You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Build Neural Network Indicator in MT4 using Neuroshell

After changing configuration while building the dll, finally I can get smaller dll size using Visual cpp (see file size of itrendc2.dll).

Great Arryex :smart:, anyway in my case I use PowerBASIC because it's more easy to me.

Regards

Create Neural Network (Excel)

Hi Arryex:

Thanks for the wonderful work. I did read your PDF like Michel. Did you able to find the excel file? I would really appreciate if you could share this with me. I can be reached at [email protected].

Thanks

Shoque

Hi Michel,

Sorry, due to my mistake, some time creating pdf file but not keeping the native in the same name and folder. Searching the old file with the file name or extension not giving me the expected correct file.

If I could not found it, I will make a simple excel one, please give me few days in order can prepare it.

Cheers,

Mr. Arryex

NB: I am a male

Hi Arryex:

Thanks for the wonderful work. I did read your PDF like Michel. Did you able to find the excel file? I would really appreciate if you could share this with me. I can be reached at [email protected].

Thanks

Shoque

Hi Clarod & Shoque,

Please find here attached file in post #469, since I have forgotten also the password, the file attached is without password. Its difficult also for me to find the excel file that I made on 2011.

Enjoy..

Please find here attached file in post #469, since I have forgotten also the password, the file attached is without password. Its difficult also for me to find the excel file that I made on 2011.

Enjoy..

Attachments

Last edited:

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Hi arryex - the master of NN

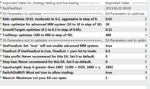

I bought an expensive ea nn for MT5. It's results in strategy tester are good but in real trading the drawdown is too big. Is it possible to open the program and tweak up certain parts like loops to improve it ? I can only change inputs in the strategy tester NOT the real program.

I bought an expensive ea nn for MT5. It's results in strategy tester are good but in real trading the drawdown is too big. Is it possible to open the program and tweak up certain parts like loops to improve it ? I can only change inputs in the strategy tester NOT the real program.

Attachments

Hi Pat,

The following steps you should verify:

1. What are the inputs that are used to generate Buy and Sell signals, if you can get the mq5 code will be easier to analyze it.

2. Refer to the screenshot, the parameter included on the optimized signals is also risk, bars, trail step and growth. Those parameters are influence each other. Few things can jeopardize the result are wrong selection of these parameters, example if you have optimized bars it can be disturbed by to small value of MM, etc.

One thing that may help is to optimize the parameters gradually with one, then two, then three then four. Example optimize first the risk, then risk and bars (with fix value of risk), then risk, bars and growth (with fix value of risk and bars), etc.

We should check also the optimization range of data where the optimize inputs parameter value are taken from. The small range of optimization can lead the over-fit, indicate good result during optimization but bad result in the real trade. You can knowing this if you have the mq5 or mq4 code.

The following steps you should verify:

1. What are the inputs that are used to generate Buy and Sell signals, if you can get the mq5 code will be easier to analyze it.

2. Refer to the screenshot, the parameter included on the optimized signals is also risk, bars, trail step and growth. Those parameters are influence each other. Few things can jeopardize the result are wrong selection of these parameters, example if you have optimized bars it can be disturbed by to small value of MM, etc.

One thing that may help is to optimize the parameters gradually with one, then two, then three then four. Example optimize first the risk, then risk and bars (with fix value of risk), then risk, bars and growth (with fix value of risk and bars), etc.

We should check also the optimization range of data where the optimize inputs parameter value are taken from. The small range of optimization can lead the over-fit, indicate good result during optimization but bad result in the real trade. You can knowing this if you have the mq5 or mq4 code.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Hi Pat,

The following steps you should verify:

1. What are the inputs that are used to generate Buy and Sell signals, if you can get the mq5 code will be easier to analyze it.

2. Refer to the screenshot, the parameter included on the optimized signals is also risk, bars, trail step and growth. Those parameters are influence each other. Few things can jeopardize the result are wrong selection of these parameters, example if you have optimized bars it can be disturbed by to small value of MM, etc.

One thing that may help is to optimize the parameters gradually with one, then two, then three then four. Example optimize first the risk, then risk and bars (with fix value of risk), then risk, bars and growth (with fix value of risk and bars), etc.

We should check also the optimization range of data where the optimize inputs parameter value are taken from. The small range of optimization can lead the over-fit, indicate good result during optimization but bad result in the real trade. You can knowing this if you have the mq5 or mq4 code.

Many thanks for the above. As you so rightly say the problem is to get into the code first and that is where I am stuck.

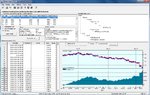

Hi all!

I have played a little bit with CH.

I used the following data EU 5mins. (O/H/L/C)

CH Inputs: none, Output: Open.

Inputs für Indis of CH, O/H/L/C, used indis: Mom, RSI, Slope, ROC, etc...

Any ideas for improvement? One Problem is, too many trades.

Bye, AT

I have played a little bit with CH.

I used the following data EU 5mins. (O/H/L/C)

CH Inputs: none, Output: Open.

Inputs für Indis of CH, O/H/L/C, used indis: Mom, RSI, Slope, ROC, etc...

Any ideas for improvement? One Problem is, too many trades.

Bye, AT

Attachments

Last edited:

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Hi all!

I have played a little bit with CH.

I used the following data EU 5mins. (O/H/L/C)

CH Inputs: none, Output: Open.

Inputs für Indis of CH, O/H/L/C, used indis: Mom, RSI, Slope, ROC, etc...

Any ideas for improvement? One Problem is, too many trades.

Bye, AT

Looks good but...........

Does it trade automatically ?

and over what time period was it run ?

was commission taken out of equity profit ?

Hi Pat!

Autotrading could be done via CH MT4-"plugin", via NSDT, or via DLL, or via formular input in MT4 as Arry has done it.

The model is just a test, not that good, but I'm testing.

I attached an other (better) model. there you see the periods and used

dates...

Commision is set to 2USD per 100.000 (should be 2pips)

Thanks for comments and tips.

Bye, AT

Autotrading could be done via CH MT4-"plugin", via NSDT, or via DLL, or via formular input in MT4 as Arry has done it.

The model is just a test, not that good, but I'm testing.

I attached an other (better) model. there you see the periods and used

dates...

Commision is set to 2USD per 100.000 (should be 2pips)

Thanks for comments and tips.

Bye, AT

Looks good but...........

Does it trade automatically ?

and over what time period was it run ?

was commission taken out of equity profit ?

Attachments

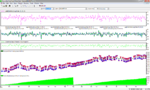

Hi AT,

You can improve your prediction by using nested technique, what I did is if I predict a future indicator, the result of first prediction will be used for the second prediction, etc.

You can do this with all other neural network application, as long as you maintain the optimization and out of sample period (date range).

I recall the same data in post #453 in 2011

http://www.trade2win.com/boards/tra...ator-mt4-using-neuroshell-65.html#post1499440

I try to predict Lead(Momentum(ExpAvg(Close,10),10),10), means future 10 bar of Momentum(ExpAvg(Close,10),10) with all inputs plus the result of previous prediction. I stop if if feel the R-squared value was good enough in both optimization and out of sample range. Afterward I put this predicted indicator as input of my NST trading strategy.

You can improve your prediction by using nested technique, what I did is if I predict a future indicator, the result of first prediction will be used for the second prediction, etc.

You can do this with all other neural network application, as long as you maintain the optimization and out of sample period (date range).

I recall the same data in post #453 in 2011

http://www.trade2win.com/boards/tra...ator-mt4-using-neuroshell-65.html#post1499440

I try to predict Lead(Momentum(ExpAvg(Close,10),10),10), means future 10 bar of Momentum(ExpAvg(Close,10),10) with all inputs plus the result of previous prediction. I stop if if feel the R-squared value was good enough in both optimization and out of sample range. Afterward I put this predicted indicator as input of my NST trading strategy.

Attachments

Hi AT,

You can improve your prediction by using nested technique, what I did is if I predict a future indicator, the result of first prediction will be used for the second prediction, etc.

You can do this with all other neural network application, as long as you maintain the optimization and out of sample period (date range).

I recall the same data in post #453 in 2011

http://www.trade2win.com/boards/tra...ator-mt4-using-neuroshell-65.html#post1499440

I try to predict Lead(Momentum(ExpAvg(Close,10),10),10), means future 10 bar of Momentum(ExpAvg(Close,10),10) with all inputs plus the result of previous prediction. I stop if if feel the R-squared value was good enough in both optimization and out of sample range. Afterward I put this predicted indicator as input of my NST trading strategy.

Hi Arryex, thanks for the file posted in #1123.

I don't understand what is the reason that used LEAD on the prediction... could you please explain again this method that you used. Thanks in advance

Btw, I used "Marked Indicators package" (NS2) to found the best inputs for NN and also I use GMDH because provides an alternate way of finding the best inputs.

Did you used it? ..please let me know your comments. Thanks

Link : http://www.wardsystems.com/manuals/neuroshell2/index.html?optindopt.htm

Regards,

clarod 🙂

Last edited:

Hi all!

I have played a little bit with CH.

I used the following data EU 5mins. (O/H/L/C)

CH Inputs: none, Output: Open.

Inputs für Indis of CH, O/H/L/C, used indis: Mom, RSI, Slope, ROC, etc...

Any ideas for improvement? One Problem is, too many trades.

Bye, AT

I don't have CH but I think that a good way to determinate the best input for a NN is to use "Market Indicator Package" (MIP) of NS2 and then you can use these inputs into CH. Let me know if you need any help about MIP, I used it before.

Take a look at this link (See "Options" and then select MIP)

http://www.wardsystems.com/manuals/neuroshell2/

Hope your help

clarod 🙂

Which of the various NS2 packages would you recommend to predict the S&P 500 daily and weekly profitably ?

I can´t recommend a packages for a specify share... depending of your predictions and strategie(st) that you can create. NS2 for me is good to identify inputs and created with these neural indicators that you can use as part of your st.

clarod 🙂

Hi Clarod,

The intention using Neural network is to predict the future value, that is why we can use the lead as target of prediction.

Some people made failure, they use current value to predict using current value of indicators and sure will get a very good prediction, on reality this will not happen because your input indicators will not be available prior you completed the current value.

In other way, you can also put current value as prediction target but ensure that all inputs are lag values.

I used MPI on NS2, at least we can understand which input indicators has capacity to predict the output, NS2 use correlation method to find the inputs. But some time a high correlation inputs may not resulting a high R-squared values.

regards,

Arry

The intention using Neural network is to predict the future value, that is why we can use the lead as target of prediction.

Some people made failure, they use current value to predict using current value of indicators and sure will get a very good prediction, on reality this will not happen because your input indicators will not be available prior you completed the current value.

In other way, you can also put current value as prediction target but ensure that all inputs are lag values.

I used MPI on NS2, at least we can understand which input indicators has capacity to predict the output, NS2 use correlation method to find the inputs. But some time a high correlation inputs may not resulting a high R-squared values.

regards,

Arry

Hi Arryex, thanks for the file posted in #1123.

I don't understand what is the reason that used LEAD on the prediction... could you please explain again this method that you used. Thanks in advance

Btw, I used "Marked Indicators package" (NS2) to found the best inputs for NN and also I use GMDH because provides an alternate way of finding the best inputs.

Did you used it? ..please let me know your comments. Thanks

Link : http://www.wardsystems.com/manuals/neuroshell2/index.html?optindopt.htm

Regards,

clarod 🙂

Last edited:

Hi Arry & Clarod,

Thanks for your inputs and hints.

@Arry: I now tried (once again ;-)) ) to use the Mom(ExpAvg) and the

Mom(ExpAvg) (LAG 1-10) and Mom(ExpAvg) (LEAD5).

So I try to use the actual and the past 10 bars and try to predict the next 5 bars. (Future) with CH. The best result for R-squ I get, is about 0,7

I used 5 mins EU bar and about 22000 bars for training and about 5500 bars for out-of-sample-test. So 0,7 not really good result...

Any ideas, how to improve the result?

@clarod: Thanks for your MPI input... I tryed to use this, but

also not got better results than 0,7 r-squr.

No I'm not quite sure whether I use NS2 right... hmmmm...

Thanks for your help!

Bye, AT

Thanks for your inputs and hints.

@Arry: I now tried (once again ;-)) ) to use the Mom(ExpAvg) and the

Mom(ExpAvg) (LAG 1-10) and Mom(ExpAvg) (LEAD5).

So I try to use the actual and the past 10 bars and try to predict the next 5 bars. (Future) with CH. The best result for R-squ I get, is about 0,7

I used 5 mins EU bar and about 22000 bars for training and about 5500 bars for out-of-sample-test. So 0,7 not really good result...

Any ideas, how to improve the result?

@clarod: Thanks for your MPI input... I tryed to use this, but

also not got better results than 0,7 r-squr.

No I'm not quite sure whether I use NS2 right... hmmmm...

Thanks for your help!

Bye, AT

Attachments

Hi Arry & Clarod,

Thanks for your inputs and hints.

@Arry: I now tried (once again ;-)) ) to use the Mom(ExpAvg) and the

Mom(ExpAvg) (LAG 1-10) and Mom(ExpAvg) (LEAD5).

So I try to use the actual and the past 10 bars and try to predict the next 5 bars. (Future) with CH. The best result for R-squ I get, is about 0,7

I used 5 mins EU bar and about 22000 bars for training and about 5500 bars for out-of-sample-test. So 0,7 not really good result...

Any ideas, how to improve the result?

@clarod: Thanks for your MPI input... I tryed to use this, but

also not got better results than 0,7 r-squr.

No I'm not quite sure whether I use NS2 right... hmmmm...

Thanks for your help!

Bye, AT

I used "Eureqa" to do this. (http://www.nutonian.com/products/eureqa/)

Please take a look at file attached (zip format and to predict I used EURUSD M5 01/01/2013 to 01/03/2013)

Regards,

clarod 🙂

Attachments

Similar threads

- Replies

- 24

- Views

- 34K

- Replies

- 5

- Views

- 4K