You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

EU - 3rd short off 5min today....and probably the last given time of day ADR etc...entry 3282.4, initial sl, 3311, 50% scaleout planned @3255, final destination 3225.

Edit: given the way price action has revealed itself as this trade has progressed, the original plan has now changed to an all out exit around the most recent 5min 123 138.2 fib extension @3260....exit plan might change again soon, if long momentum begins to build.

Edit: 16:35 - stops now @b/e.

Edit: 16:42 - all out 3268.6 (+13.8, +0.48%). Day up 1.54%, which is enough for today.

Edit: 16:45 - lucky I did...exit chart below.

Edit: given the way price action has revealed itself as this trade has progressed, the original plan has now changed to an all out exit around the most recent 5min 123 138.2 fib extension @3260....exit plan might change again soon, if long momentum begins to build.

Edit: 16:35 - stops now @b/e.

Edit: 16:42 - all out 3268.6 (+13.8, +0.48%). Day up 1.54%, which is enough for today.

Edit: 16:45 - lucky I did...exit chart below.

Attachments

In long on the GU BO tis morning (0.25% risk). Also watching GU on the hourly and will trade a short down to previous demand around 5515 (using a sub-account), should 6th Dec support fail....edit: swing high pierced so setup now void.

Attachments

Closed the GU London breakout trade for a total of 0.23% (wk: 1.77%).

I'll be closing the journal for the year on Friday, trading tailing off at the moment with increase in business at work. I'm likely to divert attention to larger swing trades throughout the rest of Dec with the odd 5min thrown in, but i won't be reporting them here.

I'll be closing the journal for the year on Friday, trading tailing off at the moment with increase in business at work. I'm likely to divert attention to larger swing trades throughout the rest of Dec with the odd 5min thrown in, but i won't be reporting them here.

9th Dec GU London Breakout

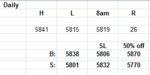

...short breakout filled as per sheet below. I tweak the first scaleout (which isn't necessarily 50% these days) when weekly or monthly pivot values are in the vaccinity of the trades 1:1 level, so todays trade had the 1st scaleout at the monthly pivot, 5780 just 10 pips from the 1:1. I'll move stops to breakeven when a confirmed SbR switch prints and not before. Even if a full on pivot reversal occurs, the loss will at least have been reduced....just need to work on letting the winners run more, as always 🙂

Edit: 9:55 - stops to b/e now...some profit taken and now a free ride to do what it likes.

...short breakout filled as per sheet below. I tweak the first scaleout (which isn't necessarily 50% these days) when weekly or monthly pivot values are in the vaccinity of the trades 1:1 level, so todays trade had the 1st scaleout at the monthly pivot, 5780 just 10 pips from the 1:1. I'll move stops to breakeven when a confirmed SbR switch prints and not before. Even if a full on pivot reversal occurs, the loss will at least have been reduced....just need to work on letting the winners run more, as always 🙂

Edit: 9:55 - stops to b/e now...some profit taken and now a free ride to do what it likes.

Attachments

Re: 9th Dec GU London Breakout

Daily S1 @5698, if it gets there i'll exit remaining lots....ties in with ADR which is 50 odd away atm....mpc not far off though, so anything could happen and i may well exit before the announcement.

...short breakout filled as per sheet below. I tweak the first scaleout (which isn't necessarily 50% these days) when weekly or monthly pivot values are in the vaccinity of the trades 1:1 level, so todays trade had the 1st scaleout at the monthly pivot, 5780 just 10 pips from the 1:1. I'll move stops to breakeven when a confirmed SbR switch prints and not before. Even if a full on pivot reversal occurs, the loss will at least have been reduced....just need to work on letting the winners run more, as always 🙂

Edit: 9:55 - stops to b/e now...some profit taken and now a free ride to do what it likes.

Daily S1 @5698, if it gets there i'll exit remaining lots....ties in with ADR which is 50 odd away atm....mpc not far off though, so anything could happen and i may well exit before the announcement.

Re: 9th Dec GU London Breakout

OK all out now @5750...8 mins before mpc, leaving me with the option of some 5min reversal trading on GU/EU, whichever has the cleanest PA post announcement. Adds 0.32% to the kitty.

Daily S1 @5698, if it gets there i'll exit remaining lots....ties in with ADR which is 50 odd away atm....mpc not far off though, so anything could happen and i may well exit before the announcement.

OK all out now @5750...8 mins before mpc, leaving me with the option of some 5min reversal trading on GU/EU, whichever has the cleanest PA post announcement. Adds 0.32% to the kitty.

wackypete2

Legendary member

- Messages

- 10,211

- Likes

- 2,058

Re: EU 5min long

Nice trading 👍

Peter

Took the break north for +18.3 and exited at the daily pivot. Sl 13 pips, 1% risk, so gain of 1.36%. That's 4.19% for the week so far, which will do for this week.

Nice trading 👍

Peter

A belated HNY!

Edging back into this year's trading slowly. Keeping it very simple, first setup for me today is on GU, the poor services data has generated an intraday reversal with a couple of shorting opportunities - i'll take either a support/resistance switch and/or a continuation entry.

Edit: added a couple of other short entry levels. SbR (horizontal) level now filled at 5489 and SbR TL entry filled @5512....

Edit: almost all scaled in now, this morning's supply being the key to this trade, hindsight being a wonderful thing etc....if this pans out, i'm targeting the 138.2 fib ext around 5428.

Edging back into this year's trading slowly. Keeping it very simple, first setup for me today is on GU, the poor services data has generated an intraday reversal with a couple of shorting opportunities - i'll take either a support/resistance switch and/or a continuation entry.

Edit: added a couple of other short entry levels. SbR (horizontal) level now filled at 5489 and SbR TL entry filled @5512....

Edit: almost all scaled in now, this morning's supply being the key to this trade, hindsight being a wonderful thing etc....if this pans out, i'm targeting the 138.2 fib ext around 5428.

Attachments

GU long

My trading frequency this year will be reduced as I make more effort to wait for the better signals. I've also increased the risk per trade from last year's max of 1% to 2%. I am in a very happy place as far as trading is concerned now, with a consistently high win rate and a simple intraday approach.

Took a GU long earlier on the break of the 5min 123 that hit the earlier supply area for +18.5.

My trading frequency this year will be reduced as I make more effort to wait for the better signals. I've also increased the risk per trade from last year's max of 1% to 2%. I am in a very happy place as far as trading is concerned now, with a consistently high win rate and a simple intraday approach.

Took a GU long earlier on the break of the 5min 123 that hit the earlier supply area for +18.5.

Attachments

neil

Legendary member

- Messages

- 5,169

- Likes

- 754

Re: GU long

Well done mate. Keep up the patient approach🙂

My trading frequency this year will be reduced as I make more effort to wait for the better signals. I've also increased the risk per trade from last year's max of 1% to 2%. I am in a very happy place as far as trading is concerned now, with a consistently high win rate and a simple intraday approach.

Took a GU long earlier on the break of the 5min 123 that hit the earlier supply area for +18.5.

Well done mate. Keep up the patient approach🙂

Similar threads

- Replies

- 519

- Views

- 80K