Trader Skillset

Active member

- Messages

- 182

- Likes

- 6

GBPUSD Wave Count

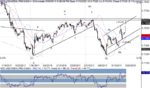

It’s difficult to get too excited about the pound here, but there’s a couple of signs of life. First, we can count a five wave decline from the wave 4 high, and last summer’s top. Second, prices rallied in five waves from the FOMC low. Lastly, a small bearish divergence showed up into this week’s low. On the negative side, however, prices have substantial overhead resistance, where GBPUSD recently failed at 1.5555. It’ll take a move above there to indicate our count is actually correct. That’s especially true since weekly and monthly RSI suggest the “sustainable bear” is ongoing.

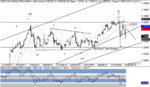

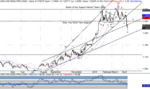

Further short term gains here wouldn’t be surprising. Prices rallied in five waves and declined in three from the low. The bounce from Thursday’s low also appears to be impulsive. The short term trend channel should provide both support and potentially resistance. What will divide the bullish interpretation, from a bearish alternate would be the point where wave iii/c would be equal to the wave i/a rally. Above and beyond there, and a larger rally phase is likely underway, potentially lasting a month or two, after the pound being down 8 of the last 9 months.

It’s difficult to get too excited about the pound here, but there’s a couple of signs of life. First, we can count a five wave decline from the wave 4 high, and last summer’s top. Second, prices rallied in five waves from the FOMC low. Lastly, a small bearish divergence showed up into this week’s low. On the negative side, however, prices have substantial overhead resistance, where GBPUSD recently failed at 1.5555. It’ll take a move above there to indicate our count is actually correct. That’s especially true since weekly and monthly RSI suggest the “sustainable bear” is ongoing.

Further short term gains here wouldn’t be surprising. Prices rallied in five waves and declined in three from the low. The bounce from Thursday’s low also appears to be impulsive. The short term trend channel should provide both support and potentially resistance. What will divide the bullish interpretation, from a bearish alternate would be the point where wave iii/c would be equal to the wave i/a rally. Above and beyond there, and a larger rally phase is likely underway, potentially lasting a month or two, after the pound being down 8 of the last 9 months.