neil

Legendary member

- Messages

- 5,169

- Likes

- 754

No posts for a while..mainly because the accounts heading the wrong way and not quite sure whether it was a discipline problem - looking at it I think I was taking too many trades..anyway..

EA's MD now has two trades (both winners ) so seems to be panning out as expected at 1 trade per week. Windfall has only taken one trade. Early morning trades just under breakeven.. account is about 1% down for the month

Intra-day .. this is where my discipline seems to have failed - had a couple of trades that went badly wrong before I managed to put a SL on, then got in to trading based on hope vs reality and let one go 5% down (naturally it then turned round and headed my way), and had a string of trades go against me. So account was well down, now is about 6% in the red

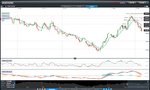

LT - sold GBPCAD again - currently up so have moved stop to BE and hope it goes to profit target - see attached chart

STOP hoping - read some of the FREE threads on T2W and demo until in profit - then trade real cash.

(maybe using cash saved from no longer buying systems)