Management of tenants can be an issue if you don't know what you are doing but with the correct approach it is controllable. Also refinancing say a 100K mortgage for 102K (2%) at 6% interest would mean that rents would need to increase from £500 per month to £510 per month to cover the new costs which is hardly a problem. Also what CGT ? You are not selling the property just taking out a new mortgage on it which is tax free.

The key for this approach is to never sell which flies in the face of what most BTL are aiming for.

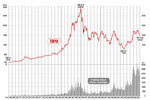

The biggest risk is a rise in interest rates which could mean very large increases in rent to cover the costs as well as impacting the market in general which could lower prices. The way around this is to try and ensure you get fixed rates when refinancing.

Yes PauL I realised after writing it that the plan is not to sell it ...ever.

That might be realistic for large trusts - but for individuals I doubt it. When interest rates are volatile and rents dont cover it - how many borrowers will be able to fix rates for long periods ? Not even the ones with large equity. And then there are costs for updating the property etc.

The question is - how will you make money if you never sell or is the idea to keep borrowing till the day you die....like the Tchenguiz brothers - but remember their father was the treasurer for the Shah of Iran....😎..