Well on backtesting my trading plan I found some major flaws.

On some days where the market had some good moves, my plan ended up losing. Even if I discard a few days' action as too small a sample, this doesn't feel right. Surely a plan that intends to trade pullbacks in trends ought to do well on trending days!

My system expects too much from the market and unless every box is ticked, which is unlikely to happen every day, it will lose money.

My current thinking is in the following line:

1. It is unlikely that (with my level of understanding of the market) I'd be able to define a system with a high percentage of winners as well as having a decent average profit to average loss ratio. I therefore have to focus on setups that give around 50% winning trades with an average profit to average loss ratio of 2 or more.

2. This means when I lose, which would be often, the losses must be small, and when I win, I must win big. This means only one thing: instead of entering with the fully loaded position and then covering, the first entry should be light and more positions should be added as the market moves in my favour.

3. Which leads us nicely to the point of reversal versas pullback trades. I am entering first with a small position. So, if there is a trend, I must always jump on it and exit only when either the trend ends as per my definition or if I am proved wrong (i.e. when my definition says there is no trend after all). So in a nutshell, forget reversal vs pullback: if there is an uptrend then buy and if there is a downtrend then sell.

I have done some more research and programming over the last couple of days and managed to knock up a decentish short-term trend definition. I have managed to colour the bars, so it would make the decision process completely mechanical, should this stand up to testing.

Finally, after my setbacks with the other plan, which is incidentally very dear to my heart (for some reasons), I thought of not writing the journal any more. I thought I'd look like a pillock to everyone. But then I decided that it's my journal and I must confront my fears of looking like an idiot. Last thing I need is to worry about what people might or might not think of me. My job here is to get what I want. After all if it was that easy...

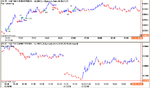

Below are some pictures of the bar colouring mechanism in action. It looks alright, although there are some whipsaws, which I guess will always be there.

I intend to backtest it using eSignal's strategy testing facility, as soon as I manage to understand how to work the damn thing. Here are charts for ES 1min, 3min and daily.