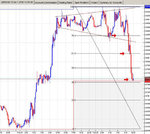

the levels are obtained by observing the short & med term reaction points on the various time scale charts, price action around these levels (according to weight of closing/opening punts) normally dictate direction, I guess the sheer volume of participants influence the overall to & fro away from the technical area's, and Forex reacts well to these numbers.

stops are dependant on your anticipated timescale & position risk....I tend to keep them tight on entry (20pt) because I can manage the trade as it occurs....cutting it quickly should the timing be off....trailing it & scaling on the move....if you're punting 'position' and not able to 'watch' it progress, then your stop/risk ratio will be wider....don't trade yen, so someone else will have to come back to you on that one, but personally, I look for opportunities in either direction....agree though, both pairs are becoming 'toppy'....currencies react quickly, i play em as I see em & simply adapt accordingly, the profit potential is there both north & south.

stops are dependant on your anticipated timescale & position risk....I tend to keep them tight on entry (20pt) because I can manage the trade as it occurs....cutting it quickly should the timing be off....trailing it & scaling on the move....if you're punting 'position' and not able to 'watch' it progress, then your stop/risk ratio will be wider....don't trade yen, so someone else will have to come back to you on that one, but personally, I look for opportunities in either direction....agree though, both pairs are becoming 'toppy'....currencies react quickly, i play em as I see em & simply adapt accordingly, the profit potential is there both north & south.