Dave Floyd

Active member

- Messages

- 184

- Likes

- 2

FX Morning Update

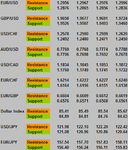

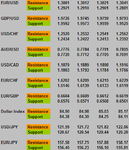

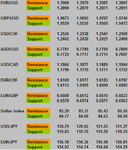

AUD/USD: a nice $5 bounce in gold and a decline in the dollar has seen a modest bounce in AUD/USD - however, as we noted in this mornings 24-Hour Targets & Levels, AUD/USD remains in a sideways trading range that will likely see prices capped at .7823-30

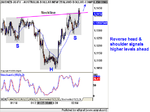

NZD/USD: see attached chart

USD/JPY: we will look to play USD/JPY from the long-side on pull-backs towards 120.00-25

Launch FX Research

Dave

AUD/USD: a nice $5 bounce in gold and a decline in the dollar has seen a modest bounce in AUD/USD - however, as we noted in this mornings 24-Hour Targets & Levels, AUD/USD remains in a sideways trading range that will likely see prices capped at .7823-30

NZD/USD: see attached chart

USD/JPY: we will look to play USD/JPY from the long-side on pull-backs towards 120.00-25

Launch FX Research

Dave