You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Clown's 2007 outlook is work in progress

- Thread starter The Dutch Clown

- Start date

- Watchers 26

one pivot several consequences

The

ND that existed from April 16th till May 22nd is gone with the turn upwards today.

There's still a PR from March 27th till May 15th target 555,x

Today a PR formed at 11.30 till closing direct target 542.

The RSI is rising, still in bull territory, but not overbought (terrible expression).

DMI crossing positive.

Monthly chart: through 161,8 fibonacci (512-469)

So, the short term trend is up.

Just wait till the second week of June.

The

ND that existed from April 16th till May 22nd is gone with the turn upwards today.

There's still a PR from March 27th till May 15th target 555,x

Today a PR formed at 11.30 till closing direct target 542.

The RSI is rising, still in bull territory, but not overbought (terrible expression).

DMI crossing positive.

Monthly chart: through 161,8 fibonacci (512-469)

So, the short term trend is up.

Just wait till the second week of June.

Attachments

Last edited:

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Vrijdag 1 juni nieuwe maand nieuwe ronde nieuwe kansen

Once you have learned to look at a chart in order to identify the Technical Analysis New School Signals you will find numerous ones of them. So the next thing would be to put them into perspective and one of the aids is written down on page 58 and the simple definition bares serious implications including the inverse meaning. An other helpful tool might be the trending methodology taught by GJN in order to obtain a feeling for direction. Both played a role in the intraday chart on Thursday in such a way that it effects trading the coming days. So make your shopping list and place your bets accordingly.

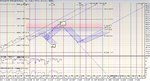

From an Elliott Wave Analysis point of view the 531,31 to 541,64 is scoring best as an impulsive wave which means it is followed by a corrective one. And based on what we have seen after 541,64 so far a ZigZagC pattern is soliciting for the job having it’s third wave already with targets 538,89 to 535,14 in extended version. Please bare in mind that this also might become the fist wave of the ABC so you should be aware of that possibility.

The projected range fractal EOD trend chart has entered the next level.

Have fun trading to WIN.

@Quick

Your observation is quite (something to do with detail and a devil) accurate as it concerns only the hourly chart. The festivity of Technical Analysis recognition can be found in the fact that the dis-proportionality was taken out so I don’t agree with your recent NR, you might want to look a bit further to the left in the very same chart. If you include both weekly and daily chart you should have looked at both NR and page 58 differently yesterday when trading.

The Derivative Oscillator met it’s peer resistance (mid May) and responded to it as well now cruising towards zero and might turn there in order to get some of the price targets on the shopping list and leave us with divergence. This however compared to the 531,31 situation is peanuts or fine-tuning if you like perhaps something for a nice scalp trade today.

From a trading point of view I am looking for those situations that provide a bit more substantial movements providing the conditioning implies reasonable reward at limited risk. You might recall rule number one in the Traders Almanac. If you study your charts you will find the next substantial price target waiting for you and the only thing you will have to do is find the entry that has written that price targets name on it. Yesterday’s AEX performance provided the comfortable trend change that is going to lead the way as the appropriate conditions are gathering.

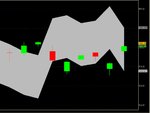

The Astro Finance Analysis is a bit of a though one to crack and I have to say I am still wondering how to optimize the found data in a presentable form. The Clowndicator is one of my attempts and contains six cycle levels of Astro activity of which study has shown that a high value corresponds with a stockmarket high. The attachment contains two graphs, the left one has all six cycle levels and the right one has got only the three largest ones (meaning longer in time). In June you will find a high value however the value is formed by only the two larger phase levels. The time scale axe is per 12 hour period and the value scale axe is identical in the two graphs.

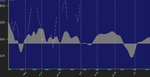

Please bare in mind that you need to have some understanding of cycles and the way different layers are joined and how they influence each other, some analysts refer to music as an example to have a level of understanding. Lately I have been implementing a more complex Astro Finance model which reflects both Bull and Bear influence. I have attached a beta version sample that also has AEX index data in it so you see what it provides even at this stage of development.

Don’t worry I will stick to the more down to earth indicators to do my P-trading.

@Quick-2

Sorry I don’t want to be a pain in the better part of your body, Groningen brr, but there is no NR in the hourly chart left since it was taken out yesterday, well if not now it definitely is anyway. The finding of the signals follows strict rules and by those rules there is, well at least according to my data file, no NR left. As suggested before you probably will have to move a bit more to the left in your chart. In respect to your sequence struggle you might want to explore the reverse engineering chapter a bit and play with the findings in your charts. The definition of an exit is something objective so when it is hit well nothing subjective about it, gone with the wind. Anyway if you consistently want to enjoy NR’s just have a look at your monthly chart, come again or excuse me.

If you find some literature on Astro and finance I would appreciate you let me know since I have not yet found any decent stuff. I have read Irma’s translation weekly’s for quite a while and learned how it is not done so I guess one could say the hard way. I even bought one of her Yank’s books, a waste of money. There was a Yank with a site called Astroecon who provided information that was not bad at all but he now is charging to finance his mobile home or something. If you read his begging messages you get sick. I did read something by Bradley but well his indicators don’t perform and I have also played with the Bayer rules without the result I am looking for.

So basically I started reading (yes sir cruising the net) about Astronomy (not the logy!!) trying to understand the merits of it and recalled the way W.D. Gann is using some of his forecasting methods. I don’t like any sort of guru worshiping so I keep an open mind although it is not so easy when the clan is trying to convince that Gann was all about Astrology and the Bible. Mind you Technical Analysis is a bit more accepted but has it’s jokers as well you will have to realize that Astro stuff is considered to be slightly controversional simply due to the idiots like Irma who are doing such an extremely lousy job. Quite a few jokers that are not seriously living as ordinary people and have developed a somewhat derived image of our world do not positively influence things. Perhaps you should take some time and look around at the NASA website there is a lot of interesting stuff, space cake science.

Nothing to do with some gipsy lady telling me I am going to live a long and happy life. Just doing some P-trading that’s all folks.

Cheers, is has been an extremely profitable week. So up to the next.

Once you have learned to look at a chart in order to identify the Technical Analysis New School Signals you will find numerous ones of them. So the next thing would be to put them into perspective and one of the aids is written down on page 58 and the simple definition bares serious implications including the inverse meaning. An other helpful tool might be the trending methodology taught by GJN in order to obtain a feeling for direction. Both played a role in the intraday chart on Thursday in such a way that it effects trading the coming days. So make your shopping list and place your bets accordingly.

From an Elliott Wave Analysis point of view the 531,31 to 541,64 is scoring best as an impulsive wave which means it is followed by a corrective one. And based on what we have seen after 541,64 so far a ZigZagC pattern is soliciting for the job having it’s third wave already with targets 538,89 to 535,14 in extended version. Please bare in mind that this also might become the fist wave of the ABC so you should be aware of that possibility.

The projected range fractal EOD trend chart has entered the next level.

Have fun trading to WIN.

@Quick

Your observation is quite (something to do with detail and a devil) accurate as it concerns only the hourly chart. The festivity of Technical Analysis recognition can be found in the fact that the dis-proportionality was taken out so I don’t agree with your recent NR, you might want to look a bit further to the left in the very same chart. If you include both weekly and daily chart you should have looked at both NR and page 58 differently yesterday when trading.

The Derivative Oscillator met it’s peer resistance (mid May) and responded to it as well now cruising towards zero and might turn there in order to get some of the price targets on the shopping list and leave us with divergence. This however compared to the 531,31 situation is peanuts or fine-tuning if you like perhaps something for a nice scalp trade today.

From a trading point of view I am looking for those situations that provide a bit more substantial movements providing the conditioning implies reasonable reward at limited risk. You might recall rule number one in the Traders Almanac. If you study your charts you will find the next substantial price target waiting for you and the only thing you will have to do is find the entry that has written that price targets name on it. Yesterday’s AEX performance provided the comfortable trend change that is going to lead the way as the appropriate conditions are gathering.

The Astro Finance Analysis is a bit of a though one to crack and I have to say I am still wondering how to optimize the found data in a presentable form. The Clowndicator is one of my attempts and contains six cycle levels of Astro activity of which study has shown that a high value corresponds with a stockmarket high. The attachment contains two graphs, the left one has all six cycle levels and the right one has got only the three largest ones (meaning longer in time). In June you will find a high value however the value is formed by only the two larger phase levels. The time scale axe is per 12 hour period and the value scale axe is identical in the two graphs.

Please bare in mind that you need to have some understanding of cycles and the way different layers are joined and how they influence each other, some analysts refer to music as an example to have a level of understanding. Lately I have been implementing a more complex Astro Finance model which reflects both Bull and Bear influence. I have attached a beta version sample that also has AEX index data in it so you see what it provides even at this stage of development.

Don’t worry I will stick to the more down to earth indicators to do my P-trading.

@Quick-2

Sorry I don’t want to be a pain in the better part of your body, Groningen brr, but there is no NR in the hourly chart left since it was taken out yesterday, well if not now it definitely is anyway. The finding of the signals follows strict rules and by those rules there is, well at least according to my data file, no NR left. As suggested before you probably will have to move a bit more to the left in your chart. In respect to your sequence struggle you might want to explore the reverse engineering chapter a bit and play with the findings in your charts. The definition of an exit is something objective so when it is hit well nothing subjective about it, gone with the wind. Anyway if you consistently want to enjoy NR’s just have a look at your monthly chart, come again or excuse me.

If you find some literature on Astro and finance I would appreciate you let me know since I have not yet found any decent stuff. I have read Irma’s translation weekly’s for quite a while and learned how it is not done so I guess one could say the hard way. I even bought one of her Yank’s books, a waste of money. There was a Yank with a site called Astroecon who provided information that was not bad at all but he now is charging to finance his mobile home or something. If you read his begging messages you get sick. I did read something by Bradley but well his indicators don’t perform and I have also played with the Bayer rules without the result I am looking for.

So basically I started reading (yes sir cruising the net) about Astronomy (not the logy!!) trying to understand the merits of it and recalled the way W.D. Gann is using some of his forecasting methods. I don’t like any sort of guru worshiping so I keep an open mind although it is not so easy when the clan is trying to convince that Gann was all about Astrology and the Bible. Mind you Technical Analysis is a bit more accepted but has it’s jokers as well you will have to realize that Astro stuff is considered to be slightly controversional simply due to the idiots like Irma who are doing such an extremely lousy job. Quite a few jokers that are not seriously living as ordinary people and have developed a somewhat derived image of our world do not positively influence things. Perhaps you should take some time and look around at the NASA website there is a lot of interesting stuff, space cake science.

Nothing to do with some gipsy lady telling me I am going to live a long and happy life. Just doing some P-trading that’s all folks.

Cheers, is has been an extremely profitable week. So up to the next.

Attachments

Last edited:

mosterd na de vraag

Dear Clown, though I have been silent lately, I am reading your posts daily with great interest, let's say some sort of disproportional behaviour from my side. As you know from earlier posts, I find it difficult to sort out the order of priorities when having mixed (New School) signals. Yesterday was one of those days, starting with a disproportional RSI movement upwards relative to the price action, due to this I saw a NR building up in the hourly and shorter timeframes, in effect this NR is still present, be it with a bit higher target (at moment 532,14), During the remainder of the day the RSI was moving dispoportional again in opposite direction resulting in a 542,7 PR on the last price bar. I guess this one will be seen first today, afterwards, the other NR may still be alive for follow-up. Furthermore I noticed a high value movement in the derivative (hourly), so I may reason this could be followed by a similar movement downwards.

cheers

Edit1: forgot to mention the standstill of the derivative on the daily, which may herald a significant move

while typing this, above mentioned PR has been met, the NR still in place

@Clown, since Mercury will be retrograde 15June, maybe you could publish the Clownindicator for the next period

Edit2: thx Clown for your reply and astro update, which I understand is not an easy cake and must have cost you a lot of sweat and hard work. This is an area I would like to explore further, therefor I would appreciate if you can advise some directions / literature to start with, thusfar it seems I have found a lot of crap from the web.

In reply to your answer: yep, I am aware of the PR's in the daily (567,79 and 545,09 more recently) and weekly (543,88), as well as in the hourly (557,42 and 545,33 more recently (also an NR 521,69 in between)).

Regards the NR in hourly: it is in the chart (objective), though what I understand from you is that this one should be neglected which is a matter of validation (subjective, except for the lack of validation in the longer timeframes which ofcourse is an objective observation). This does not mean it is not going to happen on short term, and, if so, this might influence the picture in the longer frames depending the proportionality of the move. Anyhow, my interest in the NR signal relates to the "hope" (I know this is the wrong thing to do, but due to the lack of solid rock validation rules) to find - on short notice - a lower long entry for the longer term. Furthermore, whilst the most recent PR's are high in the bullrange, I am interested to see what is left on the plate IF the NR is happening at all.

When interpreting your Astro map right, the only chance allowed by the stars would be within the next week, which is in line with the NR period length.

Dear Clown, though I have been silent lately, I am reading your posts daily with great interest, let's say some sort of disproportional behaviour from my side. As you know from earlier posts, I find it difficult to sort out the order of priorities when having mixed (New School) signals. Yesterday was one of those days, starting with a disproportional RSI movement upwards relative to the price action, due to this I saw a NR building up in the hourly and shorter timeframes, in effect this NR is still present, be it with a bit higher target (at moment 532,14), During the remainder of the day the RSI was moving dispoportional again in opposite direction resulting in a 542,7 PR on the last price bar. I guess this one will be seen first today, afterwards, the other NR may still be alive for follow-up. Furthermore I noticed a high value movement in the derivative (hourly), so I may reason this could be followed by a similar movement downwards.

cheers

Edit1: forgot to mention the standstill of the derivative on the daily, which may herald a significant move

while typing this, above mentioned PR has been met, the NR still in place

@Clown, since Mercury will be retrograde 15June, maybe you could publish the Clownindicator for the next period

Edit2: thx Clown for your reply and astro update, which I understand is not an easy cake and must have cost you a lot of sweat and hard work. This is an area I would like to explore further, therefor I would appreciate if you can advise some directions / literature to start with, thusfar it seems I have found a lot of crap from the web.

In reply to your answer: yep, I am aware of the PR's in the daily (567,79 and 545,09 more recently) and weekly (543,88), as well as in the hourly (557,42 and 545,33 more recently (also an NR 521,69 in between)).

Regards the NR in hourly: it is in the chart (objective), though what I understand from you is that this one should be neglected which is a matter of validation (subjective, except for the lack of validation in the longer timeframes which ofcourse is an objective observation). This does not mean it is not going to happen on short term, and, if so, this might influence the picture in the longer frames depending the proportionality of the move. Anyhow, my interest in the NR signal relates to the "hope" (I know this is the wrong thing to do, but due to the lack of solid rock validation rules) to find - on short notice - a lower long entry for the longer term. Furthermore, whilst the most recent PR's are high in the bullrange, I am interested to see what is left on the plate IF the NR is happening at all.

When interpreting your Astro map right, the only chance allowed by the stars would be within the next week, which is in line with the NR period length.

Attachments

Last edited:

Page 58, when words enlighten the graphics

There's a lot said about page 58. Is it that important? That depends on how you see it. When it comes to you as a surprise, I think you don't understand how these things work.

It's just logic and mathematical. The RSI is formed by 14 tics. A tic in this sense can mean real tics, minutes, hours, days, weeks, and so on. The change in the RSI is formed by adding the next new value and subtracting the 14th which becomes the 15th and therefore out of range. The RSI has a tendency to move towards 50. If the next value is very negative and the preceding values were also very negative, the RSI has nevertheless the tendency to go to 50. The same for very positive values. A page 58 situation is when the indicator moves disproportionatelly to the markets' movement.

What is disproportionatelly and how can that happen?

First, it doesn't happen against the elastic properties of the RSI. So, a disproportional movement up must take place when the RSI is low, or under 50. The lower the better.

Also, a disproportional movement down only takes place when the indicator is over 50, the higher the better.

Disproportional means that the markets'movement was less than the indicator movement.

So in an uptrend, when the RSI is normally over 50, you can only see the RSI moving down(not up) abruptly. If this is disproportional then a PR is formed. Yes, with the indicator you are on the wrong side of the movement.

Same for a downtrend. The indicator can only have a disproportional movement up. When it does, you will have a NR.

So, what's so special about a page 58? Nothing!

Pacito

There's a lot said about page 58. Is it that important? That depends on how you see it. When it comes to you as a surprise, I think you don't understand how these things work.

It's just logic and mathematical. The RSI is formed by 14 tics. A tic in this sense can mean real tics, minutes, hours, days, weeks, and so on. The change in the RSI is formed by adding the next new value and subtracting the 14th which becomes the 15th and therefore out of range. The RSI has a tendency to move towards 50. If the next value is very negative and the preceding values were also very negative, the RSI has nevertheless the tendency to go to 50. The same for very positive values. A page 58 situation is when the indicator moves disproportionatelly to the markets' movement.

What is disproportionatelly and how can that happen?

First, it doesn't happen against the elastic properties of the RSI. So, a disproportional movement up must take place when the RSI is low, or under 50. The lower the better.

Also, a disproportional movement down only takes place when the indicator is over 50, the higher the better.

Disproportional means that the markets'movement was less than the indicator movement.

So in an uptrend, when the RSI is normally over 50, you can only see the RSI moving down(not up) abruptly. If this is disproportional then a PR is formed. Yes, with the indicator you are on the wrong side of the movement.

Same for a downtrend. The indicator can only have a disproportional movement up. When it does, you will have a NR.

So, what's so special about a page 58? Nothing!

Pacito

another myth page 133

I know spring is over and summer is starting. Just a late spring cleaning. Late because I'm a procrastinator just like we all are. What about ND and PD. Cardwell made a statement: "bearish divergence is bullish and bullish divergence is bearish". Puzzled? The man is right, in contrast with what Brown says. Did you ever see a marketmovement without a correction. Well, I didn't. It's very normal to see the RSI from a top moving towards 50 (as I explained in the earlier posting). This can be very gradual or with hickups. As long as the uptrend is not accelerating, the RSI will try to reach 50. Then there's definitely a ND or BD as Cardwell called it. Of course there will be a correction at some time, but untill then the ND stays in place. What can you say about this ND? Well, that there will be a correction sometime in the future is as clear as a chalkstream. Can you predict the time when the correction occurs by just looking at the ND. No.

If you look at page 133 fig 8-8 you will see an ND that just fades away in 1994 without ever having had the correction. In contrast to the reversals that have to take effect immediately, the divergences do not have that habit. Conclusion: unless you will see a divergence as a continuing story of the trend, it has no value at all.

Pacito

I know spring is over and summer is starting. Just a late spring cleaning. Late because I'm a procrastinator just like we all are. What about ND and PD. Cardwell made a statement: "bearish divergence is bullish and bullish divergence is bearish". Puzzled? The man is right, in contrast with what Brown says. Did you ever see a marketmovement without a correction. Well, I didn't. It's very normal to see the RSI from a top moving towards 50 (as I explained in the earlier posting). This can be very gradual or with hickups. As long as the uptrend is not accelerating, the RSI will try to reach 50. Then there's definitely a ND or BD as Cardwell called it. Of course there will be a correction at some time, but untill then the ND stays in place. What can you say about this ND? Well, that there will be a correction sometime in the future is as clear as a chalkstream. Can you predict the time when the correction occurs by just looking at the ND. No.

If you look at page 133 fig 8-8 you will see an ND that just fades away in 1994 without ever having had the correction. In contrast to the reversals that have to take effect immediately, the divergences do not have that habit. Conclusion: unless you will see a divergence as a continuing story of the trend, it has no value at all.

Pacito

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

het zal wel......

Just one quick scan at the hourly chart and you will find at the 531,31 positive (bullish) divergence in the RSI. The only negative thing about the following move is that it is a page 58, and it even continues way above the theoretical value 50, until Thursday afternoon when that was taken out. The next page 58 resulted in a PR with a target that was delivered the next day a true present so ask yourself why the first situation differs from the second. To me the joke is that both Brown and Cardwell are right however you will have to look beyond just one page or statement like pieces of a puzzle. Or they are both wrong so a conclusion might be maybe I am missing something here to complete the stockmarket puzzle.

Bottom line for me simply is, I couldn’t care less anyway as long as it does the trick to provide me my P-trades. Have fun trading this week I will pursue other interests close to nature.

EDIT:1

My hard labor session in nature is finished for today and I came back in just in time to find my present in the intraday chart. It’s going to be an extremely close call.

Just one quick scan at the hourly chart and you will find at the 531,31 positive (bullish) divergence in the RSI. The only negative thing about the following move is that it is a page 58, and it even continues way above the theoretical value 50, until Thursday afternoon when that was taken out. The next page 58 resulted in a PR with a target that was delivered the next day a true present so ask yourself why the first situation differs from the second. To me the joke is that both Brown and Cardwell are right however you will have to look beyond just one page or statement like pieces of a puzzle. Or they are both wrong so a conclusion might be maybe I am missing something here to complete the stockmarket puzzle.

Bottom line for me simply is, I couldn’t care less anyway as long as it does the trick to provide me my P-trades. Have fun trading this week I will pursue other interests close to nature.

EDIT:1

My hard labor session in nature is finished for today and I came back in just in time to find my present in the intraday chart. It’s going to be an extremely close call.

Last edited:

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Daar is er al weer zo eentje

And now we have the opposite with negative (or bearish) divergence which Cardwell and Brown are going to argue being either bullish or bearish. So what it’s going to be?

EDIT

Well do we have a winner, or did we just moved into the next negative (or bearish) divergence situation? The spread is a bit larger so might that be an avenue to pursue?

@CoW

Not yet the grass is almost dead and dry…. might be later this afternoon and the toughest part is getting those stacks up in the barn…. a high value is a relative statement when indicators are involved… I prefer ranges, trending modus and even more focus by adapting fractals and dynamic and for 13-14u the values are 546,01 <AEX< 548,80 to complete the picture this subset is trending positively so the support is important.

And now we have the opposite with negative (or bearish) divergence which Cardwell and Brown are going to argue being either bullish or bearish. So what it’s going to be?

EDIT

Well do we have a winner, or did we just moved into the next negative (or bearish) divergence situation? The spread is a bit larger so might that be an avenue to pursue?

@CoW

Not yet the grass is almost dead and dry…. might be later this afternoon and the toughest part is getting those stacks up in the barn…. a high value is a relative statement when indicators are involved… I prefer ranges, trending modus and even more focus by adapting fractals and dynamic and for 13-14u the values are 546,01 <AEX< 548,80 to complete the picture this subset is trending positively so the support is important.

Last edited:

cold or warm

Guest

- Messages

- 58

- Likes

- 0

Green green grass

DDC,

Haystack filled ??

Most indicators on high level so waiting for new entry ? According to the time able to spend at the desk, have to use.......the stoploss :-((

Not present at AW, no cigars and beer for me this time.

KvKd

DDC,

Haystack filled ??

Most indicators on high level so waiting for new entry ? According to the time able to spend at the desk, have to use.......the stoploss :-((

Not present at AW, no cigars and beer for me this time.

KvKd

easy?

I never said that it would be easy. I try to make it easier than it was before by skipping details that don't ameliorate to decision making. Somehow it must be easier than we think. The only problem is how to put that into a formula which can be used all the time.

For instance: I didn't have much time today. Only one hour between 12.30 and 13.30. Yet with all the signals I had I decided to go short and keep it overnight. Which signals did this? First the PR in the 15 min from thursday till yesterday. That was a PR. But just after noon it seemed it wouldn't reach its target. When a target is missed its obvious that the short term trend will turn. Stochastics short was falling. My last Elliot counting starting at 469 showed an equal 1 and 5 wave. I don't say there will be no extension, but for the moment there's a negative feeling. It's just that feeling from the quantum computer inside my head that gave a negative sign. So I saw the objective signs, but in some way or another, my "cray" cells gave me a sign that this is the entry for short. So I must have noted extras that I'm not aware of. I will think about what this could be. Maybe it's just an ordening of the indicators when which is more important at a specific moment . If I come to a solution I will let you know.

Pacito

Another interesting remark (in Dutch):http://www.volghetgeld.nl/artikel/463/1-2-3-4_de_bulls_rit_stopt_hier.html

This seems right for the LT(in Dutch):http://www.volghetgeld.nl/artikel/461/%91Bullmarket_is_nog_maar_net_begonnen%92.html

I never said that it would be easy. I try to make it easier than it was before by skipping details that don't ameliorate to decision making. Somehow it must be easier than we think. The only problem is how to put that into a formula which can be used all the time.

For instance: I didn't have much time today. Only one hour between 12.30 and 13.30. Yet with all the signals I had I decided to go short and keep it overnight. Which signals did this? First the PR in the 15 min from thursday till yesterday. That was a PR. But just after noon it seemed it wouldn't reach its target. When a target is missed its obvious that the short term trend will turn. Stochastics short was falling. My last Elliot counting starting at 469 showed an equal 1 and 5 wave. I don't say there will be no extension, but for the moment there's a negative feeling. It's just that feeling from the quantum computer inside my head that gave a negative sign. So I saw the objective signs, but in some way or another, my "cray" cells gave me a sign that this is the entry for short. So I must have noted extras that I'm not aware of. I will think about what this could be. Maybe it's just an ordening of the indicators when which is more important at a specific moment . If I come to a solution I will let you know.

Pacito

Another interesting remark (in Dutch):http://www.volghetgeld.nl/artikel/463/1-2-3-4_de_bulls_rit_stopt_hier.html

This seems right for the LT(in Dutch):http://www.volghetgeld.nl/artikel/461/%91Bullmarket_is_nog_maar_net_begonnen%92.html

Last edited:

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

de simpelste dingen zijn vaak het moeilijkste te vatten

Well easy it is, like the merits of the computer a straight forward yes or no. Nothing to it, the complexity of the beast is found in the huge number of those yes and no situations. Or again brake it down in + or – trending the only thing you will have to cover is the trend changes and that’s what effectively happened between 13-14u. So you enjoy your drink and ride until the next change and place your next calculated P-trade.

The introduction of signaling that can imply two opposites will not make your trading life any easier so you will need an additional signal for qualification. A signal or the combination of signals you use for trading MUST always have the identical implication if not you are going to have nightmares.

Basically we are once again back at the main Technical Analysis challenge, the lagging versus the reading capabilities of the indicators or combinations you use. Having second thoughts I would like to add that a number of lagging indicators are quite functional as a pre-warning system. Even the Elliott Oscillator is utilizing when concluding the divergence to distinct a fifth wave.

Have fun trading to WIN.

EDIT:1

To provide some guidance the EOD chart dynamic short term trending fractal phase is positive and changes at a close below 538,79. While enjoying yet an other P-trade the trader is as good as his next trade so thinking about the next one as well.

Well easy it is, like the merits of the computer a straight forward yes or no. Nothing to it, the complexity of the beast is found in the huge number of those yes and no situations. Or again brake it down in + or – trending the only thing you will have to cover is the trend changes and that’s what effectively happened between 13-14u. So you enjoy your drink and ride until the next change and place your next calculated P-trade.

The introduction of signaling that can imply two opposites will not make your trading life any easier so you will need an additional signal for qualification. A signal or the combination of signals you use for trading MUST always have the identical implication if not you are going to have nightmares.

Basically we are once again back at the main Technical Analysis challenge, the lagging versus the reading capabilities of the indicators or combinations you use. Having second thoughts I would like to add that a number of lagging indicators are quite functional as a pre-warning system. Even the Elliott Oscillator is utilizing when concluding the divergence to distinct a fifth wave.

Have fun trading to WIN.

EDIT:1

To provide some guidance the EOD chart dynamic short term trending fractal phase is positive and changes at a close below 538,79. While enjoying yet an other P-trade the trader is as good as his next trade so thinking about the next one as well.

Last edited:

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Zo dat hebben we weer gehad

Well the work has been done and the barn is packed with home made hay for the winter my back is telling me it was though my mind set is one of an extremely rich man. The sprinklers are creating rain so the cut grass grows into a nice green meadow it makes me feel wealthy having that possibility when there still are people on this earth that have no water at all.

The AEX has arrived at a critical point or better area since I genuinely think we should allow a bit of tolerance in road-mapping on both price and time. So I use the Elliott Wave count from the 547,82 pivot which has presently the highest scoring scenario Extension5C with the fifth wave starting at 542,26. This scenario allows two additional target area’s a) 535 and b) 530 and please don’t get upset when it turns out to be only 531,something. Just try to see the overall picture as displayed last week, so…… think for a minute what the above pattern implies when it turns out to be the winner.

EDIT:1

The price/time matrix is creating some negotiating margin for price as we move along in suspense. The intraday short term dynamic trending modus continues to be negative although time is also effecting the range which at 14-15u is 535,69 <AEX< 538,92 , once again please notice this is dynamical chips. The standard derivative oscillator might help to guide you into the next phase as well, almost there you know the drill by now. Maybe it is a good idea to keep in mind the bonus signaling as well, just a possibility.

Have fun trading to WIN.

@Albee

Nothing to do with hope at the stock-market…. Ask Paris H. how to obtain a get out of jail card……

Well the work has been done and the barn is packed with home made hay for the winter my back is telling me it was though my mind set is one of an extremely rich man. The sprinklers are creating rain so the cut grass grows into a nice green meadow it makes me feel wealthy having that possibility when there still are people on this earth that have no water at all.

The AEX has arrived at a critical point or better area since I genuinely think we should allow a bit of tolerance in road-mapping on both price and time. So I use the Elliott Wave count from the 547,82 pivot which has presently the highest scoring scenario Extension5C with the fifth wave starting at 542,26. This scenario allows two additional target area’s a) 535 and b) 530 and please don’t get upset when it turns out to be only 531,something. Just try to see the overall picture as displayed last week, so…… think for a minute what the above pattern implies when it turns out to be the winner.

EDIT:1

The price/time matrix is creating some negotiating margin for price as we move along in suspense. The intraday short term dynamic trending modus continues to be negative although time is also effecting the range which at 14-15u is 535,69 <AEX< 538,92 , once again please notice this is dynamical chips. The standard derivative oscillator might help to guide you into the next phase as well, almost there you know the drill by now. Maybe it is a good idea to keep in mind the bonus signaling as well, just a possibility.

Have fun trading to WIN.

@Albee

Nothing to do with hope at the stock-market…. Ask Paris H. how to obtain a get out of jail card……

Attachments

Last edited:

What makes you think we're breaking 531,x or even 530,2 from your chart?Looks like we have a target of 522, see the picture for details.

Pacito

What makes you think we're breaking 531,x or even 530,2 from your chart?

Pacito

Yesterday we closed below a TDtrendline. Acording to the theory of Tom DeMark, this will result in a downward move. Target can be calculated by taking the highest distance above the TDtrendline (up arrow) and subtract the amount from the point where the trendline is broken (down arrow). Of course the breakout may be false and there are actually some qualifiers to validate it. I don't think it is an unreasonable target, if we will have an ABC-correction. Wave A down to approximately 531, then B up to 537 and the C down again to 520-522. It is also around the 38% retracement of 473-548.

The Dutch Clown

Established member

- Messages

- 592

- Likes

- 11

Het is weer een mooi feestje

The AEX has arrived in the b) target area so we had to consider our options, see above postings. Yes Sir, it might even drop a bit further so we can’t exclude that possibility. So let’s take the objective signaling route which of course is the dynamic short term trending modus which just changed into positive. However within this positive trending modus a lower low remains possible without changing that trend. So it’s up to the Yanks.

Have a nice weekend.

The AEX has arrived in the b) target area so we had to consider our options, see above postings. Yes Sir, it might even drop a bit further so we can’t exclude that possibility. So let’s take the objective signaling route which of course is the dynamic short term trending modus which just changed into positive. However within this positive trending modus a lower low remains possible without changing that trend. So it’s up to the Yanks.

Have a nice weekend.