Predict JRSX, using NS2 in XAUUSD 60 minutes data, 8549 rows:

1. Input: JRSX (t), JRSX (t+1),JRSX (t+2),JRSX (t+3),JRSX (t+4), JRSX(t+5)

afterward named them as variable I0 to I6

2. Output: JRSX(t-5) as variable O

Here is sample code defining input and output Neural network:

for( shift=i; shift>=1; shift--)

{

input[0] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift);

input[1] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift+1);

input[2] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift+2);

input[3] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift+3);

input[4] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift+4);

input[5] = iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift+5);

output[0]= iCustom(NULL,0, "aaJRSX", 0,14,0,0, shift-5);

}

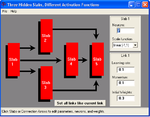

3. Neural Network architecture in NS2: Back Propagation, Wards Net, 3 hidden slabs, 7 input neuron, 1 output neuron. Training criteria: rotation, turboprop, 80% data for training and 20% for testing.

See attached training data (in a zip), input-output and training result: I achieve only 0.6321 (less than 2 minutes optimization).