Been looking at this, and I'm not so convinced the original author's methods are sound. He appears to just ignore everything above a period of 50 because he doesn't want to see it. While it's fine to ignore the results, I think his calculations are trying to ignore it too...

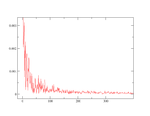

Personally, I just did a Fourier transform on GBP/USD (Sep-Mar-ish of the last year on one minute data) in Grace Home and got the attached image, which is rather interesting IMHO. I'll write more later, but need some more results first...

Personally, I just did a Fourier transform on GBP/USD (Sep-Mar-ish of the last year on one minute data) in Grace Home and got the attached image, which is rather interesting IMHO. I'll write more later, but need some more results first...