I have been playing around with mechanical strategies, and have found one that I am happy with. I have backtested it but the results look a bit "too good to be true"*. I have done the following to make sure I'm not making stupid mistakes:

* Tested it on out of sample data (strategy designed on 6m sample, tested on 3yrs)

* Significant sample size

- Instrument 1: 6,801 trades from 13th March 2007

- Instrument 2: 5,121 trades from 13th March 2007

* Been through the backtesting logic to make sure I'm not buying at unavailable prices

* Included commissions and slippage (aggressively)

* picked out trades from the sample and "sanity checked" them

* I am not holding overnight positions

* forward tested the methodoligy

Can any of you guys with more experience give me some guidance as to other things I should check?

Thanks

G

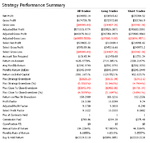

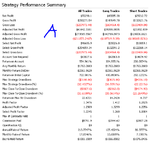

* Without compounding:

Instrument 1 - $10,000 -> $126,028

Instrument 2 - $10,000 -> $154,475

* Tested it on out of sample data (strategy designed on 6m sample, tested on 3yrs)

* Significant sample size

- Instrument 1: 6,801 trades from 13th March 2007

- Instrument 2: 5,121 trades from 13th March 2007

* Been through the backtesting logic to make sure I'm not buying at unavailable prices

* Included commissions and slippage (aggressively)

* picked out trades from the sample and "sanity checked" them

* I am not holding overnight positions

* forward tested the methodoligy

Can any of you guys with more experience give me some guidance as to other things I should check?

Thanks

G

* Without compounding:

Instrument 1 - $10,000 -> $126,028

Instrument 2 - $10,000 -> $154,475