You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

P

postman

You snooze you lose. 😆

Food is for wimps.

And shorts are for losers! 😡

P

postman

What the actual F*ck has to happen to make these markets go down!

P

postman

I'm holding my short but I'm Mad 😡 in more than one sense of the word!

P

postman

Here we go, this will be epic.

P

postman

Im out at 85 for -23

Complete nutters.

Complete nutters.

P

postman

Close 21220 or better. 🙄

lexcorp

Senior member

- Messages

- 2,004

- Likes

- 571

small long 21138

+45

P

postman

lexcorp

Senior member

- Messages

- 2,004

- Likes

- 571

Yes well done, thanks for not rubbing it in too much. 🙂

Sorry, mate.

If it's any consolation, your short was technically good in my mind, and in a non-rigged market, i'd have given it good odds on paying you. On these markets?....not so much!!

counter_violent

Legendary member

- Messages

- 12,672

- Likes

- 3,787

Im out at 85 for -23

Complete nutters.

Oil still droppin.

Wot ya closed out for ya wimp 😆

P

postman

Oil still droppin.

Wot ya closed out for ya wimp 😆

Cause its the Dow and it only goes UP! 😡

lexcorp

Senior member

- Messages

- 2,004

- Likes

- 571

So after closing that Dow, i'm just holding that Dax long from around here.

I think seasonally/statistically, a good trade is to short at the close tomorrow and cover it on Monday!

If it gives me a good exit tomorrow i'll take it and then see how that theory plays out, not that i'd put too much faith in a bearish scenario!

I think seasonally/statistically, a good trade is to short at the close tomorrow and cover it on Monday!

If it gives me a good exit tomorrow i'll take it and then see how that theory plays out, not that i'd put too much faith in a bearish scenario!

no stops trader

Active member

- Messages

- 210

- Likes

- 9

Short the dow 21162

Last time I shorted the DOW I learned never to Short the DOW except in a recession

no stops trader

Active member

- Messages

- 210

- Likes

- 9

P

postman

Nikkei closes down 78 at 19,905 then the spread bettors move the price 50 points higher within 10 minutes of the close.

Move along nothing to see here. :whistling

Move along nothing to see here. :whistling

psaTrading

Experienced member

- Messages

- 1,063

- Likes

- 53

In the pre-opening, the European markets negotiated with contained gains. For political and economic reasons, today was the most awaited by investors because of the elections in the UK and the ECB meet, as well as the testimony of the former FBI director fired by President Trump. With regard to the legislative elections in England, it should be remembered that although the legislature should only end in 2020, Prime Minister Theresa May called early elections in order to reinforce her majority in Parliament and, consequently, her internal position in the conduct of the Brexit process. The polls open at 7:00 a.m. and close at 10:00 p.m. Regarding the possible reactions of the market to the outcome of the elections, opinions are divided. A minority victory of Congressmen or an indefinite result would, according to some investors, increase political uncertainty but on the other hand would increase the likelihood of a more conciliatory stance of the UK in the process of leaving the EU, called Soft Brexit. A victory for Theresa May would make the future English politician more crystalline but would reinforce the likelihood of a more intransigent UK position, dubbed Hard Brexit. Concerning the ECB meeting in Tallinn (Estonia), no changes are expected in the current monetary conditions, but there is an expectation of the statements made by Mario Draghi in order to try to gauge the future performance of the ECB. Markets are therefore awaiting news on macroeconomic forecasts. The big question is what will be the rhythm of monetary policy normalization, which will first happen by reducing the asset purchase program and later by the increase of the leading rates.

no stops trader

Active member

- Messages

- 210

- Likes

- 9

Why you Brits hold elections mid-week instead of weekends? I mean, why purposely cause mayhem at each poll release?

P

postman

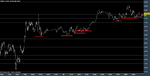

FTSE looks like it has built a base and is going up.

P

postman

Similar threads

- Replies

- 1

- Views

- 2K