You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

sideways-sid

Active member

- Messages

- 136

- Likes

- 24

To answer your original question, yes you can make money buying to open.

I had a journal doing similar; although mainly options on index futures instead of equities.

In my experience you'll do better significantly better trading spreads though.

I had a journal doing similar; although mainly options on index futures instead of equities.

A final update.

The last 130 trades, mostly detailed here over the last six months have produced an average return of 11.9% in 22.6 days. Below backtested average, but still just over 500% on an annualised basis, which is not too shabby.

This thread has had >8000 views, but only three comments other than mine, which doesn't suggest there is much interest in it.

In addition to the long options positions detailed here, I trade futures on bollinger breakouts which is accretive to returns, and have recently started trading weekly credit spreads on the same securities, which has made my...

The last 130 trades, mostly detailed here over the last six months have produced an average return of 11.9% in 22.6 days. Below backtested average, but still just over 500% on an annualised basis, which is not too shabby.

This thread has had >8000 views, but only three comments other than mine, which doesn't suggest there is much interest in it.

In addition to the long options positions detailed here, I trade futures on bollinger breakouts which is accretive to returns, and have recently started trading weekly credit spreads on the same securities, which has made my...

In my experience you'll do better significantly better trading spreads though.

da-net

Member

- Messages

- 77

- Likes

- 4

Sid, Thank You! I truly appreciate the comment and the insight especially from your thread. I will look up your thread and read it. I had hoped that others would comment and help refine this as a means for people to supplement their incomes. In level 1, I think it might be possible to initiate a straddle around a news release, but that requires watching intraday.

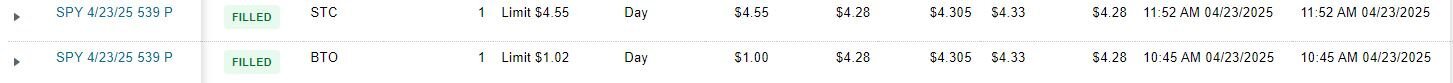

I am currently looking at 1 day per week of active trading and using 0 DTEs. I'm looking at the SPY. Of course the SPY daily is currently in an expansion phase. My thoughts, when it exits this expansion is it going to retest highs or down to 514?

I am currently looking at 1 day per week of active trading and using 0 DTEs. I'm looking at the SPY. Of course the SPY daily is currently in an expansion phase. My thoughts, when it exits this expansion is it going to retest highs or down to 514?

sideways-sid

Active member

- Messages

- 136

- Likes

- 24

I think you might benefit from stepping back, then focussing on what you're trying to achieve and then how you do so.

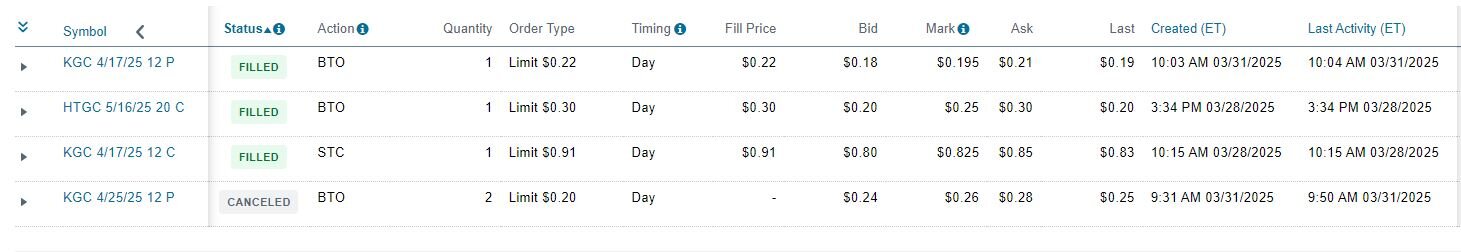

Your first post mentioned 60-90DtE. But then you don't mention how the trades in subsequent posts went.

You later say:

Plenty of opportunities to deploy that now, but you haven't shown if your testing showed positive P&L at what Sharpe.

But a few months later you're exploring 0DtE.

Perhaps decide where your edge is by backtesting with as much historic data as you can get hold of, and then deploy trades to monetise it.

Your first post mentioned 60-90DtE. But then you don't mention how the trades in subsequent posts went.

RULES:

All options that I purchase will have 2 to 3 months of life, 1 level out of the money, and cost no more than $1 + or -. One option contract at a time. Focus on the KISS principle and don't deviate. The more complicated I make it, the more times I am wrong, thus KISS.

You later say:

Recently in a T2W journal by Brett Bot, he disclosed that new 52 week lows on good companies typically bounce 10%, and I have started to test this with an option in SWBI. here's that trade BTO:

Plenty of opportunities to deploy that now, but you haven't shown if your testing showed positive P&L at what Sharpe.

But a few months later you're exploring 0DtE.

Perhaps decide where your edge is by backtesting with as much historic data as you can get hold of, and then deploy trades to monetise it.

da-net

Member

- Messages

- 77

- Likes

- 4

Sid, thank you. I had already started looking closely at the trades I've taken but far more importantly at the time frames of particular stocks trade best. This is why I've considered the idea of giving up one day per week to sit at a computer to "day trade". Many stocks appear to be trading around 4 hour timeframes. As to back testing, that is not something I care to do. Same as posting my account P&L for anyone that might be interested. It's implied that if I did not post a STC, then the option expired worthless.

Attachments

da-net

Member

- Messages

- 77

- Likes

- 4

Something to consider with all the tariff talk from politicians. The world will have increased cost from these and reduced discretionary funds. People still need the 5 basic things to survive or thrive. Others are seeing this and hopping on TDUP, which has been going higher while the markets sell off. It might be a short term upside, but long term it also looks good. the question is; buy the stock? or buy options?

FYI..

FYI..

Last edited:

da-net

Member

- Messages

- 77

- Likes

- 4

If you look at some of my "wins" you'll notice that I exited far too early and left too much on the table. While reviewing these trades and trying to find a way to stay in longer for the bigger gains. One thing I tried to learn long ago was Elliottwave, but even the so called experts had problems. I learned of Prof. Aldo Lagrutta and his teachings. Prof. Aldo Lagrutta doesn't try to "curve fit" as I have taken some of his FREE lessons and applied them. His Elliottwave teachings include the use of Fibonacci. I have scheduled myself for a 60 day mentorship very soon, which wasn't very expensive.

I chose 2 markets;

ACAD which has a probability of hitting $38, and bought an option which was very hard to buy as the market maker is very alert. According to Schwab news, RBC recently raised it's target to $39 from $38. ACAD $23 Call Sept $0.95 x $1.95 BTO $0.95

EUR/USD which has a strong possibility of $1.30 according to Elliottwave & Fibonacci According to Carolyn Borden's teaching I should watch closely as it gets to $1.20 area. This I'm trading very small, but will add to position at every pullback.

As a note only. I applied this to a SPY chart and it shows 2 possibilities; $547 and $566

I chose 2 markets;

ACAD which has a probability of hitting $38, and bought an option which was very hard to buy as the market maker is very alert. According to Schwab news, RBC recently raised it's target to $39 from $38. ACAD $23 Call Sept $0.95 x $1.95 BTO $0.95

EUR/USD which has a strong possibility of $1.30 according to Elliottwave & Fibonacci According to Carolyn Borden's teaching I should watch closely as it gets to $1.20 area. This I'm trading very small, but will add to position at every pullback.

As a note only. I applied this to a SPY chart and it shows 2 possibilities; $547 and $566

Attachments

da-net

Member

- Messages

- 77

- Likes

- 4

First, fixing a typo. The Spy possibilities are $647 & $666.

If I have done my EW & Fib work correct, then BKV should go to $25.63 area. So this trade;

BKV $25 Call Aug $0.10 x $0.60 BTO $0.35 (2)

Have been thinking about AI, EVs, Robots, etc and what are all these going to need. These things are going to consume a lot of copper, and tin. Last nite James Hickman @ Schiff Sovereign's email confirmed the low supply of tin for solder. Did some research and here's what I found. Last night it was quoted at $0.03, today $0.10. When It falls back down, going to buy just 10000 shares and give them to my niece.

from wiki:

PT Timah Tbk (OTCMKTS: PTTMF)

PT Timah Tbk is a state-owned Indonesian tin stock primarily engaged in tin production and smelting operations. Founded in 1976 and headquartered in Bangka, Indonesia, PT TIMAH operates as a subsidiary of PT Indonesia Asahan Aluminium (Persero).

The company’s activities encompass exploration, mining, processing, and marketing of tin.

PT TIMAH also produces and sells non-tin items like coal, nickel, quartz sand, and various tin products including Banka, Mentok, and Kundur tin.

Besides mining, the company is involved in construction, agricultural trading, real estate, transportation, and engineering services.

PT TIMAH is one of the largest tin producers globally, playing a crucial role in the tin sector.

The company’s diverse operations and strategic focus on tin production and smelting highlight its significant contribution to the tin industry.

If I have done my EW & Fib work correct, then BKV should go to $25.63 area. So this trade;

BKV $25 Call Aug $0.10 x $0.60 BTO $0.35 (2)

Have been thinking about AI, EVs, Robots, etc and what are all these going to need. These things are going to consume a lot of copper, and tin. Last nite James Hickman @ Schiff Sovereign's email confirmed the low supply of tin for solder. Did some research and here's what I found. Last night it was quoted at $0.03, today $0.10. When It falls back down, going to buy just 10000 shares and give them to my niece.

from wiki:

PT Timah Tbk (OTCMKTS: PTTMF)

PT Timah Tbk is a state-owned Indonesian tin stock primarily engaged in tin production and smelting operations. Founded in 1976 and headquartered in Bangka, Indonesia, PT TIMAH operates as a subsidiary of PT Indonesia Asahan Aluminium (Persero).

The company’s activities encompass exploration, mining, processing, and marketing of tin.

PT TIMAH also produces and sells non-tin items like coal, nickel, quartz sand, and various tin products including Banka, Mentok, and Kundur tin.

Besides mining, the company is involved in construction, agricultural trading, real estate, transportation, and engineering services.

PT TIMAH is one of the largest tin producers globally, playing a crucial role in the tin sector.

The company’s diverse operations and strategic focus on tin production and smelting highlight its significant contribution to the tin industry.

Attachments

da-net

Member

- Messages

- 77

- Likes

- 4

Just a heads up, for those that invest long term. Rwanda and Burkino Faso have jointly agreed to develop nuclear power to supply their countries with electric. Rwanda has chosen Nano Nuclear Energy for SMR. If they are successful, and they should be, this gives NNE their foot in the door to all of Africa who will be watching.

da-net

Member

- Messages

- 77

- Likes

- 4

UROY, Uranium Royalty Trust, According to news stories Nigeria has refused to allow Orano to mine Uranium and ship the raw product and Uranium stockpiles are pretty thin. I applied the ElliottWave & Fib projections to the chart. Currently it looks to be in a wave 4. I expect it to close the gap down to $2.69 first. Upside projected targets are $3.80 to $4.20. Given the current condition of Uranium it could go lots higher.

UROY $2.50 Call October17 $0.45 x $0.55 BTO $0.50

UROY $2.50 Call October17 $0.45 x $0.55 BTO $0.50

Attachments

da-net

Member

- Messages

- 77

- Likes

- 4

Two trades today. Closed 5 August GROY $2.5 calls @ $0.37 and initiated a Sept $19 put on IVZ @ $0.25. If I've done my wave count correct, IVZ could pull back to the "Golden Zone" between $17 & $18, but more realistic is $19 before advancing to the $25 to $27 area.

Attachments

da-net

Member

- Messages

- 77

- Likes

- 4

Closed out a nice gain on CMPO that I forgot to post, and took a short position on same, but doubt it will reach the target price completely. Bought a call on NTLA as it has retraced 50% and EW / Fib suggests it has upside to $17.50 area. If CMPO retraces like I think, I may take another call on it.

Bought Carolyn Boroden's book (paperback) off ebay, hope she can improve my understanding and usage of Fib.

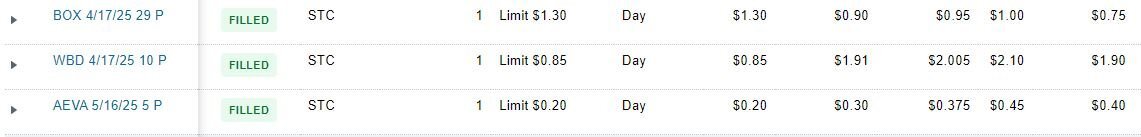

CMPO $17.50 Call Sep BTO $0.28

CMPO $17.50 Call Sep $1.65 x $1.90 STC $2.12

CMPO $17.50 PUT Sep $0.15 x $0.35 BTO $0.30

NTLA $15 Call Sep $0.25 x $0.30 BTO $0.28

Bought Carolyn Boroden's book (paperback) off ebay, hope she can improve my understanding and usage of Fib.

CMPO $17.50 Call Sep BTO $0.28

CMPO $17.50 Call Sep $1.65 x $1.90 STC $2.12

CMPO $17.50 PUT Sep $0.15 x $0.35 BTO $0.30

NTLA $15 Call Sep $0.25 x $0.30 BTO $0.28

Attachments

Similar threads

- Replies

- 3

- Views

- 6K

Q