the hare

Senior member

- Messages

- 2,944

- Likes

- 1,282

What interesting conclusions you draw. Thats the sort of thinking that led ornithologists to conclude all swans where white 😆

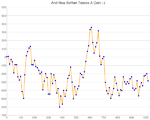

By the way belflan, the answer you gave was 100% correct 🙂 and the equity curve below is the sort of thing you'd typically get when you rectify that particular problem 🙂