As I try to quickly transition to a Q2 mindset, I feel I need to improve formally documenting and tracking to my goals. So here they are, listed in order of personal significance.

Frankly, if I just accomplish 1a and 1b, I’ll consider it a monumental quarter … the rest are simply guides and motivators.

Personal:

1a. Love more.

1b. Reflect far more of God and far less of self.

2. Talk and tweet less, and only if necessary, kind, and true.

3. Finish reading book in progress (Imagine Heaven) and target two others.

4. Continue New England Emmaus Board leadership efforts including Spring Walk participation.

5. Complete weight loss program, attaining target weight of 178.5 from 203 starting point.

6. Sustain new weight level; Close quarter < 180 lbs on 6-30.

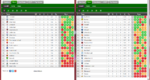

Trading Goals:

7. 100% profitable weeks & months.

8. Incur maximum six draw days in approx. 60 trading days (2 per month; <10%).

9. Optimize targeted capital preservation/growth mix (<5 years to 60!) via earnings no less than $200k w/$400k stretch goal.

10. Attain minimum of four $25k days, two $50k days, and one $100k day.

11. Increase maximize ES trading size to 300 contracts.

12. Reduce transaction costs by 25%.