Gedigan

Junior member

- Messages

- 19

- Likes

- 4

Hi Everyone

I'd like to start off 2019 with my first ever Journal. Don’t get me wrong, I’ve got tons of saved homework and actual trade charts but I’ve never had a journal. A first for me. Lets see where this goes.

About me, I have a day job (const. superintendent) & day trade between projects. So anticipate some day trades & swing charts. I’ll try and keep this to setups as they happen, with follow up once the objective is reached or I’m proven wrong and exit. As time permits.

All charts will show Wyckoff as I understand the methodology. I hope, this helps me stay honest with myself, improve my reading of price action and entertain those who may drop in from time to time as i share my analysis.

Appreciate any feedback and constructive comments.

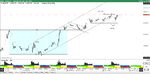

To start things off lets look at a 20 min. NQ.

Reading from left to right, I’ve labeled the chart with a red flag after a test of the 50% area. Price action was labored (over lapping bars), one would anticipate another selling bar (reaction bar) from this test. To me the ease of movement at this point was a COB (change of behavior). This behavior set up a spring condition. I've labeled PA from this point forward. One last comment, I have an objective of 6577.00 for this time frame, enjoy the chart, let's see how the day goes. 🙂

I'd like to start off 2019 with my first ever Journal. Don’t get me wrong, I’ve got tons of saved homework and actual trade charts but I’ve never had a journal. A first for me. Lets see where this goes.

About me, I have a day job (const. superintendent) & day trade between projects. So anticipate some day trades & swing charts. I’ll try and keep this to setups as they happen, with follow up once the objective is reached or I’m proven wrong and exit. As time permits.

All charts will show Wyckoff as I understand the methodology. I hope, this helps me stay honest with myself, improve my reading of price action and entertain those who may drop in from time to time as i share my analysis.

Appreciate any feedback and constructive comments.

To start things off lets look at a 20 min. NQ.

Reading from left to right, I’ve labeled the chart with a red flag after a test of the 50% area. Price action was labored (over lapping bars), one would anticipate another selling bar (reaction bar) from this test. To me the ease of movement at this point was a COB (change of behavior). This behavior set up a spring condition. I've labeled PA from this point forward. One last comment, I have an objective of 6577.00 for this time frame, enjoy the chart, let's see how the day goes. 🙂