datav

Active member

- Messages

- 230

- Likes

- 9

Thursday

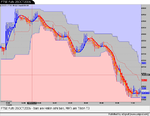

Nice trending day yesterday if you could stand back and look at the bigger picture. Close up it was really choppy, but on a 15 minute chart, quite nice.

Patience, patience, patience. A trader is like a hunter, sitting in the bushes all day long waiting for their prey to come within range. If you shoot at everything that moves, you'll run out of ammunition before you get a decent target. When you get a good target, you must go for the kill,. If you are indecisive at the critical moment, your prey will get away, leaving you witha bit of skin in your hands.

Nice trending day yesterday if you could stand back and look at the bigger picture. Close up it was really choppy, but on a 15 minute chart, quite nice.

Patience, patience, patience. A trader is like a hunter, sitting in the bushes all day long waiting for their prey to come within range. If you shoot at everything that moves, you'll run out of ammunition before you get a decent target. When you get a good target, you must go for the kill,. If you are indecisive at the critical moment, your prey will get away, leaving you witha bit of skin in your hands.