E (the little doji) because there where two green bars, i wouldn't have exited at the first one, because it didn't close higher than the previous bar, but after that green bar had another green bar which closed above the previous candle , i would have closed at the opening of that doji.

But what we have now is a couple of hammers as well as divergence, i would wait for a confirmation bar- too me the confirmation bar should be clear- not another doji/hammer etc.

But what we have now is a couple of hammers as well as divergence, i would wait for a confirmation bar- too me the confirmation bar should be clear- not another doji/hammer etc.

Attachments

and they pointed out that trading breakouts, although sometimes produces great rewards, is often a risky endeavour, but we should trade the pullback, and trade the retracement.

Part of your first post mentioned pullbacks. That got me interested because that is what I do. I am a trend follower, never keen on spotting the tops, and I have found this to be a simple and profitable trading methodology.

Before the pullback is defined, the new trend must be established, otherwise what is interpreted as a pullback could well end as a breakout in the direction of the old trend.

Your indicator signals the possibility of a change of trend--nothing more-- that is why, with due respect, I don't use them. Not because I do not think them useful but because they do not fit into my trading.

If you are not, now, trading pullbacks, that is ok and this post is irrelevant. Otherwise, I suggest that you have a pullback that you should be shorting now, instead of closing a trade that was due a reaction when you entered. It may be a little premature, that is a matter of personal opinion, but the sooner you enter the closer that your stop can be.

I am a little out of my depth because I do not trade forex and prefer 5M charts as I only trade in the 0800-1330 period but that is the way I read your chart.

What you must decide is the trend direction. Is it a new one, or not? Get that right and you are on your way.

Similar threads

- Replies

- 16

- Views

- 17K

- Replies

- 7

- Views

- 9K

- Replies

- 1

- Views

- 4K