BLS

Established member

- Messages

- 642

- Likes

- 229

Well I ****ed up big on Friday so unless someone is really interested in what happened I'm not going to make the effort to post Friday's trades.

Today's trade:

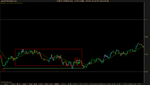

Prices finally broke out of this range hanging around the 1.26 handle after the ISM manufacturing numbers came out. You can see the typical digestion of the news with the price action for 7:00 to 7:03. The numbers came out worse than expected which intuitively means the dollar will weaken. I admit I entertained a bullish bias after the numbers came out and was confused with prices started to drop. I quickly realized my folly and changed outlook to neutral and tried to analyze price action. I was considering an ARB trade (S1) but felt that the price action inside the range did not support a bearish trade at that time. In other words, there were few clues pointing to the bears having the upper hand prior to the news release.

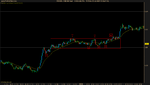

E1: I waited patiently for an opportunity to trade after that skipped ARB. Prices broke out of the range, tested it, then moved down even further. It looked like a new trend was forming so I kept my eyes peeled for a pullback setup. Prices pulled back to the 20EMA, printing an FB. I waited for the superior SB setup and after prices broke the first pullback high, the dropped back down again, making that break a false one. I was rather nervous when prices seemed to have trouble breaking the 83 level (green line) and I was considering lowering my stop 3 pip lower (lack of follow through on the break). I'm still skittish about the break even as prices drop below the 80 level in a slow manner. I see some stalling as prices reach within 0.5 pip of my target and I decide to close early. Again, I am rather unsure of adding 0.8 pip to my target so I am ready to close out early when the trade is over 10 pip in profit.

9.4 pip profit for me today.

Today's trade:

Prices finally broke out of this range hanging around the 1.26 handle after the ISM manufacturing numbers came out. You can see the typical digestion of the news with the price action for 7:00 to 7:03. The numbers came out worse than expected which intuitively means the dollar will weaken. I admit I entertained a bullish bias after the numbers came out and was confused with prices started to drop. I quickly realized my folly and changed outlook to neutral and tried to analyze price action. I was considering an ARB trade (S1) but felt that the price action inside the range did not support a bearish trade at that time. In other words, there were few clues pointing to the bears having the upper hand prior to the news release.

E1: I waited patiently for an opportunity to trade after that skipped ARB. Prices broke out of the range, tested it, then moved down even further. It looked like a new trend was forming so I kept my eyes peeled for a pullback setup. Prices pulled back to the 20EMA, printing an FB. I waited for the superior SB setup and after prices broke the first pullback high, the dropped back down again, making that break a false one. I was rather nervous when prices seemed to have trouble breaking the 83 level (green line) and I was considering lowering my stop 3 pip lower (lack of follow through on the break). I'm still skittish about the break even as prices drop below the 80 level in a slow manner. I see some stalling as prices reach within 0.5 pip of my target and I decide to close early. Again, I am rather unsure of adding 0.8 pip to my target so I am ready to close out early when the trade is over 10 pip in profit.

9.4 pip profit for me today.