You heard scientists found dark matter, well some say Darktone eats it for breakfastWho's this Darktone dude Mike ? never heard of him, he sounds like a dangerous highwayman with his hijacking, thinking outside the box, lulz & whatnot milarky.... surely we must all be single minded in our approach to trading, that's how winners are grinners right ?......tell me I'm not going to have find my own way, tell me it ain't so ?

Good post btw

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mike.

Senior member

- Messages

- 2,101

- Likes

- 709

thanks m8👍

Thats what i was trying to say M8.....writers block.:cheesy:

MajorMagnuM

Legendary member

- Messages

- 9,284

- Likes

- 888

One mans garbage is another mans treasure 😀.

I dunno, at various times ive had a look around 'other forums' and I see a lot o blinkers, all stamping down their view of what is 😛.

Theres some great incite on here if you dig around, some great lulz too, sometimes the two come together. This sets T2W apart from 'the others' imho.

"So Mr Mark has losses ? Case closed"

Really?.. So how we define the ole good/bad trader via win% then?

2500 / 2500 = good 👍

3500 / 1500 = good 👍

4500 / 500 = hmm 😕

4800 / 200 = ??????

4951 / 49 = ??????

4999 / 1 = ??????

5000 / 0 = Bad Trader! 😴

Happy New Year everyone :cheers:

man that link is a little bit cold. fair is fair, i can trade now, i could not before. Credit where its due imo

MajorMagnuM

Legendary member

- Messages

- 9,284

- Likes

- 888

Many a true word spoken in jest. I like to convey my view of truthfulness in gifs / memes and lulz. A single gif of meme can cover an awful lot of text, please see below:-

175x is a lot of leverage. It would only takes a small sharp blip to wipe the account or puke you out. It could become hot very quickly, hot hot hot and

leverage is one of the most important concepts to understand about Forex trading. It’s the reason traders are able to gain full exposure to a trade and experience big returns despite not having all the full amount of equity - something you’d need when trading something like traditional stocks or bonds.

Put another way, leverage makes trading more accessible by letting a trader trade more than they physically have. This happens in much the same way as someone purchases a house by borrowing from a bank; if you can deposit a percentage of the total value, the bank will cover the difference. When applied to trading it has you putting up a portion of the full trade amount with your broker covering the rest.

Before we delve too much further, let’s have a quick recap about how leverage works at a very basic level…

Let’s say you have $1,000 in your trading account (this is your equity) to put towards a trade. You could take that equity, apply a leverage ratio of 50:1 - this means for every $1 you put in, the broker will lend the other $49 - and thereby gain full exposure to a larger trade. In this case, your $1,000 combined with a 50:1 ratio (50 x $1,000) lets you control a $50,000 trade and the exposure to both the potential reward, and the risk, of the full amount.

Brokers will let you adjust your leverage up or down to suit your needs, as far as 400:1 in some cases which offers some big returns from a small outlay. That can be great in theory - especially so when it comes off - but there’s another side to leverage traders must always remember: leverage not only amplifies your profits, but your losses too. So the higher the leverage, the greater the risk.

To show the relative negative impact of leverage, let’s consider a scenario whereby two traders decide to put their $10,000 of capital behind the same trade but using different leverage sizes. Unfortunately for them, the trade goes against them to the tune of 100 Pips.

As you can see, the results for each trader are significantly different, with the higher ratio of leverage greatly amplifying the loss of Trader X - in one trade, they have wiped out half of their equity. While Trader Y still experienced a loss, the more conservative approach to leverage means that, as a percentage, there was a lesser effect on their total equity.

The obvious conclusion from the above example is that if you want to mitigate risk it’s sensible to use less leverage. However, if the trades had gone the other way, in favour of the traders, Trader Y would have earned a greater profit, it would look like a great trade and they’d come out of it feeling pretty clever. This means the argument for low leverage isn’t necessarily straightforward.

Some traders actually prefer a higher degree of risk because of that potential for larger profits in a shorter time frame. The decision of how much leverage to apply is therefore very much a personal one, dependent on your trading style, general attitude to risk, availability of capital and what you want to gain from trading.

A tried and true method of figuring out whether you’re going too deep with your choice of leverage is to simply ask yourself what would happen if the trade went against you. How will it affect your bottom line? Could you afford to cover the loss? Simple questions like this should help guide you towards an answer. It also pays to remember that just because a broker is offering high leverage doesn’t mean you have to take it. Leverage of 400:1 might be the maximum offered, but it’s not the level you have to trade at.

Ultimately, leverage is never something to be taken lightly. The more you use, the bigger the reward but the bigger the risk. So use your Demo account wisely, practice with virtual funds and get a real feel for the impact of leverage and all credits for the above is here.

or

see 👍

ty good post, is there a sticky like this, perhaps this cld be stuck for newer traders

priceactionking

Junior member

- Messages

- 23

- Likes

- 0

It is, but that should be an alarm bell.

There is plenty of good (free) content here to get you thinking. Alternatively, how about practice trading. You could invest 100's in an online trainer with no qualifications, or you could spend the same on a good software license which allows you to market replay with real historical data and learn and test out your ideas.

You pay for what you get, free staff are usually free for a reason.

You cant go cheap on learning

seekingTruth16

Active member

- Messages

- 149

- Likes

- 24

You pay for what you get, free staff are usually free for a reason.

You cant go cheap on learning

Really? You can do a 3 year degree in Cambridge University for 10k per year in fees. Or I can open up a college, and charge people 50k for a 6-month course which claims to be better. Do you just assume that because it costs more this new college is better and you must be getting what you paid for, or do you do some due diligence as I said?

priceactionking

Junior member

- Messages

- 23

- Likes

- 0

Really? You can do a 3 year degree in Cambridge University for 10k per year in fees. Or I can open up a college, and charge people 50k for a 6-month course which claims to be better. Do you just assume that because it costs more this new college is better and you must be getting what you paid for, or do you do some due diligence as I said?

10K isnt free ;-)

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

The webs is free, although you dont get the 'all important piece of paper' at the end of it.10K isnt free ;-)

priceactionking

Junior member

- Messages

- 23

- Likes

- 0

The webs is free, although you dont get the 'all important piece of paper' at the end of it.

Exactly what i was saying

If you go the free road you never get the full picture, same with trading, shortcuts will lose you a lot of money

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Exactly what i was saying

If you go the free road you never get the full picture, same with trading, shortcuts will lose you a lot of money

You never get the full picture with any tuition imo. I see it as more of a start, it gets out the gate. You really start leaning when you roll your sleeves up and get your hands dirty.

I mean, I look out over the interwebs with my various interests and find a lot of great info. All for free!

Have learned all sorts from the tube. Wanna curl that perfic chip?, perhaps get a start on a bit of handscraping, or maybe you wanna lap a granite flat? No worries, its all out there, for free! Learning about air brakes atm, you need too have an understanding o that shiz when you got an SM8 😛. Even the odd good video about tarding, if you look hard enough.

Just imagine If Id had the old 'you get what you pay for' 'You cant go cheap on learning' type beliefs. All that opportunity, deleted in one belief fuelled submit reply click :smart:👍

Last edited:

barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

You never get the full picture with any tuition imo. I see it as more of a start, it gets out the gate. You really start leaning when you roll your sleeves up and get your hands dirty.

I mean, I look out over the interwebs with my various interests and find a lot of great info. All for free!

Have learned all sorts from the tube. Wanna curl that perfic chip?, perhaps get a start on a bit of handscraping, or maybe you wanna lap a granite flat? No worries, its all out there, for free! Learning about air brakes atm, you need too have an understanding o that shiz when you got an SM8 😛. Even the odd good video about tarding, if you look hard enough.

Just imagine If Id had the old 'you get what you pay for' 'You cant go cheap on learning' type beliefs. All that opportunity, deleted in one belief fuelled submit reply click :smart:👍

You can learn the techniques from the web, but you can't learn the skill.

darktone

Veteren member

- Messages

- 4,019

- Likes

- 1,086

Well, Ive learnt lots of techniques from the webs Jon, about all sorts. Then I got mi hands dirty and developed levels of understanding and skill through 'try - succeed/fail - improve' practice.You can learn the techniques from the web, but you can't learn the skill.

Hows that sound 😀

AbdulLight

Newbie

- Messages

- 3

- Likes

- 0

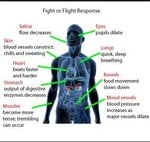

To answer this in a simple matter.

The psychology is within the money & the money in this system is digital.

The psychology is within the money & the money in this system is digital.

priceactionking

Junior member

- Messages

- 23

- Likes

- 0

You can learn the techniques from the web, but you can't learn the skill.

agree

foroom lluzers

Veteren member

- Messages

- 3,608

- Likes

- 140

Is James 16 foresight or hindsight course with or without mindtraps?

Customer:Your hindsight course does not make money , if i place trades before the p/a set up.

Mentor:I was only selling how money is made , hindsight results p/a course.

Customer:I am upset , I want my money back

Mentor :foresight price action course is the holy grail , it is in my semen and will cost you.

Customer :That means you screw me twice

Mentor :No ,thrice , then you need a psychology course for mind traps

Customer:Your hindsight course does not make money , if i place trades before the p/a set up.

Mentor:I was only selling how money is made , hindsight results p/a course.

Customer:I am upset , I want my money back

Mentor :foresight price action course is the holy grail , it is in my semen and will cost you.

Customer :That means you screw me twice

Mentor :No ,thrice , then you need a psychology course for mind traps

TWI

Senior member

- Messages

- 2,562

- Likes

- 269

You can learn the techniques from the web, but you can't learn the skill.

Very true that

foroom lluzers

Veteren member

- Messages

- 3,608

- Likes

- 140

You never get the full picture with any tuition imo. I see it as more of a start, it gets out the gate. You really start leaning when you roll your sleeves up and get your hands dirty.

I mean, I look out over the interwebs with my various interests and find a lot of great info. All for free!

Have learned all sorts from the tube. Wanna curl that perfic chip?, perhaps get a start on a bit of handscraping, or maybe you wanna lap a granite flat? No worries, its all out there, for free! Learning about air brakes atm, you need too have an understanding o that shiz when you got an SM8 😛. Even the odd good video about tarding, if you look hard enough.

Just imagine If Id had the old 'you get what you pay for' 'You cant go cheap on learning' type beliefs. All that opportunity, deleted in one belief fuelled submit reply click :smart:👍

There are things you can not experience or learn about , until you jump in the shark pool , trading is like jumping in the sharkpool.They can sell you as many courses as ythey want , but you won't learn much of use , half the information can be dangerous .

Traders don't have emotions , mind traps , stress or other psychological demons , according to forex factory , where James 16 is marketed.Forex factory have no psychology section , they can sell this price action as a STICKY , but without the the 80 % psychology , all this price action is worthless .It is also subjective , hindsight results based and has no edge .This price action stuff is for amateurs , it is trying to analyze noise to predict the market , like all the 2600 free systems on FF.

The subject is far more detailed and beyond the knowledge of most forum posters , the superior knowledge is obtained by listening to many webinars and reading articles /books by top trading doctors/phds in psychology and other non trading psychologists .These psychologists are Rande Howell , Dr Br Steenbarger , Dr Van tharp , Mark Douglas , Dr Andrew Menaker and a few others .The knowledge of the subject of psychology of these psychologists is way superior to the discussions by non psychologists on forums.These psychologists give a far superior understanding of the differences between professionals and amateurs .

The main differences are

1) Trading mindsets 80 % is pychology and 20 % the method .Professionals understand trading psychology

2)Professional's Methods incorporate psychology

3)Professional's Methods have an edge

Professionals trade because they have a edge trade , amateurs tradeprice action because they have to trade , when there is no trade they look for a reason with price action to gamble.Professionals are very patient.

Traders have zero edge , unless you have a mental edge .All your illusionary edges are worth zero , if you can't execute your edge.This is a statement according to Mark Douglas.He preached patience, discipline and eliminating errors.

"No man ever reached to excellence in any one art or profession without having passed through the slow and painful process of study and preparation," he wrote.

Here is something else he wrote on the secret to success.

"If there is such a thing as a secret to the nature of trading, this is it: At the very core of one's ability 1) to trade without fear or overconfidence, 2) perceive what the market is offering from its perspective, 3) stay completely focused in the "now moment opportunity flow," and 4) spontaneously enter the 'zone,' it is a strong virtually unshakeable belief in an uncertain outcome with an edge in your favor.

Price action relies on timing the markets , but this has been proven to be too difficult for most , according to this article below and free google searches .

http://www.trade2win.com/boards/edu...22-what-happens-when-you-try-time-market.html

Price action relies on being reality with the markets , and this article on t2w examines whe traders are not in reality with the markets.

http://www.trade2win.com/boards/edu...92-your-brain-wasnt-built-handle-reality.html

The third most important reason is , traders using subjective price action most are set to be defeated with mind traps , there is thread on it in the psychology section.Human mind traps are the same , if applied to trading or any other activity.

In conclusion Mark Douglas, one of the greatest trading educators and authors of our time , taught us the opposite of the James 16 phillosophy for trading genuises .His 10 rules contradict with the application of price action education of James 16 .

1. Be rigid with rules, flexible with targets.

2. Focus on opportunities that provide an edge.

3. Trade free of expectations of being right or wrong.

4. Synchronise your mind to the truth of the market.

5. Beleive in uncertanity (The market can do anything)

6. Be flexible so as to perceive with the greatest degree of clarity and objectivity of what the market is offering from its perspective.

7. Be careful what you project into the future because nothing has got the potential to create more misery and unhappiness than unfulfilled expectations.

8. To make money, trade without fear but also overconfidence.

9. The degree to which you think you know, or assume you know or need to know what is going to happen next, equals to the degree you will fail as a trader.

10. What you perceive in the market is limited to what you know less that what is blocked by fear.

foroom lluzers

Veteren member

- Messages

- 3,608

- Likes

- 140

You can learn the techniques from the web, but you can't learn the skill.

The most important skills are the mental skills of traders , other skills like technical anylysis , systems , methods , technical skills and trade management are less important .Without a trading mindset suitable for trading , trader will inevitably mess up with latter skills .

The skills required are not even known on the internet , trading forums or books.Infact ,the knowledge of these skills remain purposely hidden from traders.

All the elephants went to the same water hole , to drink the same water .Every body has the same information.Unless we think outside the box , we will join the herd , so free your mind and think!

No matter who tries to teach you lessons about trading , you won't understand it , until you get your hands dirty.

Attachments

ffsear

Guest Author

- Messages

- 2,304

- Likes

- 551

Professionals trade because they have a edge trade , amateurs tradeprice action because they have to trade , when there is no trade they look for a reason with price action to gamble.Professionals are very patient.

.

Are you a professional trader?

foroom lluzers

Veteren member

- Messages

- 3,608

- Likes

- 140

Are you a professional trader?

I think you are , because you undestand patience , the most important skill in trading , as per your posts some where.I would say , you are a more professional trader than myself!😀

Similar threads

- Replies

- 27

- Views

- 10K

- Replies

- 0

- Views

- 2K