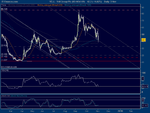

LONDON, Nov 2 (Reuters) - British Yellow Pages publisher Yell (YELL.L) moved one step closer to fixing its heavy debt burden as lenders gave it the green light to raise equity, sending its shares up 13 percent.

The deal to refinance 4 billion pounds ($6.57 billion) in debts gives Yell the go-ahead for a 500 million pound rights issue.

Investors have been hoping that the company will find a long term solution to its financial problems and the funds from the equity raising will be used to cut its debt.

Yell -- hit by the advertising downturn and a shift towards the Internet -- needed 95 percent of its lenders to approve the deal, but was forced to extend a deadline three times before it got the acceptance. [ID:nLU549243].

At 1045 GMT, Yell shares were trading up 6 percent at 54.4 pence in a slightly higher overall market, after rising as high as 61.4 pence earlier in the day.

Yell's earlier difficulties getting lenders to back the refinancing are unlikely to jeopardise the planned rights issue, said Sam Hart, an analyst at Charles Stanley.

"If Yell proceeds with the rights issue then they should get the money they want," Hart said. "The window is open for rights issues at the moment, with the market up about 50 percent and investors optimistic about outlook."

However, Yell is one of the "higher risk situations" in the market and there remain longer-term concerns about the directories business model, Hart said.

Following the deal with lenders, Yell will now approach its major shareholders and announce details of the equity issue as soon as practicable, the company said in a statement.

The company's refinancing deal amends the terms of the company's debt, extends the maturity of its loans to 2014 and relaxes covenants on its debts. In exchange, lenders will receive higher interest rates. ($1=.6090 Pound) (Editing by Karen Foster)