Good luck Pat, hope you'll found what you need...initiate your journey with NN..

I have a basic stuff about linear model (least square) which is used as well in NN:

1. Sample linear Data file

Assume we have the following data 12 pairs data, x and d

x = [1 2 3 4 5 6 7 8 9 10 11 12]

d = [1.72 1.9 1.57 1.83 2.13 1.66 2.05 2.23 2.89 3.04 2.72 3.18]

The intention is to get a linear equation

y= wx + b,

where y is predicted value, w=weight and b=bias

Prediction error is difference between predicted and actual data d

e= y-d

Square of error is

e^2

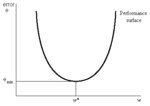

Average of error (Mean Square of error= MSE)

MSE= average(e^2)

You can change the value of w and b on "find your w and b.xlsx" file in order having smallest MSE. At the moment our criterion is to minimize MSE, smaller MSE indicates better prediction.

2. The excel file "get w & b analytically.xlsx" consist data and equation to get w & b values which resulting smallest MSE.

Using analytical method, since MSE is a square equation (see error curve), you can get the smallest value (in a curve) if the slope (differentiation) of error is equal to zero.

Check out about differential/integral Calculus to get the differential equation result.

With NN, you will have similar equation y=wx + b, where w & b become vectors/matrix and not a single scalar value. In NN you find w & b in order to minimize MSE.

Cheers