da-net

Member

- Messages

- 77

- Likes

- 4

DEFINIING OPTION TRADING LEVEL 1:

This is the buying only of calls and puts to open a position.

PLEASE understand that level 1 buying options, historically loses money. The ideal thing is to sell options through spreads or covered options. Selling is a proven way to make money or buy the stocks you want at prices you like.

GOAL:

My goal with this thread is to check the possibility of making money only buying options (level 1) in a $1000 funded account. Can I be selective enough to grow the account to the point it becomes a source of income like a part time job? I don't want to sit in front of a screen all day.

Simply being net positive is not good enough, there has to be enough to compensate for both risk & time. I will do this for one year or the account is exhausted.

RULES:

All options that I purchase will have 2 to 3 months of life, 1 level out of the money, and cost no more than $1 + or -. One option contract at a time. Focus on the KISS principle and don't deviate. The more complicated I make it, the more times I am wrong, thus KISS.

Do not get greedy as some option Market Makers are known to control option pricing stating "Volatility" as the reason why. Not every option will be a home run, nor will every option lose money. If the account grows enough, I will advance from single options to multiples or more pricey options when warranted.

CHARTING SETUP:

I use daily candles with SMA of 20, 50, and 200, along with CCI (I have more screen time with it), Support & Resistance (price rejection area), and candle patterns, ie: pinbars, "W" and "M" formations, bullish / bearish bars.

INTRODUCTION:

Over the years of trading different markets, I have tried many things. I typically tried to squeeze an extra percentage point, etc with adding new indicators, or bots, but always found more was NOT better. Thus in this I adhere to the KISS principle. Since I'm a Yank, I'll be posting things from mostly USA markets. I may also post things from other stock markets around the world that allow direct access by Americans (Yanks), but they most likely will not be option plays.

I'll share tidbits of information along the way as situations arise as I remember them.

If you have some knowledge that would help everyone, I ask that you share it, but keep to the principle of KISS.

TRADE POSTING:

My trades will be real, and I will post the trade after I have opened a position or closed it. I will post both the losers and the winners with a fill notice. I will NOT post a chart as I don't want to influence you in what setup works best for you.

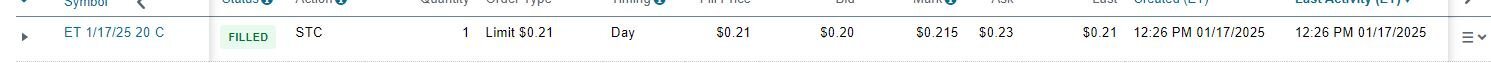

Recently in a T2W journal by Brett Bot, he disclosed that new 52 week lows on good companies typically bounce 10%, and I have started to test this with an option in SWBI. here's that trade BTO:

This is the buying only of calls and puts to open a position.

PLEASE understand that level 1 buying options, historically loses money. The ideal thing is to sell options through spreads or covered options. Selling is a proven way to make money or buy the stocks you want at prices you like.

GOAL:

My goal with this thread is to check the possibility of making money only buying options (level 1) in a $1000 funded account. Can I be selective enough to grow the account to the point it becomes a source of income like a part time job? I don't want to sit in front of a screen all day.

Simply being net positive is not good enough, there has to be enough to compensate for both risk & time. I will do this for one year or the account is exhausted.

RULES:

All options that I purchase will have 2 to 3 months of life, 1 level out of the money, and cost no more than $1 + or -. One option contract at a time. Focus on the KISS principle and don't deviate. The more complicated I make it, the more times I am wrong, thus KISS.

Do not get greedy as some option Market Makers are known to control option pricing stating "Volatility" as the reason why. Not every option will be a home run, nor will every option lose money. If the account grows enough, I will advance from single options to multiples or more pricey options when warranted.

CHARTING SETUP:

I use daily candles with SMA of 20, 50, and 200, along with CCI (I have more screen time with it), Support & Resistance (price rejection area), and candle patterns, ie: pinbars, "W" and "M" formations, bullish / bearish bars.

INTRODUCTION:

Over the years of trading different markets, I have tried many things. I typically tried to squeeze an extra percentage point, etc with adding new indicators, or bots, but always found more was NOT better. Thus in this I adhere to the KISS principle. Since I'm a Yank, I'll be posting things from mostly USA markets. I may also post things from other stock markets around the world that allow direct access by Americans (Yanks), but they most likely will not be option plays.

I'll share tidbits of information along the way as situations arise as I remember them.

If you have some knowledge that would help everyone, I ask that you share it, but keep to the principle of KISS.

TRADE POSTING:

My trades will be real, and I will post the trade after I have opened a position or closed it. I will post both the losers and the winners with a fill notice. I will NOT post a chart as I don't want to influence you in what setup works best for you.

Recently in a T2W journal by Brett Bot, he disclosed that new 52 week lows on good companies typically bounce 10%, and I have started to test this with an option in SWBI. here's that trade BTO: