In this article we will examine a specific case of a debit and a credit spread in order to point out that there is virtually very little difference between the two.

Instead of attempting to explain the concept by using a fictitious example, the stock XYZ with the one strike price being at this level and the other one at that level, etc, we shall utilize a couple of my recent trades for the same purpose. Again, this scrutiny is for education purposes only and it is not intended to be a recommendation of any kind.

My normal criteria for trading optionable stocks is the liquidity which is evident in the volume of the underlying as well as the high open interest and volume on individual strike prices. The Chevron Corporation has passed those minimum requirements. After knowing WHAT to trade, the issue becomes WHEN to trade it. Figure 1 shows that on 12-04-2008, the CVX was trading slightly above 70 which in the past had acted as a short-term diagonal support.

After completing my technical analysis, and determining my market posture as well as my directional bias on the stock, I am faced with the strategy selection. According to my rules, I go long at the support. The CVX was not exactly at the support but it was very close to it. Timing the entries perfectly is nearly impossible; it is the timing of the exits that is of more essence to me. While the Chevron was AT or NEAR its support, I had numerous choices for going long such as: a) buy the underlying, b) buy a call, c) buy a debit spread, namely a Bull Call, or d) sell a credit spread, explicitly a Bull Put. I worked out the numbers of risk to reward and they came out very much identical for both the credit and debit spread. My Bull Put had a ROI (Return on the Investment) of 37% while my Bull Call was 36%. Not even once did I consider going long with the b possibility, a straight directional call. In my previous articles, I have encouraged traders to become premium sellers. This trade is not an exception to my teaching. Out of the a-b-c-d choices presented above, I selected first a Bull Call (choice C) and then a Bull Put strategy (choice D).

The Bull Call Explanation

By choosing a Bull Call instead of a directional (non-spread) straight call, I have reduced two things; my exposure and my financial outlay. However, let us get to the particulars. Had I just purchased a call, I would have paid for December 65 call 9.52 which would be for one contract $952.00 plus the commission.

Instead I simultaneously bought Dec 65c @ 9.52 and sold December 70 call for 5.82 which in turn reduced my entry price to 3.70 or $370.00 per contract plus the two entry commissions.

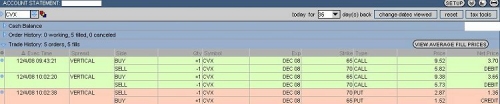

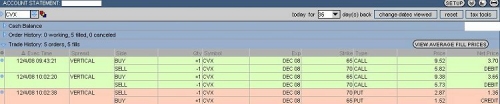

As Figure 2 shows, I did this transaction twice and got even a better fill of 3.65 on the second transaction. Let us combine these two Bull Calls:

I have bought to open (BTO) +2 Dec 65c @ 9.45 (average fill) and sold to open (STO) -2 Dec 70c @ 5.775 (average fill). My maximum loss was the difference between the premium, which is a debit of 3.675 or $367.50 times two contracts. My maximum profit is the width of spread (strike price 70 minus 65 strike) subtracted from the debit. Specifically, 5.00 - 3.675 = 1.325; therefore, the most I could have made on this trade would have been $132.50 times two contracts. From this amount the two exiting commissions need to be subtracted. To calculate the ROI (Return on Investment) we need to divide our Max profit of 1.325 with our debit of 3.675 which gives us 36% as our ROI for the Bull Call spread.

The Bull Put Explanation

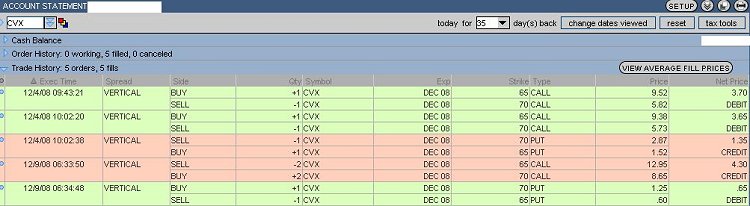

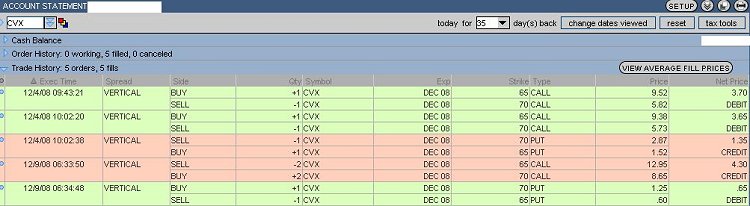

Having explained the debit part of the trade we could turn our attention to the credit part of it. Figure 3 shows an additional trade which is in red because it was a sold for the credit.

On the Bull Put, I had BTO + 1 Dec 65 put @ 1.52 and simultaneously STO - 1 Dec 70 put @ 2.87 receiving the credit in the difference of those two premiums (2.87 - 1.52 = 1.35) which is 135.00 for one contract. Once again the spread's width of 5.00 - 1.35 (our max profit) would give us 3.65 as our max loss. The ROI is 1.35 (max profit) divided by 3.65 (max loss) which comes to 37%. In short, the ROI on Bull Put is only one percent better than Bull Call's ROI of 36%.

A brief note, the max profit of 1.325 per contract on the first vertical (Bull Call) and the max profit of 1.35 on the second vertical (Bull Put) are just "that" - the MAX profit. The max profits are occasionally achieved if the trader holds the position until the expiry. In my case, the chart determined my exit.

Figure 4 shows that on 12-08-2008 the CVX had approached the 80.00 area which in the past has acted as a support. On that day the old support had acted as a new resistance. Observe on the chart that the CVX has traveled almost 10 points within four short trading sessions. Both of my vertical trades were bullish trades and the chart was telling me that it was unable to break the resistance, so on the next day 12-09-2008, I closed both of my verticals.

Figure 5 shows that I had closed both of the debit spreads for 4.30 each; to recap I've got in at 3.65 and sold it for even the higher price of 4.30 making the difference on the two which is 0.625 per contract. I had two contracts thus the profit was $125.00; whereas I sold the Bull Put at the high price of 1.35 and bought it back at 0.65 receiving in profit 0.70 or seventy dollars. In both cases I made about the half of (the maximum profit or of) what I could have if I held it until 12-19-2008 which was the day of expiry. Just ask yourself: Does it make MORE sense to close the position which had achieved the half of its initial goal in four trading session than to hold it, risking what is already made? In my case, the answer is obvious.

In conclusion, in this article I have compared apples with apples. Both credit and debit spread had four commissions - two for entry and two for exits. In some cases, the credit spread might not have the exiting commissions, yet in this case I have selected the trades of the same number of commission on the very same underlying. In short, when zooming in on the specifics there is very little difference between the credit and debit spreads. In both cases I was the seller of the premium which very much goes along with my belief that one should be trading options with the well-defined risk rather than trading them directionally without any spread strategy.

Instead of attempting to explain the concept by using a fictitious example, the stock XYZ with the one strike price being at this level and the other one at that level, etc, we shall utilize a couple of my recent trades for the same purpose. Again, this scrutiny is for education purposes only and it is not intended to be a recommendation of any kind.

My normal criteria for trading optionable stocks is the liquidity which is evident in the volume of the underlying as well as the high open interest and volume on individual strike prices. The Chevron Corporation has passed those minimum requirements. After knowing WHAT to trade, the issue becomes WHEN to trade it. Figure 1 shows that on 12-04-2008, the CVX was trading slightly above 70 which in the past had acted as a short-term diagonal support.

After completing my technical analysis, and determining my market posture as well as my directional bias on the stock, I am faced with the strategy selection. According to my rules, I go long at the support. The CVX was not exactly at the support but it was very close to it. Timing the entries perfectly is nearly impossible; it is the timing of the exits that is of more essence to me. While the Chevron was AT or NEAR its support, I had numerous choices for going long such as: a) buy the underlying, b) buy a call, c) buy a debit spread, namely a Bull Call, or d) sell a credit spread, explicitly a Bull Put. I worked out the numbers of risk to reward and they came out very much identical for both the credit and debit spread. My Bull Put had a ROI (Return on the Investment) of 37% while my Bull Call was 36%. Not even once did I consider going long with the b possibility, a straight directional call. In my previous articles, I have encouraged traders to become premium sellers. This trade is not an exception to my teaching. Out of the a-b-c-d choices presented above, I selected first a Bull Call (choice C) and then a Bull Put strategy (choice D).

The Bull Call Explanation

By choosing a Bull Call instead of a directional (non-spread) straight call, I have reduced two things; my exposure and my financial outlay. However, let us get to the particulars. Had I just purchased a call, I would have paid for December 65 call 9.52 which would be for one contract $952.00 plus the commission.

Instead I simultaneously bought Dec 65c @ 9.52 and sold December 70 call for 5.82 which in turn reduced my entry price to 3.70 or $370.00 per contract plus the two entry commissions.

As Figure 2 shows, I did this transaction twice and got even a better fill of 3.65 on the second transaction. Let us combine these two Bull Calls:

I have bought to open (BTO) +2 Dec 65c @ 9.45 (average fill) and sold to open (STO) -2 Dec 70c @ 5.775 (average fill). My maximum loss was the difference between the premium, which is a debit of 3.675 or $367.50 times two contracts. My maximum profit is the width of spread (strike price 70 minus 65 strike) subtracted from the debit. Specifically, 5.00 - 3.675 = 1.325; therefore, the most I could have made on this trade would have been $132.50 times two contracts. From this amount the two exiting commissions need to be subtracted. To calculate the ROI (Return on Investment) we need to divide our Max profit of 1.325 with our debit of 3.675 which gives us 36% as our ROI for the Bull Call spread.

The Bull Put Explanation

Having explained the debit part of the trade we could turn our attention to the credit part of it. Figure 3 shows an additional trade which is in red because it was a sold for the credit.

On the Bull Put, I had BTO + 1 Dec 65 put @ 1.52 and simultaneously STO - 1 Dec 70 put @ 2.87 receiving the credit in the difference of those two premiums (2.87 - 1.52 = 1.35) which is 135.00 for one contract. Once again the spread's width of 5.00 - 1.35 (our max profit) would give us 3.65 as our max loss. The ROI is 1.35 (max profit) divided by 3.65 (max loss) which comes to 37%. In short, the ROI on Bull Put is only one percent better than Bull Call's ROI of 36%.

A brief note, the max profit of 1.325 per contract on the first vertical (Bull Call) and the max profit of 1.35 on the second vertical (Bull Put) are just "that" - the MAX profit. The max profits are occasionally achieved if the trader holds the position until the expiry. In my case, the chart determined my exit.

Figure 4 shows that on 12-08-2008 the CVX had approached the 80.00 area which in the past has acted as a support. On that day the old support had acted as a new resistance. Observe on the chart that the CVX has traveled almost 10 points within four short trading sessions. Both of my vertical trades were bullish trades and the chart was telling me that it was unable to break the resistance, so on the next day 12-09-2008, I closed both of my verticals.

Figure 5 shows that I had closed both of the debit spreads for 4.30 each; to recap I've got in at 3.65 and sold it for even the higher price of 4.30 making the difference on the two which is 0.625 per contract. I had two contracts thus the profit was $125.00; whereas I sold the Bull Put at the high price of 1.35 and bought it back at 0.65 receiving in profit 0.70 or seventy dollars. In both cases I made about the half of (the maximum profit or of) what I could have if I held it until 12-19-2008 which was the day of expiry. Just ask yourself: Does it make MORE sense to close the position which had achieved the half of its initial goal in four trading session than to hold it, risking what is already made? In my case, the answer is obvious.

In conclusion, in this article I have compared apples with apples. Both credit and debit spread had four commissions - two for entry and two for exits. In some cases, the credit spread might not have the exiting commissions, yet in this case I have selected the trades of the same number of commission on the very same underlying. In short, when zooming in on the specifics there is very little difference between the credit and debit spreads. In both cases I was the seller of the premium which very much goes along with my belief that one should be trading options with the well-defined risk rather than trading them directionally without any spread strategy.

Last edited by a moderator: