BenHardy

Junior member

- Messages

- 10

- Likes

- 20

Hi lpphbti,

First, let me congratulate you on the incredible performance of TVS, I hope you can continue with it!

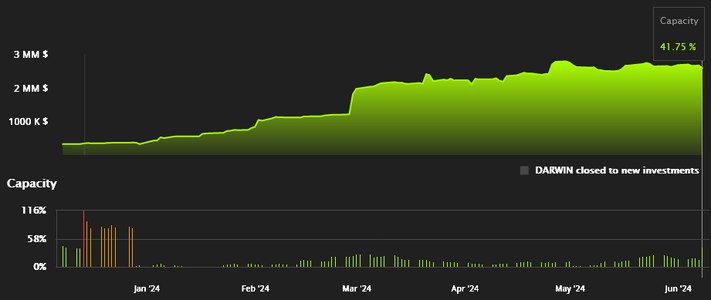

I recognized that even though you stopped night scalping in March, the used capacity remains on a high level (screenshot attached). Have you considered working with fractional entries and exits? Your average holding time meanwhile is about 1 day (+ you stopped the scalping trades, see above), so conducting e.g. 3 entires/exits each with e.g. 3 seconds delay (and only 33% of the regular size) could significantly increase your scalability in investors would earn more because of less divergence.

What do you think about it?

Best,

Ben

First, let me congratulate you on the incredible performance of TVS, I hope you can continue with it!

I recognized that even though you stopped night scalping in March, the used capacity remains on a high level (screenshot attached). Have you considered working with fractional entries and exits? Your average holding time meanwhile is about 1 day (+ you stopped the scalping trades, see above), so conducting e.g. 3 entires/exits each with e.g. 3 seconds delay (and only 33% of the regular size) could significantly increase your scalability in investors would earn more because of less divergence.

What do you think about it?

Best,

Ben