dbphoenix

Guest Author

- Messages

- 6,954

- Likes

- 1,266

Trading price will “work” in any auction market, i.e., any market that moves according to the law of supply and demand. However, the swings in some markets are much wilder than the swings in others. Some markets gap more than others. Some markets sit and do nothing for far longer than others, wearing out those who don’t have the patience to wait it out.

The general objective, however, is to find an instrument that is simple to trade, easy to trade, that is “directional”, that moves smoothly, that moves with ”intent” (i.e., that is decisive after reversals and breakouts), that chops as little as possible, and is, of course, liquid.

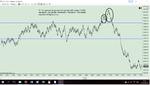

Avoiding gaps pretty much eliminates stocks. Trading outside regular market hours generally means futures. The S&P is the most popular stock-index market and the ES is therefore the most popular futures market. However, that popularity means that the S&P and the ES are the first choice of arbitrageurs. The practical consequence of this is that there will be lots of sideways movement, lots of back-and-fill, lots of congestion. For many traders, particularly small retail traders, this means scalping for ticks, and doing so alongside professionals, including HFTs, who are in a much better position to make a success of it. The small retail trader is in effect wearing a sign on his back that says “Kick Me”.

This is not to say that the ES never goes anywhere. How a particular futures instrument moves depends largely on its underlying. Dow futures are based on 30 stocks. The NQ is based on 100. The ES is based on 500. There is also the character of the underlying to consider. The NQ is essentially technology; it has for example no financials. The ES, however, incorporates nine sectors, including financials and industrials. For all these reasons the ES moves differently. Whether that difference is better or worse depends on the trader’s objectives.

When all is said and done, the more directional the instrument is, the more money there is to be made with it. Trade costs are less given that the number of trades is less due to the fact that sideways movement is less and stops are hit less frequently. And, consequently, commission costs are less. If the trader therefore finds himself resorting to scalping ticks because his instrument is yanking him around, he most likely would be better off investigating a smoother and more directional instrument, for example the NQ.

The general objective, however, is to find an instrument that is simple to trade, easy to trade, that is “directional”, that moves smoothly, that moves with ”intent” (i.e., that is decisive after reversals and breakouts), that chops as little as possible, and is, of course, liquid.

Avoiding gaps pretty much eliminates stocks. Trading outside regular market hours generally means futures. The S&P is the most popular stock-index market and the ES is therefore the most popular futures market. However, that popularity means that the S&P and the ES are the first choice of arbitrageurs. The practical consequence of this is that there will be lots of sideways movement, lots of back-and-fill, lots of congestion. For many traders, particularly small retail traders, this means scalping for ticks, and doing so alongside professionals, including HFTs, who are in a much better position to make a success of it. The small retail trader is in effect wearing a sign on his back that says “Kick Me”.

This is not to say that the ES never goes anywhere. How a particular futures instrument moves depends largely on its underlying. Dow futures are based on 30 stocks. The NQ is based on 100. The ES is based on 500. There is also the character of the underlying to consider. The NQ is essentially technology; it has for example no financials. The ES, however, incorporates nine sectors, including financials and industrials. For all these reasons the ES moves differently. Whether that difference is better or worse depends on the trader’s objectives.

When all is said and done, the more directional the instrument is, the more money there is to be made with it. Trade costs are less given that the number of trades is less due to the fact that sideways movement is less and stops are hit less frequently. And, consequently, commission costs are less. If the trader therefore finds himself resorting to scalping ticks because his instrument is yanking him around, he most likely would be better off investigating a smoother and more directional instrument, for example the NQ.