You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

I'm practicing my stock day trading today.

Seeing if my fx methods can work on stocks or not.

3 out of 3 so far.

All trades generally have about a max risk of 20pips or so.

Great work! What method are you applying?

What does SS stand for?

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

TLM was not correlating with the overall futures. As they were falling, TLM was simply consolidating, indicating strength. As the futures turned, I went long on TLM prior to the breakout and scalped 4 cents per share out of it. It failed to get through the high.

2 more trades.

A small loss on ICE and a slightly bigger win on AMZN

Just TA - looking mainly at just price action along with some custom stuff on the ES to help me time my entires.

SS means sell short on the dastrader platform.

Should also say that this is a demo account.

I trade FX on a live account at tiny stakes, but dont have the 25k required under the pdt rule to trade stocks , although my results have always been much better with stocks.

Might start my own thread after Christmas...

A small loss on ICE and a slightly bigger win on AMZN

Just TA - looking mainly at just price action along with some custom stuff on the ES to help me time my entires.

SS means sell short on the dastrader platform.

Should also say that this is a demo account.

I trade FX on a live account at tiny stakes, but dont have the 25k required under the pdt rule to trade stocks , although my results have always been much better with stocks.

Might start my own thread after Christmas...

Attachments

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

2 more trades.

A small loss on ICE and a slightly bigger win on AMZN

Just TA - looking mainly at just price action along with some custom stuff on the ES to help me time my entires.

SS means sell short on the dastrader platform.

Should also say that this is a demo account.

I trade FX on a live account at tiny stakes, but dont have the 25k required under the pdt rule to trade stocks , although my results have always been much better with stocks.

Might start my own thread after Christmas...

Be careful with these high priced stocks like AMZN...I used to trade them and sometimes, I would get very nice moves on them, but others, I couldn't get handle the large losses. Your 20 pip stop on AMZN must be adjusted as it is quite a wild stock.

Looking forward to the thread.

Be careful with these high priced stocks like AMZN...I used to trade them and sometimes, I would get very nice moves on them, but others, I couldn't get handle the large losses. Your 20 pip stop on AMZN must be adjusted as it is quite a wild stock.

Looking forward to the thread.

cheers.

Yes. I've been warned before. I reduce the size of the position and 'should' be basing my stop on the ATR with this method.

I have spent alot of time with Grey1 (the best, most genuine trader T2W has had IMHO) and am trying to employ some of his ideas in my trading.

Its just for fun, but if I ever get months and months of clear profitable consistency, i'll probably get a loan out! lol

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

cheers.

Yes. I've been warned before. I reduce the size of the position and 'should' be basing my stop on the ATR with this method.

I have spent alot of time with Grey1 (the best, most genuine trader T2W has had IMHO) and am trying to employ some of his ideas in my trading.

Its just for fun, but if I ever get months and months of clear profitable consistency, i'll probably get a loan out! lol

LOL...not sure about the loan idea, but the ATR is a good stop criteria...don't understand why people put arbitrary stops.

I heard about grey1 and how another member on T2W had scammed others using grey1's software. What sort of trading did grey1 do? What setups/methods did he use?

timsk

Legendary member

- Messages

- 8,836

- Likes

- 3,538

Hi redart,

Have you considered CFDs?I trade FX on a live account at tiny stakes, but dont have the 25k required under the pdt rule to trade stocks , although my results have always been much better with stocks.

👍Might start my own thread after Christmas...

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Took two more trades, this time on AXP:

1) Reversal trade: -4 cents per share

2) Continuation breakdown trade with early entry: +20 cents per share

At the end of the day, it really boils down to keeping your losers as small as possible. I knew my initial counter trend trade would have a low probability of success as the markets were weak and therefore, knew when to get out if it failed.

1) Reversal trade: -4 cents per share

2) Continuation breakdown trade with early entry: +20 cents per share

At the end of the day, it really boils down to keeping your losers as small as possible. I knew my initial counter trend trade would have a low probability of success as the markets were weak and therefore, knew when to get out if it failed.

LOL...not sure about the loan idea, but the ATR is a good stop criteria...don't understand why people put arbitrary stops.

I heard about grey1 and how another member on T2W had scammed others using grey1's software. What sort of trading did grey1 do? What setups/methods did he use?

Not sure about the member scamming people (jayjay121 I assume) but I know that grey1 is the complete opposite (he hates trading coaches and always says that if someone can make money from the market they wouldn't need to charge people)

He's always done everything for free.

I've seen his automated trading engine and its amazing.

As for the methods : - I think his automated trading uses a neural network and lots of other things of which I have no understanding. He is a maths whiz and has worked for many banks in risk modelling and analysis etc.

However, he also does some daytrading manually using the concepts that he teaches.

There's too much to go into and i haven't even scratched the surface as im still trading forex but he has some theories based on market cycles combine with exhaustion patterns using orice and volume, and other methods based on pair trading, using the relative strength (NOT RSI) of the stocks against various idexes to choose candidates.

Too much to get into really, but you did ask! lol

Hi redart,

Have you considered CFDs?

👍

Indeed I have.

Unfortunately, its just not feasible for me.

In my experience, the spreads can be huge, sometimes the spread when trading direct might be 1c, and the same stock on a CFD can be 14c!

Its a huge difference.

There also seems to be a more limited stock selection with spreadbet and CFD's.

Also, the execution isn't as fast, and there is the question of the games that brokers might play when nit trading 'direct'.

Overall, it makes something that is already hard pretty much impossible in my experience.

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Another +4 cents out of AXP. I am going to wait for a retracement before I initiate anymore trades on AXP...the last three AXP trades have been pure scalps from level2 momentum.

I'd like to get my hands into a nice swing trade....scalping is tiring!

I'd like to get my hands into a nice swing trade....scalping is tiring!

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

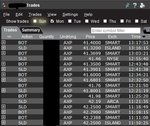

Many trades today, most of which were AXP scalps. Here's a summary of all AXP trades in order of time taken (also see attached broker screen shot):

1) +1 cent per share

2) -4 cents per share

3) +21 cents per share

4) +4 cents per share

5) +8 cents per share

6) +4 cents per share

7) +9 cents per share

8) -8 cents per share

Total Profit: +35 cents per share

A combination of a clean chart, tight spread, strong level 2 momentum, low volatility, and falling markets allowed for high probability trades.

1) +1 cent per share

2) -4 cents per share

3) +21 cents per share

4) +4 cents per share

5) +8 cents per share

6) +4 cents per share

7) +9 cents per share

8) -8 cents per share

Total Profit: +35 cents per share

A combination of a clean chart, tight spread, strong level 2 momentum, low volatility, and falling markets allowed for high probability trades.

Attachments

amit1986

Experienced member

- Messages

- 1,100

- Likes

- 66

Several more trades, mostly scalps, listed in order of trades taken (earliest to latest):

1) TIBX: 0 cents per share

2) TIBX: -4 cents per share

3) TIBX: +9 cents per share

4) XLNX: +4 cents per share

5) XLNX: +2 cents per share

6) XLNX: -1 cent per share

7) XLNX: -7 cents per share

8) XLNX: +20 cents per share

Total Profit from these scalps: +23 cents per share

Very choppy environment today so not expecting big moves. All these scalps are adding up though.

1) TIBX: 0 cents per share

2) TIBX: -4 cents per share

3) TIBX: +9 cents per share

4) XLNX: +4 cents per share

5) XLNX: +2 cents per share

6) XLNX: -1 cent per share

7) XLNX: -7 cents per share

8) XLNX: +20 cents per share

Total Profit from these scalps: +23 cents per share

Very choppy environment today so not expecting big moves. All these scalps are adding up though.

Mr. Charts

Legendary member

- Messages

- 7,370

- Likes

- 1,200

Good, controlled trading, Amit 🙂

Food is still food, even in small mouthfuls 🙂

Richard

Food is still food, even in small mouthfuls 🙂

Richard

Similar threads

- Replies

- 512

- Views

- 69K

- Replies

- 9

- Views

- 6K