Z Forex

Established member

- Messages

- 805

- Likes

- 1

Global Financial Markets React to Central Bank Signals and Economic Data

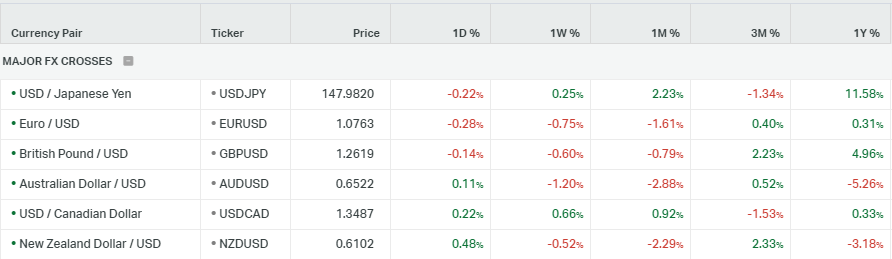

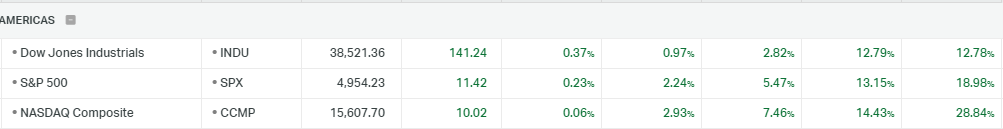

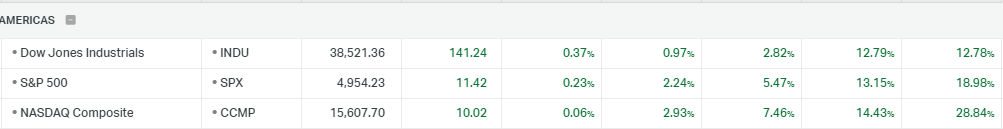

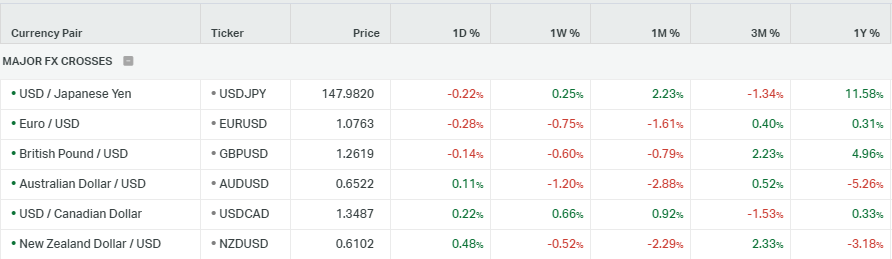

In early European trading, the U.S. dollar appreciated after the Federal Reserve indicated that a rate cut in March would likely be earlier. However, the Fed also expressed willingness to consider lowering rates later, depending on greater assurance that inflation will revert to its 2% target. Consequently, the likelihood of a March rate reduction, as implied by traders, has decreased from 59% before the Fed's announcement to 38%, a significant drop from the 89% expectation a month earlier.

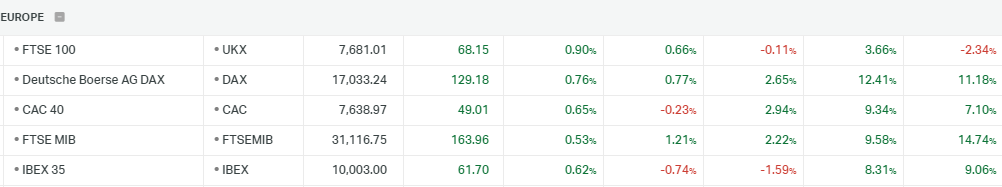

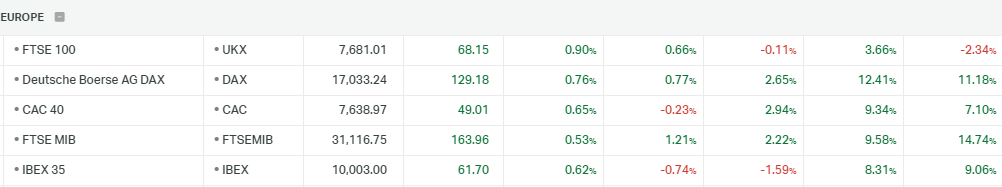

The euro experienced a decline, reaching a seven-week drop against the dollar, ahead of the flash eurozone inflation data for January. This forthcoming data, anticipated to reveal further deceleration in both headline and core inflation from December, may apply additional pressure on the euro. Meanwhile, preliminary GDP figures for the fourth quarter indicated a marginal 0.1% year-over-year expansion in the eurozone's economy, with no growth compared to the preceding quarter. Although these figures surpassed initial forecasts, they remain disappointingly low.

The Bank of England (BoE) is anticipated to maintain its benchmark interest rate at 5.25% during its upcoming policy meeting, dubbed “Super Thursday” due to the simultaneous release of the Monetary Policy Report (MPR) and a press conference by Governor Andrew Bailey. The BoE is expected to continue its tight monetary policy, emphasizing the theme of “higher interest rates for longer” and defying anticipations of early rate cuts, especially in light of a surprising increase in December's annual inflation rate.

A recent hawkish shift by the Bank of Japan (BoJ) bolstered the yen, as did a decrease in U.S. Treasury bond yields, which narrowed the interest rate differential between the U.S. and Japan, further encouraging yen investors. The BoJ's January 2024 meeting summary suggested maintaining monetary easing while exploring options for exiting negative interest rates.

Geopolitical tensions in the Middle East and economic challenges in China may support gold prices, offering a safe haven during times of uncertainty. The ongoing decline in U.S. Treasury yields could also lessen losses for gold, which does not yield interest.

West Texas Intermediate (WTI) oil prices face constraints due to disappointing Chinese manufacturing data. The National Bureau of Statistics' (NBS) Manufacturing PMI for January remained below expectations, marking the fourth consecutive month of contraction in China's manufacturing sector, thereby applying downward pressure on WTI prices. The market awaits the Caixin Manufacturing PMI for January, hoping for insights into China's economic health, given its status as a major crude importer.

In early European trading, the U.S. dollar appreciated after the Federal Reserve indicated that a rate cut in March would likely be earlier. However, the Fed also expressed willingness to consider lowering rates later, depending on greater assurance that inflation will revert to its 2% target. Consequently, the likelihood of a March rate reduction, as implied by traders, has decreased from 59% before the Fed's announcement to 38%, a significant drop from the 89% expectation a month earlier.

The euro experienced a decline, reaching a seven-week drop against the dollar, ahead of the flash eurozone inflation data for January. This forthcoming data, anticipated to reveal further deceleration in both headline and core inflation from December, may apply additional pressure on the euro. Meanwhile, preliminary GDP figures for the fourth quarter indicated a marginal 0.1% year-over-year expansion in the eurozone's economy, with no growth compared to the preceding quarter. Although these figures surpassed initial forecasts, they remain disappointingly low.

The Bank of England (BoE) is anticipated to maintain its benchmark interest rate at 5.25% during its upcoming policy meeting, dubbed “Super Thursday” due to the simultaneous release of the Monetary Policy Report (MPR) and a press conference by Governor Andrew Bailey. The BoE is expected to continue its tight monetary policy, emphasizing the theme of “higher interest rates for longer” and defying anticipations of early rate cuts, especially in light of a surprising increase in December's annual inflation rate.

A recent hawkish shift by the Bank of Japan (BoJ) bolstered the yen, as did a decrease in U.S. Treasury bond yields, which narrowed the interest rate differential between the U.S. and Japan, further encouraging yen investors. The BoJ's January 2024 meeting summary suggested maintaining monetary easing while exploring options for exiting negative interest rates.

Geopolitical tensions in the Middle East and economic challenges in China may support gold prices, offering a safe haven during times of uncertainty. The ongoing decline in U.S. Treasury yields could also lessen losses for gold, which does not yield interest.

West Texas Intermediate (WTI) oil prices face constraints due to disappointing Chinese manufacturing data. The National Bureau of Statistics' (NBS) Manufacturing PMI for January remained below expectations, marking the fourth consecutive month of contraction in China's manufacturing sector, thereby applying downward pressure on WTI prices. The market awaits the Caixin Manufacturing PMI for January, hoping for insights into China's economic health, given its status as a major crude importer.