From The Trader 21/9

The Bank of Japan has just announced that it is joining the Federal Reserve and the European Central Bank by pumping yet more freshly created money into the financial system. If you're in any doubt about how the central banks' latest synchronised splurge of liquidity should affect your trading strategy, I suggest you reflect upon the legendary words of Harry Callahan, the maverick cop played by Clint Eastwood in Dirty Harry.

"I know what you're thinking: 'Did he fire six shots or only five?" Well, to tell you the truth, in all this excitement, I kind of lost track myself. But seeing as this is a .44 Magnum, the most powerful handgun in the world, and would blow your head clean off, you've got to ask yourself one question: 'Do I feel lucky?' Well, do ya, punk?"

I say this because it seems to me that there are currently more than a few punks out there in the markets who still seem to think they stand a sporting chance of profitably short-selling the indices, despite being faced with no less than three Magnum-toting Harry Callahans. And, unlike in the case of Dirty Harry, there is no doubt whatsoever that the Fed, ECB and BoJ have the full compliment of ammo.

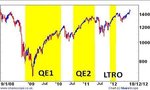

The first two rounds of quantitative easing fired by the Federal Reserve - and the ECB's LTRO - were bad times to short equities. I know this because I tried it myself during QE1 in early 2009. And, I got my head blown clean off, figuratively speaking. By the time the Fed brandished QE2 under the market's nose, I had wised up to the idea that it might be safer – and more profitable – to comply with Dirty Ben's wishes.