Correct bgold -

MACD (blue) must cross EMA (red) FROM ABOVE whilst positive for a SELL

MACD (blue) must cross EMA (red) FROM BELOW whilst negative

for a BUY.

To answer some of your questions -

JonnyT - In reducing the method to MACD DIFF (histogram) crossing above and below 0 you will undoubtably generate many more false signals.

Using Slow Stochastic rule gives further confirmation of signal by indicating Overbought /Oversold conditons.

The more confirmation, the greater the probability of a good trade signal leading to a SIGNIFICANT MOVE.

Bgold -

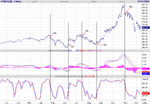

I have back-tested the method on other markets. (See Gold chart attatched). The Method is certainly not perfect (No one method ever is), so if I find a market that has regularly given good signals using this method I will trade accordingly.

If possible , I always look for confirmation in the PRICE ACTION - -ie trendline break, pattern completion, reversal day ,etc.

Remember the method uses 2 momentum indicators - you buy and sell PRICE , NOT MOMENTUM.

I use a SB company to trade, using their charting software for stocks, and FutureSource for other markets - comms, bonds,etc.

As a position trader, I always look at the longer-term charts first, and I do follow fundamentals as the general background.

I am quite happy to remain flat for days or weeks (as now). Iview FLAT as a position.

I have attached the DEC03 GOLD chart using the same method.

The first signal was clearly FALSE, which underlines my point about seeking PRICE PATTERN/TRENDLINE etc confirmation.

The last highlighted signal shows why JonnyT's idea of just using MACD DIFF would be insufficient - MACD lines were above 0 when crossing AND Slow Stoch was approaching 80 (Overbought).

I hope this clarifies.