bigbadboot

Member

- Messages

- 57

- Likes

- 1

Hello there!

I'm going to be using this thread to test a trading system I have developed (developing).

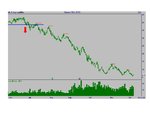

I'm not really going to go into the details of the system so this might not be of much use to anyone, but I will be posting the set-ups the night before. The system itself isn't particularly complicated and is basically a trend following system. I will be showing trades on FTSE350 shares (mainly FTSE100) both long and short trades. I will have stop and limit price targets or close the trade in 5 trading days if the targets are not reached.

I have backtested the system to January 2003 and intend to use this thread to forward test it. Most of the trades I will NOT be using real money but will be using Fantasy Share Trading, Spread Betting and CFD Trading Game to paper trade.

Ok here goes:

Trades for Monday 8th December 2008:-

Long:

No trades

Short:

JMAT @ 993.2; Stop 1030; Limit 799

WMH @ 210.5; Stop 220; Limit 170

ITV @ 37.2; Stop 40; Limit 32

LGEN @ 75.0; Stop 90; Limit 62

The above trades are in order of preference. Usually most of these trades wont get filled and should be left as orders until the end of the trading day then cancelled.

I'll give an update on Monday evening. Should anyone have any questions please ask. I might answer.

I'm going to be using this thread to test a trading system I have developed (developing).

I'm not really going to go into the details of the system so this might not be of much use to anyone, but I will be posting the set-ups the night before. The system itself isn't particularly complicated and is basically a trend following system. I will be showing trades on FTSE350 shares (mainly FTSE100) both long and short trades. I will have stop and limit price targets or close the trade in 5 trading days if the targets are not reached.

I have backtested the system to January 2003 and intend to use this thread to forward test it. Most of the trades I will NOT be using real money but will be using Fantasy Share Trading, Spread Betting and CFD Trading Game to paper trade.

Ok here goes:

Trades for Monday 8th December 2008:-

Long:

No trades

Short:

JMAT @ 993.2; Stop 1030; Limit 799

WMH @ 210.5; Stop 220; Limit 170

ITV @ 37.2; Stop 40; Limit 32

LGEN @ 75.0; Stop 90; Limit 62

The above trades are in order of preference. Usually most of these trades wont get filled and should be left as orders until the end of the trading day then cancelled.

I'll give an update on Monday evening. Should anyone have any questions please ask. I might answer.