Good afternoon traders. It was another day where we saw more action in the S&P's than in FX. Granted, pairs like EUR/USD and EUR/JPY had some decent downside action in the overnight session, but once NY rolled into town, the S&P's were the better vehicle, as EUR/USD and EUR/JPY tapped out and went sideways - see the charts below.

However, this bifurcated market should continue to remain on traders radar screens. Cyprus appears to be 'old news' if you listen to the financial entertainment channels, but that to me is the rub. Cyprus

does matter and it may be gaining traction if you look in the right places. European markets lost around 1% and more importantly, debt markets in Italy, Spain, and Portugal began leaking worse than they did yesterday, and Greece was hit pretty hard. Additionally, bank stocks in Europe continue to be under pressure. Additionally, if the party is so great in equity land, why is volume in SPY and QQQ at levels last seen on the Thanksgiving and Christmas breaks?

I believe this is why you saw EUR weak across the board and the S&P's begrudgingly going higher. I came across a new word today that might accurately describe what equity bulls are taking these days - 'hope-ium' - thanks to Bill Fleckenstein for that. I continue to play the S&P's only on an intra-day basis because of this event/headline risk.

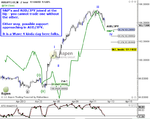

With the S&P's chipper to the upside, some clients have noted they are hesitant to be short EUR/USD or other EUR crosses. In the past I think this was a valid argument but as you will see in the chart below, that is not the case presently - EUR is going down regardless of the S&P's going higher. Welcome to the alternative universe we trade in presently.

That said, traders intent on chipping away at EUR/USD to the downside should consider this chart for the next 8-12 hours.

(the remainder of this article is available to Aspen clients)

Have a great evening.

Dave