oildaytrader

Senior member

- Messages

- 2,806

- Likes

- 125

Hi

Avoid dealing desk brokers .Orders placed with dealing desk brokers are routed to via dealing desks.This additional routing time delays order fills and may result in orders not being filled at all .In fast moving markets the dealing desk will simply ignore your order, cause everytime your order is placed the price will be moving , therefore your orders won't be filled.Your order is being ignored ,in fast moving markets, by dealing desk.If you are lucky to get a fill , it will be at a bad price.

If trader does not get a fill on winning trades, the dealing desk maybe placing its own trades in the market , the trader's profitable trades cease to exist.Trader may only be filled on losing trades . and this hugely impact trader's profitability.These dealing desk brokers will cost you more than the fictitious fixed spread they offer.They will cost you your profits.

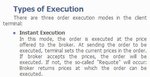

Metatrader dealing desk brokers use instant execution(it is only instant by name ,but delayed or non fill execution in reality).According to the Metatrader user guide , the broker can ignore your orders.Quote from dealer guide "if the broker accepts the price ,the order will be executed".

Many brokers like Alpari claim STP execution , but their platform still has instant execution used by dealing desks.

I ran expert advisors on demo and live accounts simultaneously at ALPARI u k.The results were many non order fills .The metatrader live account log files are missing on the platform.

I will now move to S T P (Straight through processing) with ODL securities. Alpari do not offer STP at time of writing this post.At least I can only see instant execution on their platform .

None of the brokers admit publicly to using the VIRTUAL DEALER PLUGIN, as this admission would be bad publicity.The dealing desks do require some sort of a dealer software( to hold orders whilst getting hedged in the interbank market .

http://www.trade2win.com/boards/metatrader/74696-metatrader-bucket-shops.html

http://www.trade2win.com/boards/metatrader/74910-metatrader-backtests-flawed.html

OILDAYTRADER

Avoid dealing desk brokers .Orders placed with dealing desk brokers are routed to via dealing desks.This additional routing time delays order fills and may result in orders not being filled at all .In fast moving markets the dealing desk will simply ignore your order, cause everytime your order is placed the price will be moving , therefore your orders won't be filled.Your order is being ignored ,in fast moving markets, by dealing desk.If you are lucky to get a fill , it will be at a bad price.

If trader does not get a fill on winning trades, the dealing desk maybe placing its own trades in the market , the trader's profitable trades cease to exist.Trader may only be filled on losing trades . and this hugely impact trader's profitability.These dealing desk brokers will cost you more than the fictitious fixed spread they offer.They will cost you your profits.

Metatrader dealing desk brokers use instant execution(it is only instant by name ,but delayed or non fill execution in reality).According to the Metatrader user guide , the broker can ignore your orders.Quote from dealer guide "if the broker accepts the price ,the order will be executed".

Many brokers like Alpari claim STP execution , but their platform still has instant execution used by dealing desks.

I ran expert advisors on demo and live accounts simultaneously at ALPARI u k.The results were many non order fills .The metatrader live account log files are missing on the platform.

I will now move to S T P (Straight through processing) with ODL securities. Alpari do not offer STP at time of writing this post.At least I can only see instant execution on their platform .

None of the brokers admit publicly to using the VIRTUAL DEALER PLUGIN, as this admission would be bad publicity.The dealing desks do require some sort of a dealer software( to hold orders whilst getting hedged in the interbank market .

http://www.trade2win.com/boards/metatrader/74696-metatrader-bucket-shops.html

http://www.trade2win.com/boards/metatrader/74910-metatrader-backtests-flawed.html

OILDAYTRADER