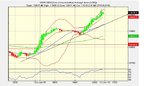

chindl said:Big flag pole on the 30 min charts, but too late in the session. Not sure I'm focused enough for the last hr. Let's see. Missed a stonkin move from my post at 7-15, the one from the final whistle. That would have paid for the week. See Ben's been sticking his oar in again today....

We all missed the big move thanks to the game among others 🙂 I don't like the chart one iota so I won't trade again today. That's it, 16 points up.

Have a good night everyone!

Hung